No V bottoms here. As if you needed more proof that we are in a completely different trading environment than 2009-2021, just see how much the market has pulled back off the top of the rally, almost 200 SPX points in less than 48 hours. That would have been unthinkable back in the bull market days.

A couple of days ago, you heard a lot of talk about quarter end rebalancing from stocks to bonds, about a big rally into the end of the quarter, as if the market would conveniently cooperate with the plans of a bunch of short term traders. A group who have about as much conviction in their trade as Powell does with "fighting" inflation. In other words, almost none.

You have to play by bear market rules. Only buy when there are deep, deep pullbacks, big oversold conditions. And don't get greedy after buying, when you get a short covering rally for a few days and the crowd starts getting excited, you have to push the eject button and sell. If you missed the bottom, don't chase stocks higher. If you are waiting to short, wait for the bulls to push the market to short term overbought readings, preferably after at least a week of rallying, and near previous resistance levels (now around 3900-3940) and then short and wait for the sellers to come back, as they usually do quite quickly.

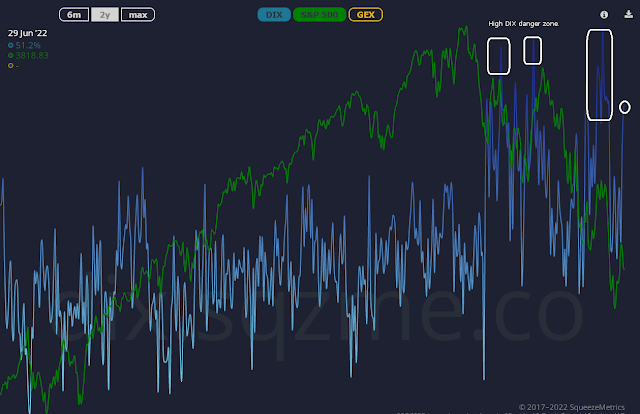

My favorite short term indicator of retail investor behavior (DIX dark pool buying) has popped above 50 for the past 2 days. DIX > 50 is usually quite rare, although it has been much more common in 2022. A high DIX used to be very bullish during the bull market, but the indicator has flipped on its head, and its now a contrarian indicator. Retail buying (high DIX) used to be a bullish sign, especially with a low/negative GEX reading, but now its the complete opposite. Low DIX after a big selloff is bullish, High DIX after a bounce is very bearish.

With 2 consecutive DIX readings above 50, we are well into the danger zone. It flashed warning signs in early February after a rally, late March after a rally, late May/early June after a rally, and now in late June after a rally.

My theory on this indicator is that retail buying (high DIX) used to work when the institutions would occasionally be dumping their holdings aggressively, usually in a pullback during an uptrend (2011-2021 was mostly a huge uptrend). Retail as is their tendency, was to buy the weakness, and as institutions stopped selling, and got back to buying, the market rebounded quickly. That's no longer the case. Institutions have only gotten back to buying in short spurts, which have left retail holding the bag when they bought the dips and chased after they thought they saw a V bottom (early February, late March, late May/early June, and now), only to have the rug pulled underneath them.

Low DIX environments are when institutions are more aggressively buying than selling, and retail is not actively buying or participating. Those are environments when fundamentals are favorable and conducive to buying the dip. This is not one of those environments. It is an environment that the DIX database has never covered until this year, a bear market (like 2001-2002, 2008). That's why you see so many of the stat based market trading systems fail because they are mostly mean reversion strategies that are effectively just buying the dip, and it worked fabulously since 2009. That's no more. Its a true bear market, something 2020 didn't prepare anyone for. The quick 20% "bear markets" that people were used to like 2010, 2011, 2018, 2020 were never real bear markets. They were short term panics in a raging bull, with an activist Fed looking to rescue the markets whenever they went down. Comparing 2010,2011,2015, 2018, 2020 with 2022 is like comparing oil and water. Totally different situations. Totally different price action.

That's why so many have been frustrated by the market this year, because its acted totally different than what investors have seen over the past 13 years. And we are still seeing equity fund inflows. When was the last time you saw equity fund inflows into such a weak market? Its unprecedented. I don't expect a real bottom until you see lots of fund outflows. Nowhere even close to that.

Wow, last week's rally fizzled fast. Going into Monday, its the first time this year I've seen short term traders on TV or Twitter so bullish. I should have taken that cue and aggressively shorted the rally on Monday. I still believe the bear market rally which started on triple witching opex has more time left. But after how deep this pullback has been, I expect this bear market rally to struggle to even get to 4000, much less the 4100 that many seem to be predicting.

8 comments:

OWL there are no buybacks

So the DIX buying is probably bigger than what you think.

Also ARK took in over$600m since mid June-accumulated inflows 8 consecutive days-longest since Marc 21.WTF??

JF

Right, we are in buyback blackout period, which means retail buying is even a bigger piece of the pie than usual. ARKK flows are probably best indicator of retail investor flows. Mom and pop are still buying aggressively....

same thoughts on the Dix. Seen lot on twitter slurp earlier this year and are now silent

I always thought of DIX as institutional buying (as the squeeze metrics site says/implies) and maybe dealer flows. But the bbg article they are quoted in talks about DIX as a retail driven metric. On a macro level it is likely it is a mix of the two…which would then lead me to want to make a retail-lovers dix sub-index. TSLA, FAANG, any others?

Keep calm

And

반바지

DIX is based on dark pool short selling, which is done by market makers taking the other side of buy orders. Those buy orders have a tendency to be done by retail traders, as they flow through payment for order flow centers like Citadel, Wolverine, etc. Institutions also use dark pools, but their overall percentage of volume is much less than lit venues.

TSLA, FAANG, NVDA, AMD, etfs: ARKK, TQQQ, a few others that are smaller market cap like AMC, GME, PLTR, etc.

The bear market rally is over? Damn wished I'd closed my long towards end of day. Almost 60 points up already from 3770.

Didn’t say bear market rally was over, just suprised that its struggling to rally off of such oversold conditions. Ths SPX has been trading well below the 50 day moving average for the last 2 months, which is rare. Usually you get a very strong bounce and continuous rally off of those conditions. Next week is the time for bulls to run this market up as yields have come way down. Seasonally bullish time period as well around July 4 holiday.

Post a Comment