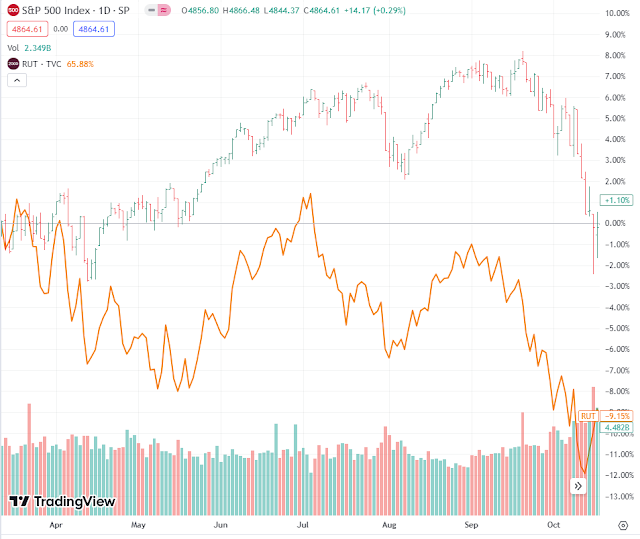

When the stock market is strong, the economy is considered strong. When the stock market is weak, the economy is considered weak. The stock market is strong. The SPX is around all time highs. So right now, the bias in the investment community is to be positive on the economy. But its clear that the economy is slowing. If the economy was so strong, why would unemployment rates go up in so many states? Why isn't the Russell 2000 stronger than the SPX in an up market? The Russell 2000 usually outperforms when the economy is strengthening.

|

| Russell 2000/SPX ratio |

The signs are there that the economy is slowing. But all I hear on CNBC is how the economy is strong enough that the Fed doesn't need to cut, that too many rate cuts are priced into STIRS. But that's flawed logic. The market rallied strongly in November and December because of increased rate cut expectations, not in spite of them. If you take away those rate cuts priced into STIRs and the rest of the yield curve, then the stock market weakens, and financial conditions tighten.

I rarely hear anyone say that the market pricing is about right, or that its not pricing in enough rate cuts because the economy will weaken in 2024. People are fighting the last war, inflation. There are more people worried about inflation re-igniting than about a hard landing. I still hear talk about how Jerome Powell doesn't want to repeat the mistake of cutting early like Arthur Burns. Are we still in 2022? I thought we found out a while ago that Powell is no Volcker. Disinflation is likely to continue. There are so many biases built into the CPI and PCE that understate inflation that's its not easy to get high inflation numbers showing up in the government stats. With the lagging effect of lower rents feeding into owner equivalent rents in the CPI, expect inflation to slowly go down over the next few months.

As for the jobs market, its hard to keep getting big jobs growth when the working age population is hardly growing. The post Rona catch up hiring done from 2021 to 2023 is behind us. Yes, the jobless claims numbers haven't gone up, and NFPs are still showing solid job numbers, but government tax receipts are weak for January, month to date.

You have seen quite a few layoff announcements this month. Its nothing alarming, but companies usually don't do layoffs if they think the economy is strong.

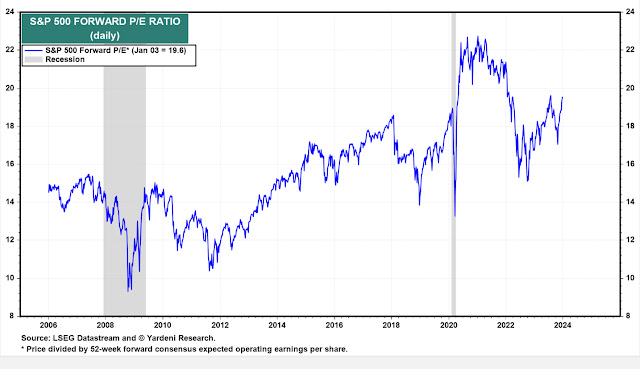

Could it be that the effects of the Covid stimmies are starting to wear off and the lagged effect of 525 bps of rate hikes are starting to slowly kick in? I heard so much talk about the lagged effect of Fed rate hikes in 2023, but now, when they should start to kick in, its crickets. Higher interest rates work quickly in the financial economy, but they work slowly in the real economy. Even if the Fed cuts 125 bps (what is priced into Fed funds futures for 2024), that doesn't really stimulate the economy. Its just less restrictive. It wouldn't keep the stock market from going down, if god forbid, we actually got this bubble market to pop and go down. 125 bps of cuts would still keep real rates positive, and 5 year corporate bonds would still be rolling over at more than 200 bps higher yields than 2019.

The Fed doesn't usually mess around with 25 bps paper cuts when jobs numbers are getting weak in a disinflationary environment. The Fed took its time in 2019 to cut because rates weren't that high, and the economy wasn't that weak. This time around, real rates are much higher, monetary policy much tighter, and I would argue the global economy is weaker now than back then. Back in 2019, at least you had Europe and China that were relatively strong compared to now. Those countries help contribute to disinflationary pressures for goods in the US.

I wouldn't be surprised if the Fed funds rate was below 3% by year end. That's 250 bps of cuts, most of which would come in the form of 50 bp increments. I could see the Fed doing 25 bps/meeting for 2 meetings in the spring, realize that its too little as stocks continue going lower, NFPs continue coming in weaker, forcing them to up the pace to 50 bps/meeting until year end. If they start in May, they could cut 250 bps in 6 meetings in 2024 under that scenario. I see that as being much more likely than the Fed dot plots of 3 rate cuts for 2024 as the economy just hums along without any worries.

We got some geopolitical worries hitting the overnight markets as crude oil went up, but has since settled back towards unchanged. Crude oil already rallied the past few days going into the weekend ahead of potential Middle East risk, so its not that surprising that there was little reaction from crude oil. After the trauma from higher oil prices in 2022 after the Russian invasion Ukraine, you still see overreactions to any piece of news coming out from the Middle East. Geopolitics is now always considered a concern for investors, even though it had no real effect for the two decades prior to 2022.

Its a heavy event week with big tech earnings lined up, QRA and FOMC on Wednesday, and nonfarm payrolls on Friday. With the SPX in a strong up trend going into these events, I don't expect much selling after any of these events. If there is a dip, it will be brief and immediately bought up. As is typical for an event packed week in a strong uptrend, the odds favor the bull side for both stocks and bonds. I bought some bonds late last week, looking to hold for the next few weeks. No position in stocks at the moment, but the COT data came out bullish with dealers covering shorts into the rally, and asset managers selling. It jives with what I am hearing on CNBC, which is skepticism about this rally. Its going to take time to form a top, definitely not seeing signs of a top yet in the positioning data.