Friday, December 30, 2011

Resistance and Shorting

There is heavy line of resistance between 1260 and 1264. I do not see this market able to break through on the final day of the year. You should see traders closing out their books and that could lead to some weakness today. I am looking to daytrade short intraday but will not stay short overnight. As I have mentioned in the past, the first trading day of the year is the highest percentage gap up trade out of whole year.

Friday, December 23, 2011

Slow Till Next Friday

Historically, you see the lowest volume the day before Christmas until the last day of the year. Usually, you will see volume pick up on the last trading day of the year. So it will be low volume action till next Friday, so I don't see us moving much from current levels till then. Not much to say unless the market starts to move, but I doubt it will. Merry Christmas.

Wednesday, December 21, 2011

No Santa

I think we've already topped out on this rally (1 day and 1 night). The Europeans marked the top at 1249 spazzing out over their ECB scheme, whatever it is. The trend remains down. Yesterday was a short squeeze + Santa rally buyers. Those buyers will become sellers over the next few days. Looking for a retest of 1196 before year end.

Overnight Top

We have topped out at 1249 overnight, on the ECB long term refinancing operation report. Apparently, it came out bullishly, so you had a reflexive spike on the news. The problem with this market is too many are counting on this silly notion of an automatic year end rally. I even thought so!

There are no guarantees in the stock market. That is especially so when so many think so. As you know, I am a CNBC fader. I try to ignore most of the drivel on that channel, but Fast Money gives me a clear view of the short term trader sentiment. And it is too bullish. Anytime Brian Kelly on CNBC gets excited about stocks, I try to go the other way. We act weak for a week, not too much bearishness, and then we have a whopper of a rally and everyone is expecting us to rally relentlessly till the end of the year.

You really have to trade the European markets to catch the bigger moves in this market, because the European traders tend to overreact much more than the American traders. Not much to do now, unless we can take this thing back near 1250, where I will be very willing to provide supply.

There are no guarantees in the stock market. That is especially so when so many think so. As you know, I am a CNBC fader. I try to ignore most of the drivel on that channel, but Fast Money gives me a clear view of the short term trader sentiment. And it is too bullish. Anytime Brian Kelly on CNBC gets excited about stocks, I try to go the other way. We act weak for a week, not too much bearishness, and then we have a whopper of a rally and everyone is expecting us to rally relentlessly till the end of the year.

You really have to trade the European markets to catch the bigger moves in this market, because the European traders tend to overreact much more than the American traders. Not much to do now, unless we can take this thing back near 1250, where I will be very willing to provide supply.

Tuesday, December 20, 2011

Flatliners

I was waiting for a big snapback rally and I missed it because the bots started the rally overnight. Now after this 30 point surge, we are back in no man's land, where there are no trades to be made. The trading has flatlined for the day.

P.S. This is your Santa rally, if you didn't get long yesterday at the close, you missed it. The fuel has been all used up.

P.S. This is your Santa rally, if you didn't get long yesterday at the close, you missed it. The fuel has been all used up.

Monday, December 19, 2011

One More Push

I am waiting for one more move lower before I get interested in buying. That could take us down to anywhere from 1180-1200. The time frame I am looking at is Tuesday - Thursday. The Santa Claus rally should be quite weak, and will only set up if we can flush this market out and get rid of any remaining weak longs.

Friday, December 16, 2011

Europe Weak Again

Europe is lagging badly again. The perpetual punching bag of the short sellers. I want to get constructive on the market but with European stocks acting so weak, I will wait till I see more give up by traders. Post options expiration is usually a soft spot for the market, so we'll likely see lower prices next week. I don't see a trend day today, because I don't think we can go up big quite yet. It looks like it will be choppy like most option expiration days.

Thursday, December 15, 2011

Looking to Buy

It is almost that time. We've washed out a lot of excess from the market and it's time to look for an entry point. I would not rush in right away, as I don't believe we will V bottom this time. We should trade back and forth between 1200 and 1230. There is just too much complacency despite the damage that this market has taken. I will look to buy if we get down to 1200 during the next few trading days.

Wednesday, December 14, 2011

Closing their Books

You saw vast underperformance in the heavily owned names, like tech, energy, and gold. You saw outperformance in the hated, mainly the financials. The funds are closing out their inventory and calling it a year. Most of the funds have done terribly. This is pure liquidation. I imagine that with options expiration coming up, funds are shying away from spending more money on puts that end up becoming worthless, insurance that has killed them, and instead finally put two and two together that reducing positions is a much better risk management tool than buying puts every month that ending up going out worthless. After this week, I expect the year end rally to finally come, catching those liquidators off guard underinvested as the market goes up again.

Complacency

Watching Fast Money on Monday after we went down 20 points, there was no fear among the commentators. Yesterday, we went down again, and they couldn't understand why the market would sell off after the Fed announcement went as expected. There you go folks. That is a microcosm of the mood of Wall Street. Everyone is talking about the positive seasonality, the chase for performance, the end of year rally. I just don't see it coming. Too many are expecting it even though though they still fear Europe. Fundamentally, they are bearish the euro and expecting stocks to go up just because its the end of the year. It makes for a weak base of short term longs who will exit on any sign of weakness. When something non-fundamental like seasonality has people bullish on stocks, then usually that seasonality doesn't play out.

Tuesday, December 13, 2011

QE3 Coming Soon

The Fed can't help themselves. They have to print lots of money or they feel like they aren't doing their jobs. We are going to get QE3 sometime next year, the Fed is setting up the markets to get ready for it. Everything is telegraphed, the media is used to tell all future policy moves. It is obvious, they keep printing money until Banana Ben gets fired. Just had rumors of Fed going to QE3 and oil spikes $2 in minutes on the news. The market loves all this free money. Why not, look what happened after QE2, we went up 200 points over the next 6 months.

Monday, December 12, 2011

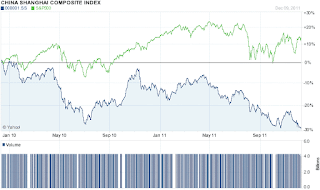

China: Between a Rock and a Hard Place

The Shanghai Composite hit a new 52 week low today. It is the weakest market in the world. For those of you who still believe in the China story, the facts are telling the opposite. The real estate market is set up for a crash. Overcapacity, overconstruction, and high inflation. Sounds like Japan in 1990. The comparison between the S&P 500 and the Shanghai Composite over the past 2 years tells the tale. Real estate developers missing payments, real estate buyers protesting their stupidity of buying at the top, etc. Everyone's favorite investment is crashing.

Market looks like it can't bust 1265, and most shorts already covered because of fears of getting squeezed by the EU summit and a monster gap up. We will dip again, still expecting us to test that 1210 zone.

Market looks like it can't bust 1265, and most shorts already covered because of fears of getting squeezed by the EU summit and a monster gap up. We will dip again, still expecting us to test that 1210 zone.

Friday, December 9, 2011

Early Weakness

News of PBOC setting up $300B in funds to buy US and European assets. They should buy their own assets. They should worry about their crashing real estate market first. EU summit was a nonevent, as usual. Everyone got their hopes up for nothing. And they are going to be disappointed for nothing.

Expecting us to gap and crap here. There is no reason to have a gap and run after just 1 day of a selloff. But we shouldn't selloff much after yesterday's pounding. So looking for early weakness and then consolidating between 1225 and 1240 (March ES futures).

Expecting us to gap and crap here. There is no reason to have a gap and run after just 1 day of a selloff. But we shouldn't selloff much after yesterday's pounding. So looking for early weakness and then consolidating between 1225 and 1240 (March ES futures).

Thursday, December 8, 2011

Broke 1243

The dip has started. The question is how long does the dip last. It should be brief, maybe 3-4 days. I don't see a prolonged selloff because the Street is underinvested, taking off a lot of risk during November. Targeting the 1210-1220 zone. Maybe if we get real panic, we can fill that gap down to 1195, but I have a hard time seeing that happen with all the strings the central bankers are pulling, and this being December.

ECB Mario = Fed Ben

We have seen Super Mario in action. He is a money printer. Super Mario = Ben Light. Benweiser tastes great. Ben Light is less filling. We have cockamamie funding programs, a covert way to shove money down the throats of the banks. The Germans are helpless, they have been taken over by the attack of the PIIGs. It is Germany against the world. They will lose this money printing battle.

Wednesday, December 7, 2011

Dip Coming Soon

I am not talking about a severe one, one that would have us test the 1210-1220 zone. The failure for any major positives from the EU summit could be the catalyst. Or it could just be that we need to have a litt give back after the big move last week. With the CNBC crowd feeling positive again, shorts mostly covered, I give us little chance to keep going higher without a pullback.

Tuesday, December 6, 2011

Shorts Covered, But

Longs are still not aggressively jumping in like they did in late October, early November. It makes it much more probably that we have a grind higher, with dips along the way. Dips will be aggressively bought. I don't see us crashing again. That period is behind us. Think late 2009, but just less bullish. We should consolidate between 1245 to 1265 for the next 2-3 days, before we make the next move. More likely than not, that move should be lower.

Monday, December 5, 2011

Going Up on Gaps

Most of the gains have been made with gap ups, you have another one today. The fuel that took us up so quickly last week was a lot of short covering on money printing hopes and EU optimism. It is a repetitive cycle, you would expect the traders would calm down and not crash us down or squeeze us to death but that is how the funds roll these days. All are in the same boat and chasing moves until you get critical mass, and then you go back in the other direction. Eventually the Europeans will print their way out of things, and we'll move on to the next story. I don't expect this kind of trading to last much longer. We'll be back to a grinding higher market in a couple of months.

Friday, December 2, 2011

Straight Up Moves

There is no moderation in this market. Everything happens in extremes, extreme selling and then extreme buying. There is no back and forth these days. Those who follow typical patterns on selling after a big up day have gotten hammered this week. The market is like a helium balloon, it keeps going up and up until it pops. Already up huge on the futures. Everybody knows after the blowout ADP numbers that the nonfarm payrolls will likely beat expectations. But with futures up already over 1%, I don't see us tacking on more today so I'm going to look to short any pop on a good jobs number.

Thursday, December 1, 2011

Unsustainable

This rally will not last. The market is broken, so you will have rallies that entice the marginal buyer but doesn't attract sticky money. Sticky money lasts through the ups and down. Right now, its all fast money chasing a rally for a few days and then selling. It is a game of buy now and sell to the next sucker at a higher price instead of investing. So the central banks will provide unlimited dollar liquidity. What's new. The Fed has done that since 2008. I will change my tune when the ECB throws in the towel and decides to print money like the Fed. It will happen, but only when their backs are against the wall.

Subscribe to:

Posts (Atom)