Back in the mid 2000s, when I thought more highly of Jim Rogers than I do now, I read his book, Hot Commodities, looking for some insight. He had some good points, but he vastly underestimated the supply response to higher prices which resulted in a steady increase in the supply of oil/natural gas, grains, and the metals throughout the 2010s. A lot of his bullishness was due to increased Chinese demand, which couldn't keep up with the increased supply that would eventually drown the commodities market, especially oil and natural gas.

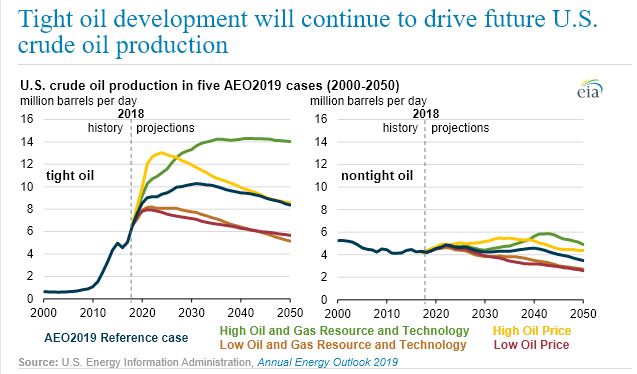

This time around, its a different animal. You still have increasing demand coming from the emerging markets, but you are not getting much of a supply response to keep up with the demand increase, even if they are smaller than in the 2000s. Remember, oil is not water, its not something where you just turn on the tap and supply increases. You have to actually spend significant capital on exploration and get machinery and skilled labor to drill wells. Unlike the 2000s, there is no easy pickings like you had in the US shale plays for oil/gas, as the current technology has already sought out the most desirable locations to explore and drill.

Oil and natural gas production declines as you deplete reserves, so new locations and wells need to constantly be drilled to just keep overall production steady. To actually increase overall production takes a lot of investment and time.

But you aren't getting that much investment in oil and gas, because due to some dubious projections made by the EIA and so-called oil experts, many were forecasting peak oil demand and/or were projecting ridiculous oil supply increases as if the trend over the past 20 years would go on for the next 20 years. Both supply and demand forecasts are wrong, and since the Russian invasion, people are waking up to this reality.

Some may say that this is a similar situation to 2008 when oil exploded higher as stocks were weakening ahead of the financial crisis, but as bad as the economy will get over the next several months, you don't have the same weakness in household balance sheets and the overextension of home equity loans that you did back then. Back in 2008, house prices were cratering, which has a huge wealth effect. Now, house prices are still much higher than a year ago. And most people haven't tapped much into their home equity, unlike 2008. Also, budget deficit is much bigger this time around, so that will buffer some of the economic weakness. Back in 2008, politicians weren't looking to cancel student debt or handout gas stimmies like they are now.

And its much harder to get a financial crisis in an inflationary environment. Debt payments are naturally easier to make and there aren't as many defaults as you would see in a deflationary environment when corporate cash flows are dramatically shrinking while debt payments remain stable.

Yes, the economy will get weak, due to negative wealth effects from stocks and bonds getting crushed and food/energy prices surging higher, but you aren't going to see mass defaults when corporations are paying such low interest rates, which are very manageable in a stagflationary environment.

Really, there are really only two possible things that can stop oil prices from continuing to go higher, and they are:

1. Severe recession. Possible, but unlikely given the things I mentioned above. You are seeing a situation more like post 2000 than post 2007. The 2001-2002 recession was mild, even though the SPX went down 50%.

2. Hamfisted, long lasting Chinese lockdowns. This is actually more likely than the above, just because how zealous Xi is in keeping his zero Covid policy ahead of his renomination in November. So it is a risk until November, but after that, China will slowly relax their rules, when they eventually realize that Zero Covid isn't a long term solution, and I'm sure he's not so dumb to keep that policy after renomination seeing how it wrecks the Chinese economy and stirs up huge discontent among the locked down. They'll eventually give up on zero Covid and oil demand will keep rising, while oil supply is unable to keep up.

Even when you've been in this business for decades, there are always new things to learn, or things to improve upon. As you get older, brainpower slowly dissipates, but to counteract that, you have to gain wisdom. A lot of this is the wisdom gained from painful experiences, both of actual big losses, and regrets at missing great opportunities.

My biggest losses happened when:

1. Market regime changed and I was still trading the past regime. (hard to avoid)

2. Doubling down to make back my losses as quickly as possible. (easy to avoid, just have to be mentally tougher).

My biggest regrets were when :

1. I sold too quickly after getting a quick profit, only to see the market go my way for several more months.

2. I tried to avoid a short term drawdown by selling core positions, only to see the thing go higher and higher without a correction, leaving me behind with no position.

That brings me back to the current market. When I look back at this time period 2 years from now, what will be my biggest regret? Having a short term drawdown on my energy longs because I didn't sell at a local top, or missing the biggest commodity bull market in my career because I was trying to avoid a short term drawdown? I think its much more likely to be the latter, so I want to make sure I keep my position, even if my short term view is bearish risk assets.

Wow, did I read that wrong. Did not expect a 200 point plunge in SPX (combined Fri./Mon.) on a slight beat in CPI. That just shows you what markets are vulnerable and which ones aren't. Commodities aren't too fazed by this big plunge in stocks, or expectations of a more hawkish Fed. In risk off days, you see which ones are filled with the weak hands and which ones aren't. There are very few weak hands in commodities. In stocks and bonds, you have a lot of weak hands. That shows up on days like Friday, when you get a risk off move, the weak hands are the most aggressively selling on days like that.

Even though I was expecting a rally after CPI, fortunately I didn't play it. As I've mentioned before in a previous post, betting on a short term move against your long term view is like picking dimes in front of a bulldozer. You will often succeed, but the times when you get hit, you will get hit hard. That's why I didn't get long SPX, even though I was expecting a rally after CPI. Now my biggest regret is missing that golden shorting opportunity around SPX 4150 (NDX 12700), looking to short around 4200-4250 SPX (12800-13000). I was a dick for a tick, trying to be Mr. Perfect, and it cost me a great opportunity on the short side. I am not selling anything so I can be honest. Lot of so-called traders selling snake oil and subscriptions, they know they can't admit mistakes, they always have to show the utmost confidence, put bad calls and mistakes under the rug, like a politician, in order to appear "strong" and "competent". Confidence doesn't equal competence. Especially in the markets.

We are close to SPX 3800, and the market has a memory. The market bottomed around these levels and ripped 400 points in less than 10 days, so there will naturally be dip buyers around here. You have some heavy options forces at play due to the huge outstanding open interest in June 17 SPX expiration, along with the heavy monthly opex for stocks and ETFs on that day. Lots of gamma squeezes going on, you are seeing a lot of dealer hedging as the deltas move wildly with expiration only a few days away. In general, when you have a huge selloff going into an FOMC meeting (see Mar./May FOMC chart patterns), you have a rally the day before the meeting into the day of the meeting. This is a combination of vanna and charm flows as the theta and IV both decay rapidly as you get closer to expiration. Since most dealers are short puts, they have to buy back their shorts to cover as the deltas on their short OTM puts goes closer to zero. I expect a similar setup this time.

And I will not be following my previous advice, just because I have a set time frame for the long SPX trade (buy on Monday, sell on Wednesday, no matter what). I am looking to put on a moderately sized long to play this short term move. There is a very high likelihood that you will bottom today and rally into the FOMC meeting at 2:00 PM ET. Beyond that, is anyone's guess, but I would still lean bullish, although wouldn't play it past Wed. 2:00 PM, as I could see Powell do whatever he can to sound like a super hawk while just raising 50 bps (talk tough, act soft). Let's see how this goes, as I am breaking one of my rules, but this time, I am not going to give the trade much rope to strangle me, so I have a time stop (Wed. 2:00 PM ET) and not putting on big size.

15 comments:

Thanks @marketowl. Dont u think there is a decent chance Fed does 75bp in june or july or both? We may be short term oversold but i would be very cautious going long

I think the market is pricing in a decent chance of a 75 bps move in June or July. Doubt he does both, since Powell is a pansy. I will sell any SPX that I buy before the FOMC announcement, so I'm not looking for any rally afterwards. But beforehand, there will definitely be options related flows that are buying as well as short covering. The longs are selling ahead of the event it looks like.

Options related flows can go both ways. Market has fallen and if it falls more, dealers will be forced to hedged their older otm put options that are in the money by shorting even more to protect themselves from a crazy down move

Yes, we're in negative gamma territory so that's always a risk, but I expect that to happen only if Powell gets a pair of balls and shocks the market, I will have already sold before he speaks a word.

Did u go long?

Yes, and will sell Wednesday in the US morning session. Strict time stop on the trade, win or lose.

Pls be careful. Tomorrow am is retail sales that may surprise to the downside based on credit card spending data. You miss a great exit tomorrow but too short an exit window imo.

Relentlessly down. Looks like 3600 coming soon. 3800 overnight was the opportunity to get out.

Nice acceleartion to the downside now. Retail sales likely give us another couple of percent points down tomorrow. Brutal moves.

Trapped long at 3820. Just have to keep adding funds continually.

Owl do you think Powell goes 75

Or is this 75 talk just Wall St playing games

If he goes 75 does the picture change for you?

Today I though we could fall more than we did and exhibit volatilty which we didn't get.

That would have made the long call easier post FOMC(at least for a day or 2).

ATM honestly have no idea how this swings post FOMC.

thoughts?

Joseph Faggianelli

Its deadly to be stuck long in this market, you have to take your losses and not expect to get bailed out by a rally like you did from 2009 to 2021. Its a different beast.

On the FOMC meeting on Wed., I expect Powell to go 75 bps, he basically panic signaled that to the Wall St. Journal on Mon. so as not to shock the market on Wednesday.

I think going 75 bps just pulls forward the lows that we'll eventually have to reach before we get a real sustained counter trend rally. Its not bullish, as some are saying. The Fed getting more serious about stopping demand growth to kill inflation is not good for stocks. If anything, its good for long term bonds.

I am slightly underwater on my Mon. trading long SPX position but I will get rid of it Wed. morning, and definitely before the FOMC announcement.

With how weak this market is, its too risky for me to call for a rally of oversold conditions post FOMC. It could very well have a short term rally of 1 or 2 days and then go right back down, or we could just have an all out gamma squeeze into June expiration and post opex (when many will be unhedged) and go straight towards 3500.

Tough trading conditions, its a pity I missed that short above 4150, would be sitting pretty right now.

Have been short SPY for a few weeks and closed my short seconds ago.I have been confident for a few weeks about direction but at this juncture have very little visibilty.I can make a case both ways.I even closed stocks shorts on ASX which I have held greater than a month.So I can think straight now.Except for the DIX which you pointed out we have seen inflows this last week/days especially retail&vix all things considered is relatively tame.But there are breadth measures that look overdone.Mired.

2 big levels are 3700 and 3800.If we break 3700 and it sticks I agree with your gamma squeeze to 3500.Alternatively a break of 3800 and it holds we get a squeeze the other way.But looking at positioning the squeeze lower will be more violent than the squeeze higher.

We are oversold but not enough to suggest any sustainable bottom.

A gamma squeeze to 3500 will create the conditions for a meaningful bounce.

I think on 14th June buybacks start to phase out so that DIX data needs to be viewed with this in mind.

JF

Also only 2 positions for me.Cash or short.Market would need to get destroyed for me to go long.

In the bull mkt I could have done better if I respected the trend.I have not made this mistake this year.JF.

Yeah, no big edge in the short term for the stock indexes, although agree a big move lower seems more likely than a big move higher.

Heading into Q2 earnings season in July, I can’t think the market will be rallying ahead of those announcements, as they will be much uglier than those in Q1. Probably already in a recession now, high inflation masks a lot of underlying weakness in orders and economic activity.

Post a Comment