The Fed, not wanting to shock the market, put out a WSJ piece to signal 75 bps, to get the market prepared for that 75 bps hike. What's the point of signaling 50 bps for June and July and then changing your mind and going 75 bps a few weeks later? Hey Powell, its real simple. Any ape can do it. Just shut up!

Forward guidance is useless, and the Fed is still using it to try to baby the market, to coddle it so it doesn't have a temper tantrum. And the market still buys it, thinking that Powell actually can keep his word, when over half the stuff he says is mealy mouth word salads meant to placate the market. He knows he's up shit creek, but he tries to act confident, and unworried.

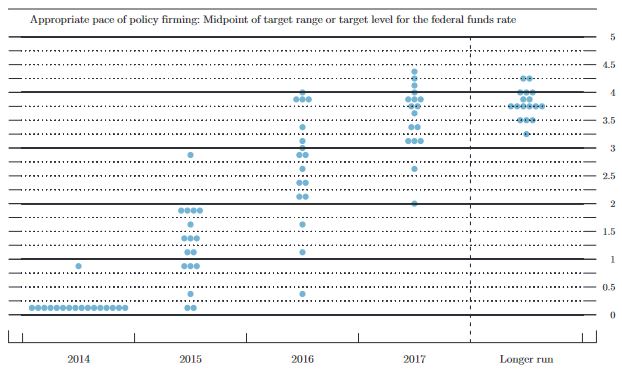

Let's not forget the ridiculous forward guidance of zero rates into 2024 in the 2020 FOMC meetings. That's been swept under the rug, just like those calls for a longer run 3.75% Fed funds rate in the Fed dot plots in September 2014.

The Fed has not only lost credibility with their transitory inflation nonsense last year, but its lost credibility from all the other unnecessary forward guidance they've put out over the years. In particular, the dot plots are a joke, but the market still likes to make market interpretations based on it. Unreal. They are micromanagers, and they don't know how to just sit still, and say nothing. Even the terrible Greenspan would come up with all kinds of polysyllabic obfuscation to give nothing away in his speeches.

They are arrogant beyond belief. They think they are Nostradamus, able to see into the future. They act like they know everything, and those shills at the press conferences eat it up and disseminate it to the masses. If you brought in someone from an Amazon tribe from the jungle and let them watch those Powell press conferences and translate it, they would think its all pure theater.

Talk about government waste: having all those Fed governors, economists, their assistants, etc. You can get rid of the Federal Reserve and all its employees. Put in a wide range of acceptable short term rates, say 1-4%, and let the supply and demand for money do its job within that range. Hand over the interest rate powers to the market, and if the government thinks the markets are panicking and getting out of line, step in and keep it in line. Not only would it save billions of dollars, it would make for much better monetary policy.

Let's get back to the market. There are some out there who think the Fed going for 75 bps instead of 50 bps is better for stocks, because it signals that the Fed is more serious about getting inflation under control. No, its not good for stocks, its good for bonds. Because the more the Fed tries to get inflation under control, the more they hurt the economy, which will spill over into corporate profits. As for bonds, they have gotten crushed with all the extra hikes priced into the short end, which has cascaded to liquidations in the long end.

The long end of the yield curve wants a Fed that is looking to aggressively tighten and make the economy weaker, because it will ensure lower rates later. The short end doesn't have that luxury, as it has to deal with the upcoming rate hikes during that process of making the economy weaker. So expect a power flattening over the next couple of months, I expect 2-10s to get inverted by at least 20 bps by the next FOMC meeting in late July. Its +6 bps now, so at least a 25 bps move in the 2-10s. After that, I expect a bull steepening starting in the fall, when it becomes clear to everyone that the economy is clearly hurtling off the cliff at 55 mph. There is no way the Fed can keep this tightening path for the rest of the year as the STIRs market is forecasting, a terminal rate of 3.75%. No way.

Economy is rapidly weakening, the leading indicators are all flashing red, the wealth effects are all negative (big losses in stocks and bonds over past 6 months, big rises in food/energy costs over past 6 months), and the Fed is still on the warpath. Its going to be a lot faster U turn than people expect. Once the employment numbers turn south, and its probably going to start at the next release, you will once again see the bond market act as a good hedge for stocks. You had a ton of baby boomers who felt rich and financially invincible as both their stock and bond portfolios skyrocketed the past 10 years, and especially sharply over the last 5 years. They are getting a rude awakening this year, and some are going to have to go back to the labor force to strengthen their financial position.

The Fed is in a bind. They are not the only ones to blame for the inflation, it started with Trump/Mnuchin and their insane corporate tax cuts, corporate welfare, plain and simple, which helped blow out the budget deficit to trillion plus during an economic expansion, 5% of GDP, unheard in previous eras. Those Mnuchin led PPP / Covid bailouts were beyond excessive, trillions going down a black hole to who knows where. I'm sure Mnuchin and friends had a field day with that one. And then you had Biden double down on excessive fiscal policy by spending trillions more on stimmies, and lots of pork, when the economy was rocketing higher in early 2021, adding fuel to the inflationary fire: creating a massive bubble in bitcoin, meme stocks, big cap tech, and real estate.

The US is well on its way towards becoming a rich man's Argentina. Trillions in net new Treasuries issuance every year will have to find real buyers, if the Fed isn't QE-ing. That's not going to be easy when its becoming more apparent that the US government is abusing their exorbitant privilege of having the world's reserve currency, by running huge budget deficits, along with a huge trade deficit, while running bazooka QE campaigns on a regular basis. That's a playbook for a future banana republic.

Back to the current market. We're seeing the worst possible situation for stocks. A hawkish Fed looking to get more hawkish, a slowing economy that's not readily apparent to the masses because of the high inflation hiding the weakness underneath, but will be clear to everyone as the wealth effect acts a wet blanket on the economy, which has no organic growth due to the lack of growth in the working age population, meaning without constant wealth effect increases and fiscal stimmy packages, the global economy is going nowhere. Zero growth organically is the new base case without massive fiscal stimulus and rising stock and bond markets. With plunging stock and bond markets, its negative growth. The only thing keeping the global economy from completely falling apart is all that money floating around in the system, which has kept house prices high.

I did put on a SPX long on Monday, looking to play the pre FOMC rally, which hasn't happened. I'll give it a few more hours and get out before the announcement. I see no edge post FOMC for either side, so I'll go back to the sidelines, and use my dry powder if the SPX really plunges lower (3400-3500) and creates collateral damage in the energy sector, where I will add to longs there.

7 comments:

75bp!! 3800 short.

Good call. It's looking like another 4%er today already.

Monday is a US holiday. the longs won't want to hold risk over the long 3 day weekend. Gamma squeeze territory here.

The market action is pretty weird. NVDA/CRWD etc faring quite well given the weakness - revisiting what I am missing and if I want to continue the shorts. If Fed is aggressive, commodity trade might slow down for some time. @marketowl would u still go long in the 3500 area?

More down for sure but I am expecting some sort of bounce here before resumption of downtrend.

If it goes down to 3500 by next week, I'll buy into that type of panic. If it consolidates and rallies up and then sells off to 3500 in Aug/Sep, I'm not going to buy it there.

I'm using the weakness today to add to energy names. Unless we get Chinese locking down their whole country, oil can't be kept down. Even a recession won't do it, its going to take a 2008 style deep, deep recession and I just don't see that happening with all the inflation. You only get those type of deep deep recessions when there is deflation and a credit freeze. That's not happening here.

I'm out. And waiting good place until next week. Longs looks like too much risky. I will rest and playing guitar with my twins for mild mental.

Now I'm listening robert miles - children LOL

Post a Comment