1. Be independent in your analysis. Don't be influenced by what the market "experts" say on TV or Twitter. Many are pumping their book or are just parrots that repeat what they hear. They are usually wrong more often than they are right.

2. In the equities market, there is a lot more competition on the long side than there is on the short side. Less competition means more opportunity. There is a huge army of traders and investors looking for long opportunities. A much smaller army of those looking for short opportunities. A lot of investors and traders just don't like going short. It feels unnatural. Awkward. That's why they'd rather buy an inverse ETF to get short exposure than outright short an ETF. They'd rather buy put options than go short stock or sell call options.

3. Shorting individual stocks is not like shorting the SPX. For example, the behavior of small cap pump and dumps is totally different than the SPX. Too many think that because the stock market goes up over the long term, that shorting individual stocks is a losing game in the long run. But there are a huge number of stocks that are long term losers, even during a bull market. Many companies use the stock market as a piggy bank and raise capital, regularly issuing stock and diluting because they need to 1. keep the company alive 2. pay themselves.

4. Why do you have an edge? Are you a step ahead of institutional and/or retail flows? Are you good at pattern recognition and recognizing a past market that is similar to the current market? Are you good at reading SEC filings of speculative small cap stocks and predicting future dilution?

If you can't logically and objectively state the reason, then you probably don't have a real edge. Trading and investing are a mixture of skill and luck. In the long run, skill is much more important. But in the short run, luck is a bigger factor. Its hard to tell whether you are lucky or skillful unless you've traded for years.5. Trading is lonely. Humans are social animals. It makes traders flock towards groups: subscription services, Twitter/Stocktwits, message boards, etc. There is nothing wrong with joining a group, but do it for social reasons. Not financial reasons. Joining a group can make you fall into group think, which is often counterproductive.

6. All things being equal, you want to be in positive carry trades. They provide you a margin for error on your trades, where you can win even if prices stay the same or slightly go against you. The most obvious example is being long Treasuries. Since the yield curve is positively sloping most of the time, you collect carry on your position, and over time, it can add up to be more than any losses from higher yields. And if yields go down, you get the carry + price appreciation. Other examples are short EURUSD, short VIX, and long SPX.

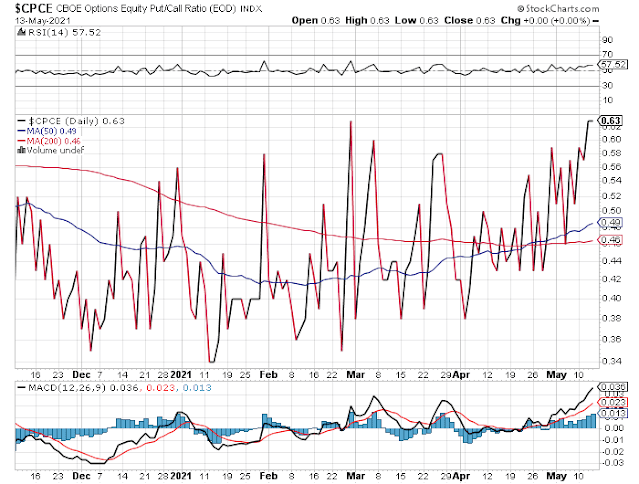

Starting to see some of the retail traders chase meme stocks again, echoes of what happened earlier this year, although much less broad based. Traders are less worried about interest rates, and have put inflation on the back burner after seeing the market shrug off a hot CPI number 2 weeks ago. Complacency is building. Market looks set up for another pullback if we see the bond market weaken again. Still over extended, although working off the overbought condition by going sideways for the last 6 weeks.