I never thought I would ever think that a VIX going up to 15 would be considered a VIX spike, but it is. Going from VIX < 10 up to 15 is now considered a risk off move. It is still a tame market, but at least we are beginning to see the volatility rise as the market has reached valuations that are increasingly unstable. Valuations that cannot withstand 10 yr interest rates going up to 3%.

Just take a look at a 2 year chart of the S&P 500 and tell me that you think this is a good time to start buying dips. I was considering covering everything yesterday and maybe should have to reset my shorts today, but I will hold the position because I still see too much air underneath to 2805, and plenty of air below that to 2760. These parabola type markets are notorious for violent shakeouts, because there is so much speculative money in the market during these type of moves.

We have the Fed meeting today, and end of month, wrapped into one. I am hearing a lot of talk about pensions rebalancing from stocks to bonds but there is no definitive proof that they will rebalance today, instead of next week, or a month from now. Usually pension funds don't trade much, and from what I have read, are increasingly looking to increase equities allocations for their "higher" returns to emerge from their underfunded status. It is speculative to guess what they will do.

What I can surmise with greater confidence is retail finally getting confident about stocks. You can see it in the global equity ETF inflows. In the TD Ameritrade and E-Trade trade data. I can just feel it now reading the Stocktwits stream. The bullish bias has permeated the investment landscape. It is really late in the rally. I can only imagine the vicious selloffs with all this speculative money in the market. It will make 2015/2016 look like an opening act.

Looking for any bounces to be sold quickly in this market. Staying short, but with one eye on the exit on the next down day.

Wednesday, January 31, 2018

Monday, January 29, 2018

Stocks and Bonds Gapping Down

Is 2.70% 10 year finally a pain threshold that stocks can't ignore anymore? The bonds keep selling off, and at some point, that is going to affect the pricing of future cash flows, as well as the negative effects it has on the broader economy. The Fed is taking its merry old time tightening, so the market is getting ahead of their actions. The Fed fund futures are now pricing in 2.6 rate hikes for 2018. That is up from 2 rate hikes at the beginning of the year. Now it is viewed as almost a certainty that there will be 3 rate hikes now for 2018, which tells you how much the market is believing the Fed. You haven't seen this kind of forward market pricing of rate hikes for the next year since 2006. Even in 2017, the market was always vastly underpricing the expectation of rate hikes from the Fed forecast, because the Fed has always overpromised and underdelivered on rate hikes since the financial crisis. The market is finally believing in the Fed forecasts, which is a game changer.

Since the Fed will rarely surprise the market by hiking more than its forward guidance, it means there is limited downside for the short end of the yield curve. Going from 2.6 rate hikes to 3 rate hikes being priced is not going to present much downside for 2 year and under Treasury maturities. And the long end is supported by end users like insurance companies and pensions which are having to buy more long bonds to match durations of their liabilities, which are increasing as the baby boomers enter retirement. So the only vulnerable part of the curve is probably the 5-10 year maturities, which also happens to be the point where the Treasury is trying to issue more coupon bonds to pay for the higher deficits this year.

I expect Powell to be just like Yellen, so he probably won't surprise on the hawkish side, but with the S&P so strong, I also think he will try to do rate hikes for March and June, and then probably wait to see higher inflation or an S&P that keeps going higher before doing anymore.

Short term, there is the State of the Union speech, and with the market loving Trump, it will probably keep the market bid until Tuesday's close. The Fed meeting is Wednesday, but it is almost meaningless like most non press conference meetings, plus it is Yellen's last meeting, so market won't put much weight to the wording of the press release. I expect a sell the news reaction after the State of the Union, so Wednesday should see some weakness. The weakness in bonds should also be a burden for this market at these Treasury yield levels. But we'll see, shorting this market feels like betting against Mike Tyson when he was on a roll in the mid 80s.

Since the Fed will rarely surprise the market by hiking more than its forward guidance, it means there is limited downside for the short end of the yield curve. Going from 2.6 rate hikes to 3 rate hikes being priced is not going to present much downside for 2 year and under Treasury maturities. And the long end is supported by end users like insurance companies and pensions which are having to buy more long bonds to match durations of their liabilities, which are increasing as the baby boomers enter retirement. So the only vulnerable part of the curve is probably the 5-10 year maturities, which also happens to be the point where the Treasury is trying to issue more coupon bonds to pay for the higher deficits this year.

I expect Powell to be just like Yellen, so he probably won't surprise on the hawkish side, but with the S&P so strong, I also think he will try to do rate hikes for March and June, and then probably wait to see higher inflation or an S&P that keeps going higher before doing anymore.

Short term, there is the State of the Union speech, and with the market loving Trump, it will probably keep the market bid until Tuesday's close. The Fed meeting is Wednesday, but it is almost meaningless like most non press conference meetings, plus it is Yellen's last meeting, so market won't put much weight to the wording of the press release. I expect a sell the news reaction after the State of the Union, so Wednesday should see some weakness. The weakness in bonds should also be a burden for this market at these Treasury yield levels. But we'll see, shorting this market feels like betting against Mike Tyson when he was on a roll in the mid 80s.

Friday, January 26, 2018

Exterminating the Shorts

I don't know if there will be any shorts left at the top of this bull market. This parabolic move has destroyed a lot of capital from those fighting this trend. All the past historical patterns have been advocating short term weakness for months now, and yet it keeps going higher. The put/call ratio remains extremely low. The equity inflows are coming in heavy. Volatility is rising. The rises are getting steeper. Retail trading volume has exploded higher (trades up about 50% from previous year), if you look at the earnings reports from TD Ameritrade and E-Trade. It is all late cycle behavior.

Usually when the dumb money starts making money, it is usually close to the top of the move. And retail is making money in the stock market. I don't ever recall this kind of straight up market even in 1999. This is something different, and definitely harder to trade short-term. After I close out this badly timed short, I will have to choose a different way of making a bearish bet on this market. Either through a different equity index, bonds, or commodities.

It was foolish to have even tried to short one of the strongest index of them all throughout this bull market, the final boss, the S&P 500. I will go after easier targets next time. Hopefully I get a chance at a graceful exit within the next few weeks. There has to be a pullback in here somewhere, right? If not, it will get ugly for shorts like me. As painful as it is watching the daily gap ups, I will hold the position waiting for a panicky down day to cover. The VIX is finally firming up so it gives me a bit more confidence that a pullback is near.

Thursday, January 25, 2018

Added Short

This market is bonkers. The last few days have felt like short capitulation and FOMO wrapped into one. There comes a point where you just have to go by feel, and ignore the momentum and sheer one sided price action. Yesterday, I finally saw the kind of intraday volatility that I like to see after a big run. It felt like shorts went from weak to strong hands. The jumpiness in the market the last few days is what I like to see when looking for a short term top.

I thought I might have missed my short add opportunity yesterday when the ES plunged from 2854 to 2825 in an hour, but we're now right back up near 2850, which looks like a gift to short. I am not going to pass it up this time, I have put in a short in the pre market, raising my average up into the 2780s. Position is double now, so the moves will be more meaningful until I close out this short. But I feel like we see 2800 before 2900.

The weak dollar trend continues, which is what Trump and his team wants. Steve Mnuchin, the yes men of yes men, blurted out his love of a weaker dollar, saying it helps the US economy. I have said before, the big tax cuts financed by increasing government debt, will eventually result in more dollars in circulation as big budget deficits eventually end up with QE to monetize the debt. Oil at $66 is no coincidence. It is going to be consumer pain, corporate gain. Those $1000 bonuses to workers are PR stunts, the consumers will be shafted with higher inflation which will eat up those bonuses in a hurry, and it will be permanent increases, unlike the bonuses.

I thought I might have missed my short add opportunity yesterday when the ES plunged from 2854 to 2825 in an hour, but we're now right back up near 2850, which looks like a gift to short. I am not going to pass it up this time, I have put in a short in the pre market, raising my average up into the 2780s. Position is double now, so the moves will be more meaningful until I close out this short. But I feel like we see 2800 before 2900.

The weak dollar trend continues, which is what Trump and his team wants. Steve Mnuchin, the yes men of yes men, blurted out his love of a weaker dollar, saying it helps the US economy. I have said before, the big tax cuts financed by increasing government debt, will eventually result in more dollars in circulation as big budget deficits eventually end up with QE to monetize the debt. Oil at $66 is no coincidence. It is going to be consumer pain, corporate gain. Those $1000 bonuses to workers are PR stunts, the consumers will be shafted with higher inflation which will eat up those bonuses in a hurry, and it will be permanent increases, unlike the bonuses.

Tuesday, January 23, 2018

Not Like It Used to Be

They don't make the markets like they used to anymore. In the past, when it was 100% humans trading, past patterns worked more effectively. You would have more short term dips, and they were good risk/reward buying opportunities. Obviously, everyone knows that game now, BTFD, so the dips are shallower, and don't last long.

They don't make the markets like they used to anymore. In the past, when it was 100% humans trading, past patterns worked more effectively. You would have more short term dips, and they were good risk/reward buying opportunities. Obviously, everyone knows that game now, BTFD, so the dips are shallower, and don't last long.With a lot of money being managed passively or through systems and algos, the patterns have changed. That is how you get the least volatile period in stock market history happening in 2017 as the market made all time highs. Now its a self reinforcing situation in overdrive, without human emotion there to keep it in check. Humans are more easily scared that computers, and if you replace a lot of decisioin making with computers, then the market will trade with different characteristics. It will be more focused on sizing based on short term volatility, being more aggressively long when there is less volatility. Also, the dip buying systems are a force in this market, overwhelming the short term risk reductions of the conservative, risk-adverse systems which are underperforming. That is why you aren't getting a 5% correction, much less a 3% correction. Nowadays, corrections stop at 1%, and even then, those corrections don't last long.

I have not done enough critical analysis of the paradigm shift that is going on in financial markets. I tend to focus more on historical patterns for short term trading, and fundamentals for long term trading. The fundamentals still apply like they always do in the long term, but short and medium term patterns have definitely changed. Some of that is a product of the super low VIX period we are in, but most of it is structural, with less human trading.

The short term trading strategies that I have used in the past in the S&P futures are no longer consistent money makers. I haven't used them much because they don't work well in this kind of low volatility grind higher market. Trading against other humans is much easier than trading against HFTs. And if you are short term trading, most of the time, HFTs will be on the other side. It is especially disadvantageous if you are trading counter trend with size going against predatory algos that look to push positions towards stop zones. That is why I rarely day trade these days. Unless you have actual paper order flow, and not just HFTs making markets, there is very little edge. And the only time that paper order flow comes out in size is during high volatility periods.

Anyway, it has been a tough time for counter trend traders, but my fundamental outlook is still the same, so I see any short term losses from this time period to be made up in droves when the market makes a top. While I don't like losing money, it does make losing money easier to handle, because if I stick with the fundamentals, which favors shorts, eventually the losses will be made back in the long term.

I am looking to add to shorts very soon, I've been patiently waiting for this opportunity to add when the market gets overextended. It feels very overextended now.

Friday, January 19, 2018

Almost Everything Bubble

The purity of bitcoin harkens back to the stock market of a hundred years ago, when the gold standard limited money supply growth, with the resulting boom and bust cycles. Now that nearly everything is denominated in US dollars, the busts just don't last long, because of Fed policy.

Ever since the Greenspan put days of implicitly supporting the stock market with monetary policy, bubbles are nurtured and eventually get too big and unwieldly and collapse not because of a tightening Fed, but from its own weight and irrationality. Two classic examples are the dotcom bubble(1998-2000) and the housing bubble (2004-2007).

Some people say this is the everything bubble, but its really 3 things: stocks, real estate, and bitcoin, and they vary by country. In the US, its a stock market bubble. In Asia, Australia, Canada, and Northern Europe, its a real estate bubble. And among the younger speculators, its the bitcoin bubble. I see no bubble in bonds, because it is just being priced off of short term interest rates, and a term premium that ebbs and flows with short/medium term supply-demand. I also see no bubble in commodities, which are well below the peak levels of a few years ago.

The stock and real estate bubbles are linked because the most speculative real estate markets in the world, such as China, Australia, Canada, etc, mostly depend on a strong housing market for economic growth. With rising private debt reaching levels that previously resulted in recessions in the past, you are seeing declining housing sales in those countries, usually a precursor to a price drop. Historically, housing sales volume drops precede house price declines by about 12-15 months. If housing prices dropped sharply, those real estate bubble countries' economies would go into recession, which would have contagion effects to economies that heavily depend on exports to those countries.

So the most likely trigger for the next global recession is the real estate bubble popping in a few overheated countries. 2016 is just a precursor to a bigger downturn in China. Now that the Party Congress is over, there will be less incentive for the Chinese leaders to keep kicking the can down the road. Even if they did kick the can again, unless its a massive stimulus, the sheer amount of debt outstanding makes its economic effects minimal, as much of the new debt will be used to payback the old debt. It just builds a bigger pyramid. It is a centrally planned Ponzi scheme, with real estate speculation at its core, with insane amounts of yuan needed to be printed to keep Humpty Dumpty together. And capital outflows shut off to keep the semblance of a stable currency, when in reality, the moment it becomes free floating, it would drop at least 50%.

The past few days, I have noticed that the intraday volatility has picked up, and the indices seem more jumpy than usual. It seems like we've finally gotten to levels where you are seeing more air pockets and weaker bids. It feels like a market that is near a short term top, with short sellers mostly cleared out. I am close to adding to my short, but will likely wait till Monday because retail seems to be jumping on board, with mutual fund Monday coming up, as inflows are coming in hot and heavy recently. The put/call ratios have been absurdly low for weeks on end, so there is very little protection out there, and even less with post opex coming up next week. A big one day drop seems to be just around the corner.

Ever since the Greenspan put days of implicitly supporting the stock market with monetary policy, bubbles are nurtured and eventually get too big and unwieldly and collapse not because of a tightening Fed, but from its own weight and irrationality. Two classic examples are the dotcom bubble(1998-2000) and the housing bubble (2004-2007).

Some people say this is the everything bubble, but its really 3 things: stocks, real estate, and bitcoin, and they vary by country. In the US, its a stock market bubble. In Asia, Australia, Canada, and Northern Europe, its a real estate bubble. And among the younger speculators, its the bitcoin bubble. I see no bubble in bonds, because it is just being priced off of short term interest rates, and a term premium that ebbs and flows with short/medium term supply-demand. I also see no bubble in commodities, which are well below the peak levels of a few years ago.

The stock and real estate bubbles are linked because the most speculative real estate markets in the world, such as China, Australia, Canada, etc, mostly depend on a strong housing market for economic growth. With rising private debt reaching levels that previously resulted in recessions in the past, you are seeing declining housing sales in those countries, usually a precursor to a price drop. Historically, housing sales volume drops precede house price declines by about 12-15 months. If housing prices dropped sharply, those real estate bubble countries' economies would go into recession, which would have contagion effects to economies that heavily depend on exports to those countries.

So the most likely trigger for the next global recession is the real estate bubble popping in a few overheated countries. 2016 is just a precursor to a bigger downturn in China. Now that the Party Congress is over, there will be less incentive for the Chinese leaders to keep kicking the can down the road. Even if they did kick the can again, unless its a massive stimulus, the sheer amount of debt outstanding makes its economic effects minimal, as much of the new debt will be used to payback the old debt. It just builds a bigger pyramid. It is a centrally planned Ponzi scheme, with real estate speculation at its core, with insane amounts of yuan needed to be printed to keep Humpty Dumpty together. And capital outflows shut off to keep the semblance of a stable currency, when in reality, the moment it becomes free floating, it would drop at least 50%.

The past few days, I have noticed that the intraday volatility has picked up, and the indices seem more jumpy than usual. It seems like we've finally gotten to levels where you are seeing more air pockets and weaker bids. It feels like a market that is near a short term top, with short sellers mostly cleared out. I am close to adding to my short, but will likely wait till Monday because retail seems to be jumping on board, with mutual fund Monday coming up, as inflows are coming in hot and heavy recently. The put/call ratios have been absurdly low for weeks on end, so there is very little protection out there, and even less with post opex coming up next week. A big one day drop seems to be just around the corner.

Wednesday, January 17, 2018

Dip Buying Brigade

Was Tuesday's afternoon stock fallout from the bitcoin plunge? I know bitcoin is not part of the mainstream asset classes, but a lot of retail investors have invested in bitcoin, most of them who aren't particularly rich. If they end up losing a lot of money, that could have a slightly negative effect on the global economy. But as we look this morning, the overnight crew has already done their job to lift the stock futures to another gap up. It shows that you cannot overemphasize the price action from one day.

Yesterday finally showed the two way volatility this market has been lacking, but until we see actual follow through selling the next day, it doesn't mean anything. Trying to find meaningful bearish clues is difficult. We did finally see the VIX go up significantly yesterday, even though the downside wasn't that big. And this morning, even with a decent gap up, the VIX hasn't given up much of its rally so far in the pre market.

VIX is now trading at a 1 month high, while SPX also trading near a 1 month high. Bond market remains weak, which definitely is a negative, not a positive for stocks.

I haven't added to my short position, and I need to see more clues line up before I add. On the commodities front, Crude oil has had trouble cracking $65 (WTI)/ $70 (Brent). The speculators are historically long crude oil, so they are definitely loaded up on one side of the boat.

Other things like the government shutdown is just noise, and news fodder. Price action has to speak, not news. And it isn't telling me enough to really make a big bet.

Friday, January 12, 2018

When They Talk About Bonds

Here we go again. Usually on CNBC Fast Money, they hardly ever mention bonds. Its basically a stock show. No one really cares about bonds, because they don't move much, and because people put money in bonds for capital preservation, not big gains. And capital preservation doesn't sell on Wall Street. Its always about the big gains, so they promote stocks. Or the fantasy that investing in stocks will make a person rich.

Here we go again. Usually on CNBC Fast Money, they hardly ever mention bonds. Its basically a stock show. No one really cares about bonds, because they don't move much, and because people put money in bonds for capital preservation, not big gains. And capital preservation doesn't sell on Wall Street. Its always about the big gains, so they promote stocks. Or the fantasy that investing in stocks will make a person rich. This week, you've had the "bond kings" Bill Gross and Jeff Gundlach, talk bearishly about bonds, which has filtered to stock people on CNBC. There has been an underlying bearish tone to the price action and investor sentiment for a couple of months now, and from a longer term perspective, ever since Trump got elected. So just like this relentlessly rising stock market, with almost no corrections, which I have not witnessed ever before, there has been a corresponding steady drip drip lower move in bonds, which is rare. Nothing spectacular, but enough to get the attention of the stock guys who usually could care less. From my experience, those are usually inflection points for bonds.

If the media was silent about this move lower in bonds this week, I would have been more worried that it could really turn into a big rout and take 10 year yields up to 2.80%, or possibly even test the often mention 3%. But all this media noise when we barely broke out above 2.50% tells me a top in yields is coming soon, probably below 2.65%.

I have a hard time imagining the Fed hiking more than 3 times over the next 3 years, much less in 2018. So if the final rate hike takes Fed funds to 2-2.25%, then the 5 year yield probably can't get above 2.50% (its trading 2.33% now), which means the 10 year probably can't get above 2.70%.

The reason I don't think the Fed can hike more than 3 times is because stocks are at such a high level, that once short term interest rates get above 2%, that is going to put pressure on stocks, which will feedback to the Fed, who rarely if ever hikes when the stock market is going down. And with Jerome Powell as Fed chair, a Trump yes man, you can be assured he won't be the one hiking the economy into a recession.

Back to what CNBC is promoting with its countless mention of this hot stock and that hot stock, and now with bitcoin. In reality, most investors end up losing, and the big winners in the investing space are those that use other people's money to collect fees and have a free call option for the privilege of gambling their money. The stock market is basically a glorified online casino. The HFTs, brokers, and exchanges take their cut of the action and everyone else is left fighting each other in a negative sum game.

They say stocks go up in the long run, so everyone can be a winner. Yes, if you just buy and hold an index. But most people aren't doing that. Things are slowly changing, and many people have finally figured out that active investing just means subpar performance and higher fees compared to passive investing. Yet you have the fund managers warning about the dangers of passive investing, when they themselves are a much bigger danger to an investor than the market itself. Most fund managers trade too much, charge too much, and most importantly, have no edge. There is a small minority of fund managers with a definite edge in the markets, but most of them are not accepting new money or charge such exorbitant fees that their edge over the S&P 500 over the long run is questionable, especially if they are managing multi billions.

It is one thing to beat the S&P when a fund manager is trading $100M, its a totally different ballgame when they are trading $10B. Most of the big edges in the stock market reside in small cap stocks, and in particular, actively traded day trader stocks that have "limited time" liquidity. "Limited time" liquidity is when a normally very low volume small cap stock suddenly has a price and volume spike on a news release. These days, most of them are bitcoin related, but they can be various flavors of the month, depending on what theme is hot at the moment. Anyway, once the excitement of these stocks die down, the volume plummets, so you can really only trade meaningful size is when the stock is in play, or right afterwards. It eliminates whales from participating in these markets, because they just can't put on any meaningful positions to affect their performance.

In general, an efficiency of a market runs along a spectrum correlating with its liquidity. Small cap stocks are less efficient than mid cap stocks which are less efficient than large cap stocks which are less efficient than the S&P 500 index.

I am still short here, and in some pain, but kept my short reasonably small, so I can weather this out with just a few scratches. But there will be hell to pay later this year once this pig tops out. Until then, play it conservatively. There will be plenty of opportunities to make money on the short side in a few months. If you are a bear like me, just don't get buried before then.

Wednesday, January 10, 2018

China and Treasuries

China is trying to be the bond vigilante. It is seeing Trump ballooning the budget deficit with tax cuts and doesn't like it. The last thing China wants is more Treasury paper coming out of Washington, which dilutes their holdings and encourages yields to go higher. They see budget deficits going to the moon with entitlement spending rising with the mass retirement of the baby boomers, while the US corporations get fat tax cuts. It is not a desirable situation for China, as they want to get better prices for the Treasuries they will eventually have to sell to defend the yuan. And that's not as far off as you would think.

Their capital controls have effectively stifled international investment and has made China a roach motel for dollars. They can come in, and but they can't get out. You think under that scenario any sane Chinese would want to bring home their dollars at 6.5 yuan/dollar, as China keeps printing money to keep their Ponzi scheme going? Maybe after a devaluation, the dollars come home, but they'll need to entice them with a much higher exchange rate, probably at least 10 yuan/dollar, and more like 12-15 yuan/dollar. Either that, or have the debt actually be paid off and not rolled over every year. That's not going to happen, because that would lead to a debt deflation crash, so you will eventually see China having to go the devaluation route, whether they like it or not.

China doesn't get to defy the laws of economics by being a command economy. It only lets them delay the inevitable longer than a free market economy.

I am a bit surprised this China news about an official recommending to halt Treasury purchases caused such a selloff in S&P futures. Its not as if China has been a big buyer of Treasuries lately, and they probably don't have the luxury to buy much anyway, considering the lack of dollars flowing in. It does show you how vulnerable this market is getting to any kind of negative catalyst, as higher bond yields are definitely starting to weigh on this market. And the 10 year hasn't even hit 2.60% yet. There is no way this stock market calmly rallies if the 10 year gets anywhere close to 3.00%. Just by that fact alone means that Treasuries can't sell off much from current levels, because stocks will probably also sell off as well.

Still short, but if we can drop down to the 2730 area, will probably cover and look to reshort at higher levels. Crude oil at $63.50 also looks like a sell area, with lots of resistance here around the 2015 top.

Tuesday, January 9, 2018

Irony of the Parabola

Since the closing price in 2017, it has been a straight shot up over 80 SPX points in 6 days. Despite the big gain in 2017, we didn't see anything close to an 80 point rally over 6 days. This looks like the bear's worst nightmare, but it may be the best thing to happen for those looking for that elusive top. If you are leaning short, like me, then it is a bit painful, but if you have managed risk and not plunged in on the short side, the opportunity is just getting better and better.

In a perverse way, I hope that the market keeps going higher for the next few days, because that will signal that the top is closer, and will cause that much more volatility when the market goes down. I have sized small enough where I have room to add to shorts or just take the loss and not be affected emotionally. It is times like this when I am glad to keep position sizes small when fighting such a strong trend. I will definitely trade bigger when the market gets more volatile and I see more concrete signs of a top formation. But right now, it is about weathering the storm and having enough capital to operate with on the other side of the mountain.

Usually these kind of parabolic rises after a long uptrend are capitulative in nature. Yes, it is a capitulation of both shorts and longs. Shorts throwing in the towel, with losses getting too big, and longs throwing caution out the window and diving in with FOMO on the mind.

Really the worst thing that could have happened for bears is a continuation of a low volatility grind higher, just prolonging the rally. But the speed of the rise is a good sign that while the top will happen at a higher level, there should be a lot more volatility once we get there because of all the air underneath. The air is getting quite thin up here, with SPX at 2757, a level that I would never have imagined would happen back in 2016 or even last year. Yes, you will get a one time boost to earnings growth in 2018 because of the lower corporate tax rates, but as soon as you get a Democrat in the White House, there will be pressure to get those corporate tax rates back up.

Today, we finally saw 10 year yields break out above 2.50%, as it has been hanging just below that level as the pressure from the relentless stock rally eroded bond sentiment. This rise higher in yields will act as a brake on the SPX rally as this stock market cannot handle much higher rates, regardless of what you hear from the pundits. The only reason the stock market was able to rally so strongly last year was because 10 year yields didn't go up with the stock market. If the 10 year had actually rallied like the 2 year yield in 2017, you would have had 10 year rates above 3% and that would have been a rally killer.

For the shorts that can withstand the early storm in 2018, they will be rewarded well later in the year when there is payback for all this greedy excess in stocks.

Monday, January 8, 2018

China Shoes to Drop

The hot new theme for the past few months has been global reflation. With WTI crude over $60 and the metals steadily rising, global investors are piling into materials, energy, and other "value" areas since tech is too expensive. These value names are loaded to the gills in debt, and their return on equity over the past 10 years is horrible. They have consistently lagged the S&P 500 during this 9 year bull market. And they are in one of the sectors which don't have quasi-monopolies like the tech names.

I mention the materials because they were being touted on CNBC Fast Money on Friday as being a good place to put your money because tech is overextended and expensive. It is coming to this. Reaching for the laggards which have worse fundamentals hoping these dogs with fleas will catch up. And usually they just keep lagging, because in the late stages of a bull market, the growth names usually outperform value because they are the only ones able to hold up as economic growth starts to flatten out. And contrary to what you hear from the CNBC cheerleaders, economic growth has been stagnant, stuck around 2% growth for years.

The sad part is that this mediocre growth has been achieved by pushing global yields to historic lows along with QE, encouraging more debt. And the masses have obliged by piling on more debt. Oddly enough, in the country with one of the highest interest rates in the G20, China. That is where the financial imbalances are building. Chinese private debt (corporate + household debt) to GDP is exploding higher, now well over 200%. Japan, US, and Europe are all around 150%.

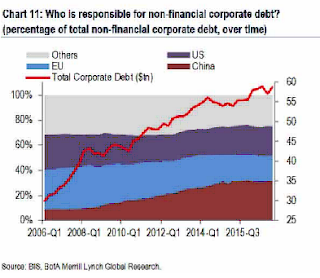

Nonfinancial corporate debt growth since 2006. Its all China.

The above charts are as of middle of 2016. The numbers have only gotten bigger since.

China is the gorilla in the room when it comes to iron ore and copper demand. It has provided the marginal growth for the global economy via debt expansion for the past 9 years. I know they say that its a command economy and they can paper everything over by cutting rates, printing yuan, and backstopping everything, but you think the owners of the debt will just stand still holding assets in yuan when the yuan gets devalued? It is ticking time bomb and what happened in 2016 is totally forgotten. That was just part 1 of the China crisis. Part 2 isn't far off.

SPX has been on fire this 1st week of January. I was completely off on my expectations for the new year. I am still short, but I will look to exit as gracefully as possible on any 20 point pullback. I underestimated the equity inflows for the new year and the crowd excitement for this market. We are clearly in a bubble blowoff phase, which is something new. Before, there would be a grind higher, but with pauses along the way. Now its a mad rush into risk assets. The fundamentals haven't changed, so there will be give back of these moves in a few months. But it definitely will not go down quietly, and the top will take longer than expected.

I mention the materials because they were being touted on CNBC Fast Money on Friday as being a good place to put your money because tech is overextended and expensive. It is coming to this. Reaching for the laggards which have worse fundamentals hoping these dogs with fleas will catch up. And usually they just keep lagging, because in the late stages of a bull market, the growth names usually outperform value because they are the only ones able to hold up as economic growth starts to flatten out. And contrary to what you hear from the CNBC cheerleaders, economic growth has been stagnant, stuck around 2% growth for years.

The sad part is that this mediocre growth has been achieved by pushing global yields to historic lows along with QE, encouraging more debt. And the masses have obliged by piling on more debt. Oddly enough, in the country with one of the highest interest rates in the G20, China. That is where the financial imbalances are building. Chinese private debt (corporate + household debt) to GDP is exploding higher, now well over 200%. Japan, US, and Europe are all around 150%.

Nonfinancial corporate debt growth since 2006. Its all China.

The above charts are as of middle of 2016. The numbers have only gotten bigger since.

China is the gorilla in the room when it comes to iron ore and copper demand. It has provided the marginal growth for the global economy via debt expansion for the past 9 years. I know they say that its a command economy and they can paper everything over by cutting rates, printing yuan, and backstopping everything, but you think the owners of the debt will just stand still holding assets in yuan when the yuan gets devalued? It is ticking time bomb and what happened in 2016 is totally forgotten. That was just part 1 of the China crisis. Part 2 isn't far off.

SPX has been on fire this 1st week of January. I was completely off on my expectations for the new year. I am still short, but I will look to exit as gracefully as possible on any 20 point pullback. I underestimated the equity inflows for the new year and the crowd excitement for this market. We are clearly in a bubble blowoff phase, which is something new. Before, there would be a grind higher, but with pauses along the way. Now its a mad rush into risk assets. The fundamentals haven't changed, so there will be give back of these moves in a few months. But it definitely will not go down quietly, and the top will take longer than expected.

Thursday, January 4, 2018

Risk Seeking

Nothing is 100% certain in this business. That is what allows individuals using mere discretion to make money by clicking mouses and pressing buttons. If trading was 100% certain, the robots would have taken over a LONG time ago. There in lies the paradox of trading. You want the edges to be big enough and consistent enough to make a decent profit, but not so big and consistent that they can be done by a robot with just rudimentary AI.

You need times like 2017 and now, to throw the robots off the scent, to get traders to abandon historically robust models because they aren't working over the last 12 months. Times like these are uncommon. A VIX staying below 10 while the market rallies relentlessly with not even a 3% correction are rare. It is times like these which make traders ignore the inherent risks of sudden price declines, and instead chase riskier strategies like selling volatility to make their returns.

You can't just hold bond and expect a risk free 5-6% anymore. So rather than lower their return expectations, investors are going out on the risk curve, from government bonds towards corporate bonds, leveraged loans, subordinated debt, etc. From cash to equities. If you are a follower of financial Twitter, I am sure many of you have seen the charts of the dropping cash allocations for individuals and funds, back to late 1990s levels. Also mentions of the low equity put call ratios. Retail is buying into this market, and bullish. I can clearly see the shift in the tone on Stocktwits, from skepticism about the rally in 2016, to outright optimism due to tax cuts and the "strong" economy since the fall of 2017.

Or you can just look at the chart of the S&P over the last 2 years. 50% move off the bottom in early 2016. And even at that bottom, at SPX 1810, the market was overvalued based on historical P/E and P/B measurements. There is so much overvaluation built into this market, a lot of potential downside energy is stored here. It is hard to predict when the dam breaks, but the risk seeking attitude of investors tells me that its not far off. I started a small short yesterday, and down a bit, but will hold for a pullback. I will give the trade at least 2 weeks to work out, and may add more if I see a bit more of a rally.

You need times like 2017 and now, to throw the robots off the scent, to get traders to abandon historically robust models because they aren't working over the last 12 months. Times like these are uncommon. A VIX staying below 10 while the market rallies relentlessly with not even a 3% correction are rare. It is times like these which make traders ignore the inherent risks of sudden price declines, and instead chase riskier strategies like selling volatility to make their returns.

You can't just hold bond and expect a risk free 5-6% anymore. So rather than lower their return expectations, investors are going out on the risk curve, from government bonds towards corporate bonds, leveraged loans, subordinated debt, etc. From cash to equities. If you are a follower of financial Twitter, I am sure many of you have seen the charts of the dropping cash allocations for individuals and funds, back to late 1990s levels. Also mentions of the low equity put call ratios. Retail is buying into this market, and bullish. I can clearly see the shift in the tone on Stocktwits, from skepticism about the rally in 2016, to outright optimism due to tax cuts and the "strong" economy since the fall of 2017.

Or you can just look at the chart of the S&P over the last 2 years. 50% move off the bottom in early 2016. And even at that bottom, at SPX 1810, the market was overvalued based on historical P/E and P/B measurements. There is so much overvaluation built into this market, a lot of potential downside energy is stored here. It is hard to predict when the dam breaks, but the risk seeking attitude of investors tells me that its not far off. I started a small short yesterday, and down a bit, but will hold for a pullback. I will give the trade at least 2 weeks to work out, and may add more if I see a bit more of a rally.

Tuesday, January 2, 2018

Europe Looking Horrible

The European markets can't handle a strong euro. At 1.20 EURUSD, the European equities are struggling to keep up with the US. The paper napkin chartist in me sees a double top made last year, One in May and one in November. The ECB is tapering bond purchases and showing few signs so far of worry about lagging European stocks and a stronger euro. The European stock market is pushing as far as it can to force the ECB's hand. They don't want to see QE end, and they are signaling their dissatisfaction by selling off despite a US market that grinds higher.

You would figure with the automatic inflows into equities, the European markets would be stronger, but they are down again today, despite Hong Kong going up 2% and Asia strong overall. The action in Europe shows you that QE isn't everything when it comes to driving stock prices. Otherwise, Europe should have outperformed the US since 2015. Clearly, they have lagged badly.

With the big gap up today, I am going to be shorting this morning, small size, to test the waters, because it seems like all the good news catalysts are behind us and the price action the past 2 weeks shows enough heaviness to interest me on the short side for short term trades.

Subscribe to:

Posts (Atom)