What can turn this weak market around? The only thing that could really turn it around is Powell pivot, part 2. The first one in January 2019, was a catalyst for a huge rally. This time, it will be a catalyst for a huge sucker's rally, that could last 1 to 2 months, depending on when he pivots. Unlike the 2019 pivot, you will have a situation where the Fed will have had an inflation scare. Remember, the Fed always fights the last battle, and is scared of repeating mistakes. Which means they will cut, but not as aggressively as before, and that won't be enough for a market that is poorly positioned (historically high household wealth in equities). It will eventually come, but probably not until you see a couple of below expectation CPI prints and some weakening NFP numbers. So late August, at the earliest. Probably September or October.

If you are a commodities bull, you can't really be long term bullish on the stock market. Inflation will stay elevated, and the poor will have less discretionary income, which will dampen demand, hurting corporate earnings. Of course, once recession is clear to everyone, the governments will rip another page out of the Covid bazooka playbook, and flood the economy with helicopter money, and in that case, demand will remain strong, at the price of boosting inflation even higher.

The only thing that can boost the stock market is either highly expansionary fiscal stimulus or a highly expansionary monetary stimulus. Zero rates won't do it anymore. Budget deficits at 5% of GDP is now the baseline needed to keep low growth going. If the market is left to its own, I'm not even talking about QT or rate hikes, just no QE and zero rates, the growth rate in that environment, considered wildly expansionary in the past, would maybe be enough for 1% real GDP growth in the US. The labor force growth isn't there. The productivity isn't there. The energy required to keep growing isn't there (unless they go full bore nuclear, which is doubtful).

The politicians are short sighted and dumb enough to fight inflation with more fiscal stimulus, and of course, the Fed will fall in line and buy up all the debt that's issued, to keep yields from exploding higher. That will just end up stoking another huge inflation wave which will then be fought by issuing more stimmy. Its a virtuous cycle for a politician, getting the masses hooked on stimmy and helicopter drops, and then trying to solve the problem of their own creation by dropping more dollars from heaven.

The only sustainable solution to an inflation problem is to stop growing the money supply, by increasing taxes, less government spending, and reducing the Fed balance sheet. Only 1 of those 3 things have happened so far, and the Fed has only just started balance sheet reduction and I doubt it lasts as long as they say it will, because they'll panic during the next recession and probably start doing QE again. There is no way in hell they are raising taxes or cutting spending. Just not what the public wants.

The public doesn't care about budget deficits, and most are too dumb to know that low taxes and lots of government spending is leading to the high inflation. They see no relation between inflation and budget deficits. No relation between money supply and inflation. I'm sure a bunch of them think Putin and evil oil companies are to blame for high energy prices, or they believe that tired excuse of supply chain bottlenecks causing price increases.

Politicians pander to the lowest common denominator. And they all think short term. Losing buying power because of high inflation? Here's some stimmy checks for you. Or some more child tax credits. Or some student debt canceled for you. Its not just one party. Its both. Republicans love tax cuts, but then complain about inflation. Democrats love pork spending, but then blame others for the inflation. They both love stimmies, one of those rare things that receive bipartisan support. Everyone is a populist, and populism is inflationary.

Don't confuse brains with a bull market. We are separating the wheat

from the chaff in 2022. No longer can you just blindly buy the dip and

expect future buyers to bail you out, like you saw from 2009 to 2021.

Investors have been conditioned over those years to believe selloffs are

brief and great buying opportunities. Just like the scars of 2008 left

the investors nervous and shaky in 2010 and 2011, with frequent scary

selloffs, all that money made by the bulls over the last 10 years are

keeping them hopeful and reluctant to sell in 2022. Hopefully, these

hopeful bulls will turn this market around and provide a good

risk/reward short.

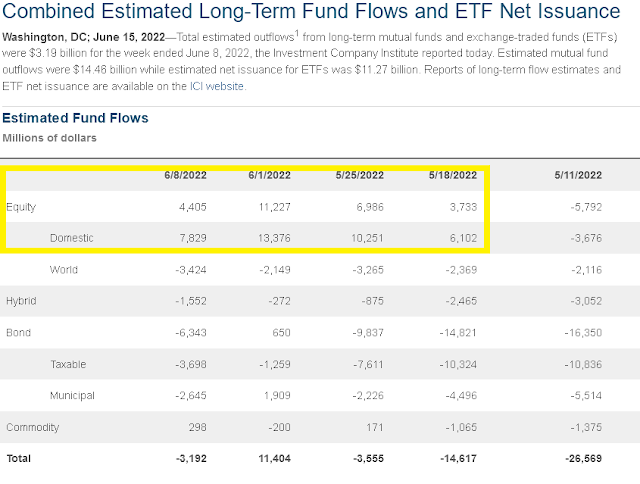

For the 3rd FOMC meeting in a row, we got a relief rally as Powell was less hawkish than expected. I'm noticing a pattern here. Maybe its...... Powell is a pansy? He doesn't have the guts to surprise the market hawkishly. He doesn't have the resolve to kill inflation. After the last 2, we got a really vicious selloff. Obviously there were some gamma squeezes happening to take the market down, as today is triple witching opex. But the underlying conditions are very weak. The daily trading action speaks loudly. At SPX 3700, its not enough blood letting for a low risk long, and still too short term oversold for it to be a good risk/reward short. Positioning is still not bearish enough for a sustained bounce. Still not seeing enough index put buying. Take a look at these equity fund flows over the past few weeks. Does this look like capitulation?

From 2008 to late 2020, even during the times when investors were optimistic, they mostly put money into bond funds and took money out of equity funds. After the 2020 election, you saw an inflow into equity funds unlike anything since 2000. There was an absolute deluge of money that poured into US equity funds in 2021. And while no longer a deluge, its still a steady stream in a weak 2022. And all that money is underwater right now. We've created a huge pool of US equity bagholders. The only reasonable comparison is to the late 1990s and 2000. I don't want to hear about bearish positioning at the hedge funds. They are on the right side for once. And they are still net long. And their capital pales in comparison to the combined size of retail and non-hedge fund institutional money. And the fund flows show that the overall positioning of US stock investors is awful.

3 comments:

Yeah I made alot of money buying the dips on 2021. Now I have pretty much lost it all. I remeber the time when people were falling over themselves to buy at 4700. But then again no-one questioned the fact that the market was up almost 25% in 1 YEAR with rate hikes coming in 2022. Now like you said it's dowm big but still seems high and there appears to not have been any real capitulation if you look at the volume.

Yeah, if you look at the big picture, monthly chart, the SPX is still overextended from where it was even 5 years ago. And the fundamentals are deteriorating quickly, because it looks like we'll see the worst recession since 2008 later this year, and valuations are high.

Its a short the rally market now, you have to flip the trade from buy the dip to sell the rip. A rally towards 3950-4000 would be a great shorting opportunity. Maybe a cooling down in CPI next month will get hopeful bulls excited. At least that's what I'd like to see.

Not cooling yet imo. No point trying to be too cute on timing. Short the worst valued names esp in tech

Post a Comment