Friday, December 30, 2011

Resistance and Shorting

There is heavy line of resistance between 1260 and 1264. I do not see this market able to break through on the final day of the year. You should see traders closing out their books and that could lead to some weakness today. I am looking to daytrade short intraday but will not stay short overnight. As I have mentioned in the past, the first trading day of the year is the highest percentage gap up trade out of whole year.

Friday, December 23, 2011

Slow Till Next Friday

Historically, you see the lowest volume the day before Christmas until the last day of the year. Usually, you will see volume pick up on the last trading day of the year. So it will be low volume action till next Friday, so I don't see us moving much from current levels till then. Not much to say unless the market starts to move, but I doubt it will. Merry Christmas.

Wednesday, December 21, 2011

No Santa

I think we've already topped out on this rally (1 day and 1 night). The Europeans marked the top at 1249 spazzing out over their ECB scheme, whatever it is. The trend remains down. Yesterday was a short squeeze + Santa rally buyers. Those buyers will become sellers over the next few days. Looking for a retest of 1196 before year end.

Overnight Top

We have topped out at 1249 overnight, on the ECB long term refinancing operation report. Apparently, it came out bullishly, so you had a reflexive spike on the news. The problem with this market is too many are counting on this silly notion of an automatic year end rally. I even thought so!

There are no guarantees in the stock market. That is especially so when so many think so. As you know, I am a CNBC fader. I try to ignore most of the drivel on that channel, but Fast Money gives me a clear view of the short term trader sentiment. And it is too bullish. Anytime Brian Kelly on CNBC gets excited about stocks, I try to go the other way. We act weak for a week, not too much bearishness, and then we have a whopper of a rally and everyone is expecting us to rally relentlessly till the end of the year.

You really have to trade the European markets to catch the bigger moves in this market, because the European traders tend to overreact much more than the American traders. Not much to do now, unless we can take this thing back near 1250, where I will be very willing to provide supply.

There are no guarantees in the stock market. That is especially so when so many think so. As you know, I am a CNBC fader. I try to ignore most of the drivel on that channel, but Fast Money gives me a clear view of the short term trader sentiment. And it is too bullish. Anytime Brian Kelly on CNBC gets excited about stocks, I try to go the other way. We act weak for a week, not too much bearishness, and then we have a whopper of a rally and everyone is expecting us to rally relentlessly till the end of the year.

You really have to trade the European markets to catch the bigger moves in this market, because the European traders tend to overreact much more than the American traders. Not much to do now, unless we can take this thing back near 1250, where I will be very willing to provide supply.

Tuesday, December 20, 2011

Flatliners

I was waiting for a big snapback rally and I missed it because the bots started the rally overnight. Now after this 30 point surge, we are back in no man's land, where there are no trades to be made. The trading has flatlined for the day.

P.S. This is your Santa rally, if you didn't get long yesterday at the close, you missed it. The fuel has been all used up.

P.S. This is your Santa rally, if you didn't get long yesterday at the close, you missed it. The fuel has been all used up.

Monday, December 19, 2011

One More Push

I am waiting for one more move lower before I get interested in buying. That could take us down to anywhere from 1180-1200. The time frame I am looking at is Tuesday - Thursday. The Santa Claus rally should be quite weak, and will only set up if we can flush this market out and get rid of any remaining weak longs.

Friday, December 16, 2011

Europe Weak Again

Europe is lagging badly again. The perpetual punching bag of the short sellers. I want to get constructive on the market but with European stocks acting so weak, I will wait till I see more give up by traders. Post options expiration is usually a soft spot for the market, so we'll likely see lower prices next week. I don't see a trend day today, because I don't think we can go up big quite yet. It looks like it will be choppy like most option expiration days.

Thursday, December 15, 2011

Looking to Buy

It is almost that time. We've washed out a lot of excess from the market and it's time to look for an entry point. I would not rush in right away, as I don't believe we will V bottom this time. We should trade back and forth between 1200 and 1230. There is just too much complacency despite the damage that this market has taken. I will look to buy if we get down to 1200 during the next few trading days.

Wednesday, December 14, 2011

Closing their Books

You saw vast underperformance in the heavily owned names, like tech, energy, and gold. You saw outperformance in the hated, mainly the financials. The funds are closing out their inventory and calling it a year. Most of the funds have done terribly. This is pure liquidation. I imagine that with options expiration coming up, funds are shying away from spending more money on puts that end up becoming worthless, insurance that has killed them, and instead finally put two and two together that reducing positions is a much better risk management tool than buying puts every month that ending up going out worthless. After this week, I expect the year end rally to finally come, catching those liquidators off guard underinvested as the market goes up again.

Complacency

Watching Fast Money on Monday after we went down 20 points, there was no fear among the commentators. Yesterday, we went down again, and they couldn't understand why the market would sell off after the Fed announcement went as expected. There you go folks. That is a microcosm of the mood of Wall Street. Everyone is talking about the positive seasonality, the chase for performance, the end of year rally. I just don't see it coming. Too many are expecting it even though though they still fear Europe. Fundamentally, they are bearish the euro and expecting stocks to go up just because its the end of the year. It makes for a weak base of short term longs who will exit on any sign of weakness. When something non-fundamental like seasonality has people bullish on stocks, then usually that seasonality doesn't play out.

Tuesday, December 13, 2011

QE3 Coming Soon

The Fed can't help themselves. They have to print lots of money or they feel like they aren't doing their jobs. We are going to get QE3 sometime next year, the Fed is setting up the markets to get ready for it. Everything is telegraphed, the media is used to tell all future policy moves. It is obvious, they keep printing money until Banana Ben gets fired. Just had rumors of Fed going to QE3 and oil spikes $2 in minutes on the news. The market loves all this free money. Why not, look what happened after QE2, we went up 200 points over the next 6 months.

Monday, December 12, 2011

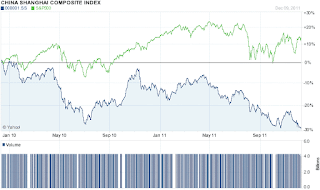

China: Between a Rock and a Hard Place

The Shanghai Composite hit a new 52 week low today. It is the weakest market in the world. For those of you who still believe in the China story, the facts are telling the opposite. The real estate market is set up for a crash. Overcapacity, overconstruction, and high inflation. Sounds like Japan in 1990. The comparison between the S&P 500 and the Shanghai Composite over the past 2 years tells the tale. Real estate developers missing payments, real estate buyers protesting their stupidity of buying at the top, etc. Everyone's favorite investment is crashing.

Market looks like it can't bust 1265, and most shorts already covered because of fears of getting squeezed by the EU summit and a monster gap up. We will dip again, still expecting us to test that 1210 zone.

Market looks like it can't bust 1265, and most shorts already covered because of fears of getting squeezed by the EU summit and a monster gap up. We will dip again, still expecting us to test that 1210 zone.

Friday, December 9, 2011

Early Weakness

News of PBOC setting up $300B in funds to buy US and European assets. They should buy their own assets. They should worry about their crashing real estate market first. EU summit was a nonevent, as usual. Everyone got their hopes up for nothing. And they are going to be disappointed for nothing.

Expecting us to gap and crap here. There is no reason to have a gap and run after just 1 day of a selloff. But we shouldn't selloff much after yesterday's pounding. So looking for early weakness and then consolidating between 1225 and 1240 (March ES futures).

Expecting us to gap and crap here. There is no reason to have a gap and run after just 1 day of a selloff. But we shouldn't selloff much after yesterday's pounding. So looking for early weakness and then consolidating between 1225 and 1240 (March ES futures).

Thursday, December 8, 2011

Broke 1243

The dip has started. The question is how long does the dip last. It should be brief, maybe 3-4 days. I don't see a prolonged selloff because the Street is underinvested, taking off a lot of risk during November. Targeting the 1210-1220 zone. Maybe if we get real panic, we can fill that gap down to 1195, but I have a hard time seeing that happen with all the strings the central bankers are pulling, and this being December.

ECB Mario = Fed Ben

We have seen Super Mario in action. He is a money printer. Super Mario = Ben Light. Benweiser tastes great. Ben Light is less filling. We have cockamamie funding programs, a covert way to shove money down the throats of the banks. The Germans are helpless, they have been taken over by the attack of the PIIGs. It is Germany against the world. They will lose this money printing battle.

Wednesday, December 7, 2011

Dip Coming Soon

I am not talking about a severe one, one that would have us test the 1210-1220 zone. The failure for any major positives from the EU summit could be the catalyst. Or it could just be that we need to have a litt give back after the big move last week. With the CNBC crowd feeling positive again, shorts mostly covered, I give us little chance to keep going higher without a pullback.

Tuesday, December 6, 2011

Shorts Covered, But

Longs are still not aggressively jumping in like they did in late October, early November. It makes it much more probably that we have a grind higher, with dips along the way. Dips will be aggressively bought. I don't see us crashing again. That period is behind us. Think late 2009, but just less bullish. We should consolidate between 1245 to 1265 for the next 2-3 days, before we make the next move. More likely than not, that move should be lower.

Monday, December 5, 2011

Going Up on Gaps

Most of the gains have been made with gap ups, you have another one today. The fuel that took us up so quickly last week was a lot of short covering on money printing hopes and EU optimism. It is a repetitive cycle, you would expect the traders would calm down and not crash us down or squeeze us to death but that is how the funds roll these days. All are in the same boat and chasing moves until you get critical mass, and then you go back in the other direction. Eventually the Europeans will print their way out of things, and we'll move on to the next story. I don't expect this kind of trading to last much longer. We'll be back to a grinding higher market in a couple of months.

Friday, December 2, 2011

Straight Up Moves

There is no moderation in this market. Everything happens in extremes, extreme selling and then extreme buying. There is no back and forth these days. Those who follow typical patterns on selling after a big up day have gotten hammered this week. The market is like a helium balloon, it keeps going up and up until it pops. Already up huge on the futures. Everybody knows after the blowout ADP numbers that the nonfarm payrolls will likely beat expectations. But with futures up already over 1%, I don't see us tacking on more today so I'm going to look to short any pop on a good jobs number.

Thursday, December 1, 2011

Unsustainable

This rally will not last. The market is broken, so you will have rallies that entice the marginal buyer but doesn't attract sticky money. Sticky money lasts through the ups and down. Right now, its all fast money chasing a rally for a few days and then selling. It is a game of buy now and sell to the next sucker at a higher price instead of investing. So the central banks will provide unlimited dollar liquidity. What's new. The Fed has done that since 2008. I will change my tune when the ECB throws in the towel and decides to print money like the Fed. It will happen, but only when their backs are against the wall.

Wednesday, November 30, 2011

Ask Dr. Bernanke

He has all the answers. One size fits all prescription. Print more money. It is a repeat of bailout nation. This time on a global scale as China is also in deep doo doo. The central banks are overreacting to a problem which is not even close to those of 2008, and it will take risk assets flying higher. Shorts are getting squeezed as usual. Wash, rinse and repeat.

Tuesday, November 29, 2011

1215-1220

We have a lot of resistance in that price area, so we might not even get there. But if we do, that would be an area to enter shorts. If you are going to trade this market, it's best just to wait for the dips and buy. The market feels about 3/4 of the way through this selloff. That last 1/4 could push the market back down to 1120, or we can just get a soft selloff down to fill the gap around 1150. We could just blasting higher from here in a relentless rally but that is the lowest possible scenario in my view.

Thought we would not trade above 1200 today so this market is stronger than I expected. Stronger than many expected. Be careful on the short side.

Thought we would not trade above 1200 today so this market is stronger than I expected. Stronger than many expected. Be careful on the short side.

Monday, November 28, 2011

Money Printing

Italy is going to get rescued. IMF is own and bought by the Europeans, they will bail themselves out. All of a sudden, shorts are in a panic with this monster gap up. I haven't seen a gap up this big in a long time. The whole world must be short. You better buy the dips from now on....

Wednesday, November 23, 2011

As Above So Below

We went straight up, and after the consolidation from 1220 to 1260, we're going straight down. The market often plays out patterns in symmetry, fast up, fast down. Fast down, fast up. Since we went up so fast in October, it would not surprise me to see us go down fast in November. With such deteriorating global economic fundamentals, I am waiting for blood on the Street before I buy. Not even close yet. Next stop is a gap fill around 1150-1155 zone.

Bloodbath

It is going to get ugly soon. I was too optimistic. And, I'm usually too pessimistic. That is how bad the situation is for the bulls. 1150 will likely be broken, and with that, a likely trip back down to 1120, where we had numerous bottoms in August and September. I will not be buying on Wednesday unless we get down to 1120.

Why do I say this? First, we've been down for 5 straight days, and you still had a lot of call activity. It is signaling there are still many looking to buy the dip. And its unusual, because you would see a lot more put volume being down 70 points in 5 days. China is turning into an absolute post real estate bubble mess, and no one is talking about it because Europe is itself imploding. The weakest equity markets right now are in Asia, not Europe. Now China is readying to begin interest rate cuts, that is not the time you want to buy Chinese stocks.

I missed a golden short opportunity at the beginning of last week, lots of regret because I've been looking for it for the past 3 weeks. But with that said, I don't want to do something else I regret by buying too early. I will wait for the panic to set in. We are far from that, and I'm 90% sure that we'll get it within a week.

Why do I say this? First, we've been down for 5 straight days, and you still had a lot of call activity. It is signaling there are still many looking to buy the dip. And its unusual, because you would see a lot more put volume being down 70 points in 5 days. China is turning into an absolute post real estate bubble mess, and no one is talking about it because Europe is itself imploding. The weakest equity markets right now are in Asia, not Europe. Now China is readying to begin interest rate cuts, that is not the time you want to buy Chinese stocks.

I missed a golden short opportunity at the beginning of last week, lots of regret because I've been looking for it for the past 3 weeks. But with that said, I don't want to do something else I regret by buying too early. I will wait for the panic to set in. We are far from that, and I'm 90% sure that we'll get it within a week.

Tuesday, November 22, 2011

More Weakness

We built up a wall of complacency over the past several weeks. Talks of end of year rally, chase for performance, cheap valuations, etc. were used to hype up stocks. It was all hype. This is not your 2010 market. The market spent its bullets in October, and its out of ammo in November.

No one wants to be long as the markets are in a downtrend ahead of the Thanksgiving. Look for the sheep to bail this week as the market tests lower lows. I will be looking to enter long positions on Wedneday if we can get one more whack lower.

No one wants to be long as the markets are in a downtrend ahead of the Thanksgiving. Look for the sheep to bail this week as the market tests lower lows. I will be looking to enter long positions on Wedneday if we can get one more whack lower.

Monday, November 21, 2011

No Deal

Supercommittee disappointed with no deal and we're getting the gap down. Ahead of Thanksgiving, the longs will look to lighten up, especially now that their November options protection is gone, and I'm sure many didn't want to throw what they thought would be more money down the drain buying December puts.

We're going down the hole this week, it's gonna get hairy. European bonds seem to be on the final stages of weakness, most of the weak hands are out, and we should see a bottom soon in the Italian and Spanish bond markets. That should provide the needed backdrop for a sustained bounce once we bottom, either end of this week, or next week. 1175 or 1150 for a bottom, I am leaning towards 1150.

We're going down the hole this week, it's gonna get hairy. European bonds seem to be on the final stages of weakness, most of the weak hands are out, and we should see a bottom soon in the Italian and Spanish bond markets. That should provide the needed backdrop for a sustained bounce once we bottom, either end of this week, or next week. 1175 or 1150 for a bottom, I am leaning towards 1150.

Friday, November 18, 2011

Consolidation

We should consolidate the past 2 days move, we cliff dived from 1225 to 1207, and traded mostly between 1207 and 1216 for most of yesterday. So there is a lot of trading to be done between 1225 and 1216. The chasers are getting nervous here, they bought at high prices, and are anxiously hanging on to their shares at bad entries. Expect them to eject those shares in the next 2 weeks, as we test 1175, and perhaps 1150, where there is a gap left behind from mid October. I would not rule out a run all the way down to 1120, but it would take some serious fear in Europe for that to happen. The sentiment surveys all came in bullish this week, the sheep are finally on board.

Thursday, November 17, 2011

Missed It

Thar she blows! This market has cracked, and we've broken out of the tight range. I am expecting us to get to 1180 by next week. It is going to get ugly as the fears of European contagion take over, however irrational they are. The markets can be irrational in the short term, and will have temper tantrums, until it gets what it wants: more money printing.

Missed the short opportunity, unfortunately. I will wait patiently for the time to get long, we are far from that opportunity.

Missed the short opportunity, unfortunately. I will wait patiently for the time to get long, we are far from that opportunity.

Wednesday, November 16, 2011

Sittng on My Hands

We're not moving much over the past few days, its been tight trading between 1236 to 1262. The ECB is coming in to support the Italian and Spanish bond markets. ECB head Draghi has shown his true colors: Bernanke Light. He is following in the same footsteps and will start wholesale monetization of the PIIGS debt. It should be euro negative, were it not for QE3, which will be coming to a theater near you. It is a fiat fantasy, printing money to solve problems. Gold should hit $2500 sometime next year.

Stocks can't stay down with this kind of money printing from the 2 biggest central banks in the world. The world is awash in liquidity. Any contagion fears that take stocks down are buying opportunities.

Stocks can't stay down with this kind of money printing from the 2 biggest central banks in the world. The world is awash in liquidity. Any contagion fears that take stocks down are buying opportunities.

Tuesday, November 15, 2011

Italy and Spain Bonds

Italy and Spain are solvent countries facing speculative pressure on their bonds. Rather than an attack, it just seems like the arbitrary bond holders are selling these 2 countries' bonds as a precaution against adverse moves rather than an actual fear that these countries will be like Greece. Fundamentally, they are in better shape than 6 months ago when yields were lower because of the ECB backstop and EFSF which will commit to bond purchases later.

This is still a faux crisis which is nothing like 2008. If Italy and Spain were really in bad shape, I would say that this was a real crisis. But the market is overreacting by grouping them with Greece. It's traders pricing in a coming recession in Europe and contagion fears. This doesn't mean we don't go down. It just means if we go down to 1180, we won't stay down there for long. No opinion on today's trading, it is fairly neutral on most fronts.

This is still a faux crisis which is nothing like 2008. If Italy and Spain were really in bad shape, I would say that this was a real crisis. But the market is overreacting by grouping them with Greece. It's traders pricing in a coming recession in Europe and contagion fears. This doesn't mean we don't go down. It just means if we go down to 1180, we won't stay down there for long. No opinion on today's trading, it is fairly neutral on most fronts.

Friday, November 11, 2011

Toothless Bears

Another gap up and Europe is surging higher. I wouldn't fade this gap up, it looks like the bears have gotten run over again by the bulls. They might have another chance next week, but for now, I would not play either long or short.

Thursday, November 10, 2011

Getting to Tech

Tech stocks have been the safe haven of safe havens in this market. It is a consensus view that if you want to be in stocks, you have to be in US stocks, or emerging markets. If you are in US stocks, you have to be in dividend paying names or tech. The long tech trade is a crowded trade. The beta chasers are all in on tech. They are avoiding high beta sectors like financials and the industrial cyclicals.

The NDX has outperformed S&P 500 for most of the year, but since we've bottomed in October, the S&P has been catching up. It looks as if tech stock weakness could be another catalyst to pressure this market lower. Apple looks like it has topped out.

The size of today's gap up surprised me, but its been a gap and crap. There are still a sizeable amount of dip buying funds who are chasing performance to make up for their bad numbers. They are the weak hands that cause big whacks like yesterday. They will be the ones panic selling in a couple of weeks as Europe gets shaky.

The NDX has outperformed S&P 500 for most of the year, but since we've bottomed in October, the S&P has been catching up. It looks as if tech stock weakness could be another catalyst to pressure this market lower. Apple looks like it has topped out.

The size of today's gap up surprised me, but its been a gap and crap. There are still a sizeable amount of dip buying funds who are chasing performance to make up for their bad numbers. They are the weak hands that cause big whacks like yesterday. They will be the ones panic selling in a couple of weeks as Europe gets shaky.

Wednesday, November 9, 2011

Mediocre Volume

Surprised to see the volume fairly light on such a big down day, this is up to 2:00 PM, maybe we'll have a lot more volume pick up in the last 2 hours of trade. But seems like there isn't any panic. This is unusual because we've seen heavy volume on the down days, which cleared out the weak hands for moves higher. I would be very wary of buying any dips for the next 2 weeks.

Doesn't Matter Till It Matters

We've been shrugging off the slow motion crash in Italy for the past several days and it finally hit the stock market. You've got a run for liquidity. Italian 10 year bonds are near 7.5%, and are trading like hot potatoes. This is going to pressure the European banks and we'll likely see ECB intervention soon. I remain bearish because the stock market still has a long ways to go to reflect everything going on overseas. Plus we've got the US budget committee having to come up with budget cuts by November 23. That will keep traders from fully embracing risk for the next 2 weeks. Staying short.

Tuesday, November 8, 2011

Twilight Zone

Italy is entering into the Twilight Zone. Berlusconi is barely hanging on, which is about the worse possible political scenario for Italy. Also you have the 10 year bond going to new lows. US stocks are putting on their best Alfred E. Neuman act but eventually the turd hits the fan. Expecting some bigger volatility in the coming days as the banks in Europe get taken out back.

Consolidation

We have closed between 1250-1258 for the past 3 sessions, tightening the trading range. I expect a 50 point move out of this consolidation over the next several days. My belief is that it will be down. Mainly based on the continued underperformance of European equities, growing complacency, and Italian 10 year bond pressures. The Italian sovereigns are heavily owned by the European banks and any kind of run on those bonds would put extreme strain on the balance sheets of the European banks.

A short around 1270 would likely be profitable in the intermediate term.

A short around 1270 would likely be profitable in the intermediate term.

Monday, November 7, 2011

Hard to Game

Headline risk coming from Italy has thrown a wrench into the market patterns. Instead of getting the gap up, we got a gap down but only a minor one from much bigger weakness earlier in the overnight session. I would look to position short because the Italian 10 year yields has reached terminal velocity. We'll probably have a moment of panic during US hours, not just European hours sometime soon. Early strength followed by afternoon weakness today.

Friday, November 4, 2011

Gap Up Signal

Expecting the market to gap up on Monday. The Greeks were the excuse to sell today. Once that excuse is out of the way at least in the short term, they will bid 'em up as the algos go back to work. We may get to 1270-1275 area before we stall out and drop hard.

Short Soon

We've gone up the past 2 days, after going down for 2 days. Yet we are 35 points away from Friday's close. I notice a subtle shift from strength to weakness here. Sentiment has gotten much less bearish, according to surveys and just from my anecdotal feel from watching CNBC. This while we trade sideways to down. The Italian 10 year yields have hit a new 52 week high. Greece is a smoke screen for the deterioration in the Italian bonds. The ECB still hasn't signaled it will increase its bond buying program, and it will be hard to do that politically until they see the market get panicky. The Germans are steadfastly against any monetization of PIIGS debt, so the ECB can't do much just yet.

Not sure about today, just believe we're going to go lower from these levels over the next 2 weeks. Initial target around 1185, which is the 50% retracement of the move in October.

Not sure about today, just believe we're going to go lower from these levels over the next 2 weeks. Initial target around 1185, which is the 50% retracement of the move in October.

Thursday, November 3, 2011

ECB Rate Cut

Well, the new ECB head has lowered rates 25 bp, and we get a spike up on that. They could drop it to zero and it doesn't solve the problem of Greek debt. Greece looks like it is on the brink, with the ruling government probably in its final days, we may seem some chaos with no government soon. Expecting intraday weakness today.

Wednesday, November 2, 2011

No QE3

If you want the Fed on your side, you want them to say the economy is horrible. They did not do that, which tells me that they are going to wait at least a couple of months before considering more QE. That is a definite negative. Bernanke is starting to fee the political pressure from the Republicans and is taking his foot of the gas for fear he will get fired if Obama is not re-elected.

DAX Dropped 600 Points

Sometimes we are too focused on just the S&P 500. When you look at Europe, it is back to being a laggard. Dax has dropped 10% from high to low from last Thursday to yesterday. Eurostoxx 50 at over 10% drop. S&P dropped just 80 points, or about 6% from high to low. Europe seems to be a leading indicator for the S&P, when it lags, it signals trouble ahead. It has been lagging the S&P for the last 2 weeks, and the market finally cracked.

Enough with the Greece charades. They should just pull the plug on the pig. Euthanize it instead of trying to save Greece. It isn't worth saving. When they do finally let Greece go bankrupt, Europe will probably be able to rally for 6 months nonstop.

Expecting a dip and run today. Buy the dip, we are oversold.

Enough with the Greece charades. They should just pull the plug on the pig. Euthanize it instead of trying to save Greece. It isn't worth saving. When they do finally let Greece go bankrupt, Europe will probably be able to rally for 6 months nonstop.

Expecting a dip and run today. Buy the dip, we are oversold.

Tuesday, November 1, 2011

Fast Moves

This market is throwing out all the patterns from the past. It goes up in a straight line and goes down in a straight line, with very little consolidation in between. We are not down because of Greece, they are meaningless. We are down because too many fund managers got nervous being left behind and chased the market higher after the good news came out! Now they are caught with their pants down after buying the euphoria (which was on huge volume as mentioned last week). Calls for new highs, 1300, they were all signs of a top.

We'll have a nasty down day today and then we'll probably grind higher slowly on a wall of worry.

We'll have a nasty down day today and then we'll probably grind higher slowly on a wall of worry.

Monday, October 31, 2011

Gap Up Signal

The market will not run away like a frieght train. But also won't drop like a rock. Still lots of fear in this market. Expecting a gap up.

Sunday, October 30, 2011

The China Bubble

The baton is being passed from Europe to China. On Europe: if everyone is bearish and knows how bad things are, then its too late. The fundamentals justify the bearishness, but the European stock prices reflect this. But China is different. I am still surprised at how many believers remain in the China story despite the stock prices being quite weak. Maybe it is because they keep growing, that has traders mesmerized. But then why aren't the share prices going up? Why is it so much weaker than US equities?

The baton is being passed from Europe to China. On Europe: if everyone is bearish and knows how bad things are, then its too late. The fundamentals justify the bearishness, but the European stock prices reflect this. But China is different. I am still surprised at how many believers remain in the China story despite the stock prices being quite weak. Maybe it is because they keep growing, that has traders mesmerized. But then why aren't the share prices going up? Why is it so much weaker than US equities? I have never seen such a big disconnect between GDP growth and stock prices in a major market. When you have 9.7% GDP growth, the stock market shouldn't be so weak. It has to be the real estate bubble. The smart money is now out of China. They know that the gig is up. The dumb money is getting anxious. Property prices are falling now.

China GDP growth has been induced by a property bubble that has non-real estate companies investing in real estate. You have insane projects like high speed rail that no one can afford, empty malls, ghost cities in the middle of nowhere. It is not quality GDP growth. It is just dumb central planning. The banks are loaded up with bad loans. They will become zombie banks. This is a repeat of Japan in 1990. Chinese companies face the double whammy of growing wage pressures and a bursting real estate bubble. The profit numbers will look like a train wreck in 2012. I see a lot more similarities between China and Japan, than I do with U.S. and Japan. China has a real estate bubble based on overinvestment, just like Japan did in 1990. The US was an overconsumption story. China is an overinvestment story.

This will have ripple effects on the commodity exporters of iron and copper, and to a lesser extent crude oil. That is why Brazil and Australia have been so weak. The market usually foretells of dire situations. I see the Australia dollar getting weaker along with their stock market. Same for Brazil. I wish there was CDS on Beijing and Shanghai real estate, because I would go all in on that trade.

Friday, October 28, 2011

Big Volume

There was a very bad sign which some may have glossed over. Nasdaq volume at 2.8 B, NYSE volume at 1.4 B. Just this past Friday on another strong up day, Nasdaq volume was just 1.6B and NYSE volume was 1.1 B. This past Monday, another up day, it was Nasdaq 1.7B, NYSE 0.9 B.

The massive volume that took place yesterday, on a big up day is an ominous sign. Usually when you get this at the bottom, its a positive sign. But when you get this kind of heavy volume on a big up day on good news, that is a negative. A lot of stock changed hands on Thursday from weak hands to strong on the short side. On the long side, those that are buying in now are nervous, either because they were too underinvested and are being forced to chase even when they don't really want to. They will be easily shaken out on the next pullback. The big volume tells me a lot of sellers met those eager buyers.

The massive volume that took place yesterday, on a big up day is an ominous sign. Usually when you get this at the bottom, its a positive sign. But when you get this kind of heavy volume on a big up day on good news, that is a negative. A lot of stock changed hands on Thursday from weak hands to strong on the short side. On the long side, those that are buying in now are nervous, either because they were too underinvested and are being forced to chase even when they don't really want to. They will be easily shaken out on the next pullback. The big volume tells me a lot of sellers met those eager buyers.

Thursday, October 27, 2011

Crazy Market

This feels like the fall of 1998 when we bottomed and went up in a straight line for 3 months to new highs. My thesis last week where we would top out at 1235-1240 and go back down to 1150 has quickly been invalidated. Luckily, I didn't put any shorts down on that thesis as I still thought it was too early to short from a time standpoint.

Now it's time to reevaluate what happens for the next few weeks. There are so many bears in this market that it makes it tough to be a steadfast short. Sometime late next week I'll look to take a longer term swing short. In the meantime, shorts are just quick trades. Also don't want to be long when we're up 210 points in 3 weeks.

Now it's time to reevaluate what happens for the next few weeks. There are so many bears in this market that it makes it tough to be a steadfast short. Sometime late next week I'll look to take a longer term swing short. In the meantime, shorts are just quick trades. Also don't want to be long when we're up 210 points in 3 weeks.

Euphoria

Everything is OK now. Don't ask, just buy. The market was too conservative and too many are underinvested. But after 200 points higher in 3 weeks, the crowd can't resist piling on and overshooting to the upside. I am selling the euphoria today at the open because it is based on good news. If there was no news, there would be no way I would be selling a monster gap up. The shorts are officially extinct after this killer gap up.

Wednesday, October 26, 2011

MF Global

The octopus of the European debt has reached MF Global. MF Global is a fragile firm, it nearly blew up in 2008 because of a rogue trader who got squeezed short in wheat futures. They are leveraged to the gills to make up for their low margin business. It is a crisis only if you are weak, and MF Global should have gone bust a few years ago, now the market wolves are going after it again. I don't think they'll let the prey live this time.

I bring this up because as much as the stock market has squeezed higher, the sovereign debt yields haven't come in. And we still have that Greek monkey that's still on the market's back. We don't have a crisis, its just a long squeeze on PIIGS debt holders.

Now that the so-called "scary" event is out of the way, the hesistant will dip their toes into the water, right when we're about to top out. It is getting closer to the time to position short for the big whack lower. It will come out of the blue like it always does.

I bring this up because as much as the stock market has squeezed higher, the sovereign debt yields haven't come in. And we still have that Greek monkey that's still on the market's back. We don't have a crisis, its just a long squeeze on PIIGS debt holders.

Now that the so-called "scary" event is out of the way, the hesistant will dip their toes into the water, right when we're about to top out. It is getting closer to the time to position short for the big whack lower. It will come out of the blue like it always does.

Tuesday, October 25, 2011

Low Expectations

Most traders are expecting there to be nothing concrete coming out of the EU summit so I don't see much of a selloff if nothing is accomplished. But we probably won't rally much either, since we've gotten to such high levels with lots of resistance above. CNBC crowd seemed nervous ahead of tomorrow's event so we shook out a good chunk of the fast money today. Any further dip tomorrow is probably buyable for a quick trade.

BTFD

Last chance to get on board before we go to 1400! This is the only significant dip we're gonna get this week. The market is just too strong to hold on to a short ahead of the EU summit. I expect us to keep going higher after a very brief pullback on the news. The market is set to squeeze into the beginning of November, where the laggard funds will pile in hoping for a year end rally, only to buy at the top. From a price standpoint, we're close to a top, from a time standpoint, we've still got a couple of weeks of topping left.

Monday, October 24, 2011

Wednesday Non Event

Unless something very unexpected happens, such as Germany refusing to go with the plan, which is very unlikely, you will get a very brief sell on the news, it might last 1 or 2 hours. And then we'll be back to higher prices. The US is dragging the other world markets reluctantly higher. China is being dragged higher, Europe is now failing to make new highs while the ES keeps making higher highs. From now to Wednesday, I expect us to pullback to relieve the overbought condition. We have run too far too fast.

Friday, October 21, 2011

Faux Crisis

It is tough being a short these days. Every other person is short because they buy into the European crisis rhetoric and that's somehow going to crash the markets like Lehman Brothers. The Europeans don't have a serious crisis. Greece does, and maybe Portugal and Ireland. But they can go bust and it will be like Argentina defaulting. No one would care. Sure, it could cause short term panic for the brainless who think contagion will happen because they see CDS spreads blowing out fearing Europe is on the verge of a 2008 repeat. But crises are born from excess. I don't see much excess over the past few years in Europe. They are cutting back government spending and taking their medicine. You get the short term result: a recession which cause credit spreads to widen, earnings to lag, and a breeding ground for fear mongers. Italy and Spain are solvent. With the ECB providing a backstop, there will be no liquidity crisis for those countries.

The Europeans aren't so willing to inflate their way out of this problem because Germany has the most power, and they are the most hawkish country in the world. So this is what you get: a weak economy, with a currency that doesn't want to go down much even with the world betting against it. If this really was a serious crisis, do you think the S&P would be down just 3% on the year? And much higher than 1 year ago? One year from now, the euro will be much higher vs. the dollar, and equities and precious metals will be higher. What may end up being the weakest are those commodities most sensitive to China, like industrial metals like copper, nickel, tin, iron, etc. The real estate bubble bursting in China will have negative ramifications for commodity exporters, like Brazil and Australia, but it shouldn't really have much impact on the US or Europe, who don't have that big of a market for exports to China.

The Europeans aren't so willing to inflate their way out of this problem because Germany has the most power, and they are the most hawkish country in the world. So this is what you get: a weak economy, with a currency that doesn't want to go down much even with the world betting against it. If this really was a serious crisis, do you think the S&P would be down just 3% on the year? And much higher than 1 year ago? One year from now, the euro will be much higher vs. the dollar, and equities and precious metals will be higher. What may end up being the weakest are those commodities most sensitive to China, like industrial metals like copper, nickel, tin, iron, etc. The real estate bubble bursting in China will have negative ramifications for commodity exporters, like Brazil and Australia, but it shouldn't really have much impact on the US or Europe, who don't have that big of a market for exports to China.

Thursday, October 20, 2011

No More Juice Left

The shorts have been squeezed to death. They are as dry as the Sahara. No more juice left in them. They are masochists fighting this rally. The rises are faster than the dips. That is unusual. Fear should be a stronger emotion than greed. Obviously this market still remains very short. So fear shows up when the market goes up, not down!

The big volume bars on the 1 minute charts have been on the up bars. Which means massive buying/covering in an instant. Fundamentals remain terrible so eventually the rally will be retraced, but only after the last short is squeezed. All those October puts are officially worthless.

The big volume bars on the 1 minute charts have been on the up bars. Which means massive buying/covering in an instant. Fundamentals remain terrible so eventually the rally will be retraced, but only after the last short is squeezed. All those October puts are officially worthless.

EU Summit

Why are traders so nervous ahead of the EU summit? Expectations are low already, plus nothing ever happens at these summits/meetings anyway and the market shrugs it off all the time. Usually greeting the nervous investors with a gap up on Monday. It proves what I believe to be a cornerstone of finance. Perception overwhelms reality in the minds of Wall Street. It doesn't matter what happens at this summit, Europe is well on the way to using the EFSF as a bailout vehicle.

P.S. When they finally finish up the details of the EFSF, probably within 2 weeks, that will likely be the top of this move.

P.S. When they finally finish up the details of the EFSF, probably within 2 weeks, that will likely be the top of this move.

Wednesday, October 19, 2011

No Man's Land

After giving back half of yesterday's gains, we are back to short term neutral. Over the rest of the week, it is hard to bet on either side. I remain on the sidelines waiting for the bulls to push us back towards 1225-1230 to short. If we dip down to 1180-1185, I would consider a short term long. The big whack down to 1150 will have to wait at least a couple of weeks. The longer we wait, the more energy we build for a bigger move lower. Market players are still nervous but getting more comfortable buying in this market. Most still are afraid to short after the 160 point face rip higher.

Tuesday, October 18, 2011

Not Going to 1250

I don't know when the drop will happen. But this move that started 2 weeks ago is now building a top. Friday was the day that tech shorts got squeezed. Today was the day that financial shorts got squeezed. Most of the weak hands have covered.

1230 is an extremely important zone which has marked short term tops twice already this week. The volume came in heavy in the final hour. This is what I have been waiting for. Heavy volume where panic buyers and patient sellers meet with lots of supply changing hands.

1230 is an extremely important zone which has marked short term tops twice already this week. The volume came in heavy in the final hour. This is what I have been waiting for. Heavy volume where panic buyers and patient sellers meet with lots of supply changing hands.

Monday, October 17, 2011

Short Leash

I don't like the price action for a longer term short. I am giving this short a short leash. I will look to cover on the weakness in the early going. We'll likely chop around for the next few days. I expect one more tech earnings related gap up later this week, probably when AAPL reports blowout number afterhours on Tuesday.

Friday, October 14, 2011

Taking a Shot

We're back to the highs on Wednesday which was rejected right at the SPX 1220 level. It is a good spot to start a short position. Euphoria over GOOG earnings, and the better than expected retail sales is enough good news for me to feel comfortable shorting. It is a strong market but a lot of that is reflected in the prices already.

Thursday, October 13, 2011

First Pullback

Don't expect a collapse right away. After the huge run up that we've had, the first pullback is usually bought. Expecting a dip and run scenario today.

Wednesday, October 12, 2011

Consolidating Before Big Drop

Today was day 1 of the consolidation at the top of the range. We should have a couple more days of consolidation between 1195 and 1215 before we get the big drop down to 1150, most likely next Monday. Now that the parameters are set, I will be looking short between 1210 and 1215 tomorrow. Expecting a gap up.

To the Moon Alice!

There is no stopping this market. There are more bears to grind. More shorts to squeeze. We will go straight to 1370, consolidate for a few days, and go down to 1100 in a straight line. Being sarcastic here. We bottomed as I suspected last week, and now any pullbacks will be voraciously bought by underinvested bulls and bleeding shorts. I expect any pullback to last 2 days, 3 days max. I've delayed my short as I don't like the sentiment, its too bearish. We are going to 1250 by end of this month.

Badly Positioned

The crowd is just not well positioned for more upside. Everyone is loaded up with cash, waiting for a good entry to buy stocks or are short. The market puts pressure on the weakest hands, and those are the short side. This looks like the last gasp, just get me in no matter what type of gap up. Shorts throwing the towel, fund managers coming in to buy so they don't underperform even more. Expecting weakness in the first hour of trading. The time to short has come.

Tuesday, October 11, 2011

Looking Short

I am very close to entering a short position. The situation is almost just right, it would be nice to have some good news to short into, perhaps the Slovakia passage of the EFSF will do it. We tagged SPX 1200 and have sold off in the past 30 minutes. We've rallied 125 points in 5 trading days. We are set up for a pullback very soon. Target on the pullback is 1130. I am thinking Thursday or Friday. It should be a whopper of a 1 day decline which gets the crowd bearish again.

Monday, October 10, 2011

In an Uptrend

The market turned from a downtrend to an uptrend last Tuesday. Traders are still adjusting to this new uptrend, and that is why you get these monster gap ups on nothing. Most are positioned for weakness and when it doesn't come, they cover and squeeze the market higher. I will look to short around 1185 to 1190. But now I believe the safer side to play is the long side, since we are now in a uptrend. The short I want to take will just be for a quick pullback, where I plan on covering, and reversing to long.

Friday, October 7, 2011

Shorts are Scrambling

That was a short squeezer of a number. Now that we are at the levels that we reached 1174, the upside is limited from here, maybe 20 points at most. So it is risky to put on longs here. But at the same time, I just don't see this market pulling back so we'll stay green today as shorts don't want to go home short overnight sitting on large losses. Also, probably another up day on Monday where you can think about putting on shorts. I am not eager to short this market. Even though I think we'll pull back to 1130 or so, I think we go a bit higher first and stay there for a couple of days. If we are higher on Monday, I will think about putting on shorts then.

Thursday, October 6, 2011

We Bottomed

Not too helpful when we've already run up 90 points off the Tuesday low. But all the signs are there that we're going to grind higher for the rest of the month. We got extremes in sentiment readings, Europe is outperforming, and we V bottomed without turning back for the last 90 points. It was a fake breakdown below 1100 and then a rip higher. That usually only happens at intermediate term bottoms. It isn't 100% guaranteed, but probably at least 80%. I would look to buy any pullback next week as we'll probably keep going higher. There is some resistance at 1174. I expect a gap up on a strong nonfarm payrolls number tomorrow.

Wednesday, October 5, 2011

Either Way

Market is no longer oversold and not yet overbought. Probably range bound for the next three days between 1095 and 1135. Next week we should retest 1068 and then break it on down to 1036. I will not be shorting because it is getting late in the selloff and I see a lasting bottom coming up very soon. Now that China's slowdown is being priced in, the selloff is almost over.

Tuesday, October 4, 2011

Fakeout

The bottom seekers were waiting in the wings for the market to rally in the final 30 minutes and they piled in. Watch for them to pile out when we get the gap down tomorrow. Yes, I am getting a gap down signal. There was very little panic this morning, or at the lows in the afternoon. It was a massive short squeeze and it will just set up a bigger drop next week. The faster we bottomed, the better for the market. But delaying capitulation is only going to build up the selling power for a bigger thrust lower. I now believe we will hit SPX 1040 by next week.

Bottom Today or Tomorrow

The market is in the last part of the freefall. Odds are extremely high that we bottom today or tomorrow. The velocity of the selloff is unsustainable and the bounce back will be quick and sharp. It is too bad there is no bad news to cause panic. But there are very few perfect opportunities, you just have to play the odds. The odds heavily favor the bulls at these levels.

Monday, October 3, 2011

Waterfall

This is looking like October 2008 action. We had the biggest waterfall decline I've ever seen from October 6 to October 10. This one will be tame in comparison, but we are in day 2 of the waterfall decline. 1066 and 1036 are the levels to watch. 1095 support will likely fail. We should start seeing some panic once we break under SPX 1100 and test new lows for the year. Waiting to see the white of their eyes to try to pick the bottom.

Europe >> China

Europe is now taking over the role as strongest market. It has outperformed the world over the past 5 trading days. The European market is taking on Teflon-like qualities, even fears of an imminent Greece default doesn't make it flinch. It is ignoring the ongoing crash in Hong Kong/China.

Market darling China is now the global weakling getting sand kicked in its face. It is helpless in the face of a real estate bubble that is popping. Calling it a hard landing is funny to me. It was a bubble and no one has the guts or the brains to admit it. Inflation is not the problem over there. It is overconstruction and bloated real estate prices. Probably the biggest real estate bubble we have seen since Japan in the late 1980s. Far bigger than what you saw in the US. Jim Chanos was right. China is Dubai X 1000.

Market darling China is now the global weakling getting sand kicked in its face. It is helpless in the face of a real estate bubble that is popping. Calling it a hard landing is funny to me. It was a bubble and no one has the guts or the brains to admit it. Inflation is not the problem over there. It is overconstruction and bloated real estate prices. Probably the biggest real estate bubble we have seen since Japan in the late 1980s. Far bigger than what you saw in the US. Jim Chanos was right. China is Dubai X 1000.

Friday, September 30, 2011

Leaning Bearish

Tough to bet on continuation in this choppy market but I think we've had the upside rally due to positive Europe news earlier this week, and today should be part of that unwind. There is a growing recognition of China weakness, although I am still seeing a lot of denial and EM love. The US stock market should be the last one to fall, and things are lining up that way. Hong Kong continues to be weak, especially H-shares. Usually it pays not to fade gap downs on Fridays when there is no capitulation. Today's gap down is definitely not capitulation.

Thursday, September 29, 2011

US/Europe Divergence

Something to pay attention to: The US is vastly underperforming the European market over the past 5 days. This is not a good sign for the ES for the next few days, but it should be looked at as a positive in the intermediate term. Europe looks like it has bottomed, Asia is in a bottoming process, and the US is the next one due. The US market has been the strongest and they always get to the strongest markets last. Perhaps some bad news out of Europe can be the catalyst for one final move lower to bottom.

Monster Gap Ups After Weak Closes

Today is a classic monster gap up off a weak close. The odds of a continuation higher off the gap up are high. I would not be sucked into selling the gap up. The move looks like the real deal and the European markets are suddenly made of Teflon. European equities look totally sold out and there are no bulls over there. Absolutely none. The sellers have done their deed and with the deep values in Europe, I don't see it going below the lows it made last Friday. Finally heard CNBC pundits get nervous about China and a hard landing. It's about time.

If we are going to get a catalyst to take this market lower, it will have to come from China or the US. Most likely it will be China but I think that hurts industrial commodities more than US equities. Copper will perform the worst of all the commodities. The hoarding of copper in China was plain silly and the reversal of that will make copper prices nosedive.

If we are going to get a catalyst to take this market lower, it will have to come from China or the US. Most likely it will be China but I think that hurts industrial commodities more than US equities. Copper will perform the worst of all the commodities. The hoarding of copper in China was plain silly and the reversal of that will make copper prices nosedive.

Wednesday, September 28, 2011

Recent Price Action and Greece

It is interesting to see that the S&P futures rallied 3.5 points in the 15 minutes after the cash close. It gives me a hint that fast money traders are well hedged already and it will take a really bad news event to take us much lower. The high put call ratios in the past few days confirm this. I initally thought we would have a waterfall decline this week but the price action doesn't agree.

Some will view the weak closes in the last 2 days as bearish. But that is only if we get continuation and gap downs off those weak closes. Today we gapped up off yesterday's weak close. If we gap up again tomorrow, it tells me that we're probably not going down much more on this downleg (1130-1140 zone at the most) and we can rally for a few days afterwards, perhaps to 1210. If any rally up to 1200+ is due to good news from Europe, I would look to short that rally.

I still don't think we've bottomed because we still haven't got that Greek monkey off our backs. Only a default from Greece can get the purge that this market needs and get rid of that monkey. And also get rid of the fear that a Greek default would be like a Lehman bankruptcy, which is I believe to be completely false.

Some will view the weak closes in the last 2 days as bearish. But that is only if we get continuation and gap downs off those weak closes. Today we gapped up off yesterday's weak close. If we gap up again tomorrow, it tells me that we're probably not going down much more on this downleg (1130-1140 zone at the most) and we can rally for a few days afterwards, perhaps to 1210. If any rally up to 1200+ is due to good news from Europe, I would look to short that rally.

I still don't think we've bottomed because we still haven't got that Greek monkey off our backs. Only a default from Greece can get the purge that this market needs and get rid of that monkey. And also get rid of the fear that a Greek default would be like a Lehman bankruptcy, which is I believe to be completely false.

Monday, September 26, 2011

China Slowdown

Dr. Copper has a PhD in economics. It is telling that there is a global slowdown, with China leading the way. The real estate bubble in china is bursting. It was a giant bubble. The repercussions should last for the next several months as market participants start getting nervous about China.

The Shanghai Composite is in the middle of vicious bear market. This is a hard landing. There is high inflation, artificially low interest rates, combined with a real estate bubble popping. Absolute the worst of all worlds over there. And it is not priced in. Whatever goes on in Europe will not surprise the market. But a hard landing in China will.

Looking for more weakness this week as Europe bumbles along and the hard realities in China become more recognized.

The Shanghai Composite is in the middle of vicious bear market. This is a hard landing. There is high inflation, artificially low interest rates, combined with a real estate bubble popping. Absolute the worst of all worlds over there. And it is not priced in. Whatever goes on in Europe will not surprise the market. But a hard landing in China will.

Looking for more weakness this week as Europe bumbles along and the hard realities in China become more recognized.

Friday, September 23, 2011

Whistling Past Graveyard

The global economy is darkening quickly. But no VIX spike, just steady trading without too much concern. In fact, I heard more that one person on Fast Money mention this as a good buying range and that the market could go right back to 1200. I don't think so. The Chinese cat is out of the bag. Europe has done nothing. And US is the most overpriced of them all.

The moves today smell of total give up and liquidation in the metals, copper down 6%, silver down 16%, gold down 5.5%. These are total liquidation moves, with no care for price, just get me out type of trading. The fundamentals are still bright for gold, but when you have so much pressure from outside market forces, you get days like today. Gold is extremely close to a bottom.

Still on course for the waterfall decline, with bottom targets somewhere between 1040 and 1080.

The moves today smell of total give up and liquidation in the metals, copper down 6%, silver down 16%, gold down 5.5%. These are total liquidation moves, with no care for price, just get me out type of trading. The fundamentals are still bright for gold, but when you have so much pressure from outside market forces, you get days like today. Gold is extremely close to a bottom.

Still on course for the waterfall decline, with bottom targets somewhere between 1040 and 1080.

Thursday, September 22, 2011

Range Mirage

The market has worked to get traders to believe in the range, buy at 1120 and sell at 1200. I no longer believe that range is valid. The fundamentals are getting worse every day. It is being reflected in all the world indices except the US. Europe believes press conferences, Greek bailouts, and band aids will make the problem go away. Nothing ground breaking has come out from Europe to stop the banking crisis.

The US stock market is the last bastion for long only funds to maintain their equity exposure. They are scared to death of European equities and they are getting killed in emerging markets. Ironically, two of the weakest markets in the world, China and Brazil, are probably the two countries that investors still like.

A break of 1100 is imminent, probably next week. Beyond that, you have an air pocket, where panic and liquidation could push us down to 1040 at the worst. Best case scenario, I see this market breaking 1100 down to 1080, and then bottoming there. Either way, we've got more downside to go to reflect the new fundamentals of a helpless Fed, slow acting Europe, and deteriorating Asia.

The US stock market is the last bastion for long only funds to maintain their equity exposure. They are scared to death of European equities and they are getting killed in emerging markets. Ironically, two of the weakest markets in the world, China and Brazil, are probably the two countries that investors still like.

A break of 1100 is imminent, probably next week. Beyond that, you have an air pocket, where panic and liquidation could push us down to 1040 at the worst. Best case scenario, I see this market breaking 1100 down to 1080, and then bottoming there. Either way, we've got more downside to go to reflect the new fundamentals of a helpless Fed, slow acting Europe, and deteriorating Asia.

Waterfall

In a bear market, you don't have time to wait for perfect short opportunities. The market follows its own timeline. China is in crash mode, and Europe is just dead. The US is the only thing keeping the patient alive. But without QE3, the US patient is in critical condition. More stimulants in the form of easy money is needed but the Republicans are putting on some serious pressure to the Fed to stop the endless money printing.

Usually waterfall declines take 7-8 trading days to complete. If you consider the start of the decline yesterday, we have till next Thursday/Friday till we hit bottom. Who knows how low we can go in that time frame. I am thinking 1070-1080 will be a price target for a reasonable bottom but we may just go straight to 1040. Today, the AUD/USD is down almost 2.5%. These are monster moves. Euro is also getting hit but a relatively tame 0.75%. Maybe the elephant in the room is not Europe, but the bursting of the real estate bubble in China.

Usually waterfall declines take 7-8 trading days to complete. If you consider the start of the decline yesterday, we have till next Thursday/Friday till we hit bottom. Who knows how low we can go in that time frame. I am thinking 1070-1080 will be a price target for a reasonable bottom but we may just go straight to 1040. Today, the AUD/USD is down almost 2.5%. These are monster moves. Euro is also getting hit but a relatively tame 0.75%. Maybe the elephant in the room is not Europe, but the bursting of the real estate bubble in China.

Wednesday, September 21, 2011

FOMC Day

I am expecting a grind higher off the open for the first 2 hours. After that, we'll probably just trade flat. This FOMC announcement will be hard to game, so I'm not really interested in trading too much after it comes out. If we do get a rally off this meeting, I will look to short tomorrow morning.

Tuesday, September 20, 2011

Do the Dip and Run

This market is going back to its old habits. The dip and run is rearing its head again. I can feel the dipsters desperate to get long ahead of Bazooka Ben and more QE goodies. No one dares short with the bazooka aimed at the sellers. Expect a finish near the highs, probably to 1211-1215 area.

U.S. Stock Premium

Was watching Bloomberg TV the other day, a segment mentioned the forward P.E. ratios of the Hang Seng Index and the Eurostoxx 50. They were between 8 and 9. The S&P's is 12.7. That is a 40-50% premium for U.S. stocks over Hong Kong or European stocks based purely on forward P.E. ratios. That premium seems grossly out of line with historical norms. For those saying that U.S. stocks are cheap, then overseas stocks are cheaper than cheap.

Monday, September 19, 2011

Gap and Go

Looks like a gap down and bleed lower all day today. Options expiration hangover, China slowing falling apart, and short term overbought readings. Another Monday big gap downer. The last 2 were bought, this one will be sold.

Saturday, September 17, 2011

Top Will Take Longer

I've been thinking about the action over the past week, and a bit surprised that very few people are believers in the rally. CNBC traders seem to think this rally won't last. But most are scared to short this thing as well. I don't think there are many shorts left to squeeze. But also without a resolution in Europe, you won't have the wave of fund money coming in to drive the market to 1250 and higher. And I don't see a Europe resolution until the market forces it through panicky trading from a Greek default or some specific bank problem. Dollar swap lines doesn't solve the problem.

So the most likely path now is one that brings a quick pullback late next week followed by another rally. In other words, this benign period should last another 2 to 3 weeks, lower volatility with limited upside and downside. A range somewhere around 1160 to 1230. My outlook has changed because the character of this market has changed to BTFD (buy the f dip) with Europe putting in a short term bottom. Europe has outperformed the US since Monday. It takes time to get bulls on board. Bulls don't like volatility, so the best way to get traders bullish is to have lower volatility, not necessarily higher prices. From a price perspective, this rally has very little left. From a time perspective, this rally still has a lot left in it.

After this benign period, we should get a sharp resolution to the downside to test 1100 and likely lower.

So the most likely path now is one that brings a quick pullback late next week followed by another rally. In other words, this benign period should last another 2 to 3 weeks, lower volatility with limited upside and downside. A range somewhere around 1160 to 1230. My outlook has changed because the character of this market has changed to BTFD (buy the f dip) with Europe putting in a short term bottom. Europe has outperformed the US since Monday. It takes time to get bulls on board. Bulls don't like volatility, so the best way to get traders bullish is to have lower volatility, not necessarily higher prices. From a price perspective, this rally has very little left. From a time perspective, this rally still has a lot left in it.

After this benign period, we should get a sharp resolution to the downside to test 1100 and likely lower.

Friday, September 16, 2011

Bear Meat

The bears are going through the grinder again. Fifth straight up day, and still a big wall of worry over Europe. The market does not make it easy on the short side. Right now, we need time at this higher level to convert more bulls before the next leg lower. I am really hoping for one more piece of government intervention in order to get performance chasers on board. That would be the easy short. If we don't get that, it will be harder to time the short, but sometime in the middle of next week sounds right. I am not interested in longs at this point until we get capitulation. The level I am looking at is ES 1222. Above that, we could get a short squeeze up to 1235.

Thursday, September 15, 2011

Dollar Swaps

This is not a liquidity problem. The ECB and the Fed think providing dollar funding will solve the banking crisis. It is a solvency problem that needs to be solved through wholesale sovereign bond purchases and a TARP like program. Liquidity is not the problem. I think you have to short government intervention that doesn't solve the problem. We probably will squeeze shorts for a few more days up to the FOMC meeting, but after that, there are no barriers to shorting this market.

Tuesday, September 13, 2011

Banking Crisis

BNP Paribas is unable to get dollar funding because US money market funds don't want to put there money there. SocGen keeps denying rumors. At some point, the rumors can't be ignored and have to be taken as fact. The stock prices don't lie. The credit spreads don't lie. The Europeans have a banking crisis and they are doing nothing about it. A press conference by Merkel, Sarkozy, and co. will not solve this problem. Each press conference will be a shorting opportunity. Getting close to the terminal stage of this crisis when there is no going back. I remain bearish.

Monday, September 12, 2011

S&P Too High Vs. The World

With the dollar finally catching a bid, the S&P cannot outperform the world like it has. It is almost as if the market views tax cuts and deficit spending as the key to prosperity. I strongly believe that the American stock market has been the hiding place for those that have to maintain equity exposure. The market always gets to the hiding places LAST. So when we panic, the S&P should finally play catch up on the downside to European equities. The Eurostoxx 50 is at fall of 2008 panic levels while the S&P is still 10% above the summer 2010 lows.

I don't believe today is a repeat of last Tuesday. I am expecting a weak close as traders don't want to stay long overnight.

I don't believe today is a repeat of last Tuesday. I am expecting a weak close as traders don't want to stay long overnight.

Friday, September 9, 2011

Point of No Return?

The center is starting to fall apart in the EU. Rumors of Greek default, member of ECB resigning, German banks preparing for a Greek default. DAX hitting new yearly lows, which were just hit on Tuesday. Reflexivity starts to go to work if the European markets fall even further. Selling begets selling. That is when you get panic selling and the S&P breaks 1100.

I thought the final panic down move would happen after September options expiration but a bear market waits for no one. When it wants to go down, it goes down. This market is a ticking time bomb and it is just a matter of time before the explosion goes off. Today could be a false signal and we could rally strongly next week, and then have the perfect setup for a run for the roses to 1100 and lower. Or we could go straight down for the next 7 days. At least for the rest of the day, the market wants to go lower and SPX 1140 is in play.

I thought the final panic down move would happen after September options expiration but a bear market waits for no one. When it wants to go down, it goes down. This market is a ticking time bomb and it is just a matter of time before the explosion goes off. Today could be a false signal and we could rally strongly next week, and then have the perfect setup for a run for the roses to 1100 and lower. Or we could go straight down for the next 7 days. At least for the rest of the day, the market wants to go lower and SPX 1140 is in play.

Safe Havens

Is the US dollar a safe haven? Yes, under the following conditions:

1) Japanese central bank scares yen buyers with bursts of yen selling that rips the face of the shorts every few weeks.

2) Europe gets so bad that no one wants to hold any euro denominated assets other than German bonds.

3) Gold volatility gets so insane that $70 moves intraday are normal, scaring off safe haven buyers. What, did they expect only $70 up moves and no $70 down moves forever?

4) Swiss gives the FU to safe haven seeking speculators and decide to peg their currency to the euro with unlimited Swiss franc selling / euro buying.

5) Fed takes a break from QEing for more than a couple of months. Bazooka Ben takes a break from bombing dollar longs to get cute and do Operation Twist, which will acheive basically nothing but squeeze 30 Year Treasury shorts.

6) Everyone believes that Obama is telling the truth when he says the $447 B jobs act will be balanced with equal amounts of spending cuts. Or, what's another $447 B in the budget deficit among friends, do people really care if it is $1.7 T instead of $1.2 T? They are dumb enough to buy 10 Year Treasuries at 2% anyway, feed them more hay.

There you have it, we have finally achieved enough conditions necessary to get a temporary speculative bid in the dollar. For those expecting a long lasting dollar rally, I suggest you join Robert Prechter in the deflationistas camp, those who think a 10 year bull run in oil prices is temporary, believe in the CPI numbers and the tooth fairy, and think S&P will go to 400.

1) Japanese central bank scares yen buyers with bursts of yen selling that rips the face of the shorts every few weeks.

2) Europe gets so bad that no one wants to hold any euro denominated assets other than German bonds.

3) Gold volatility gets so insane that $70 moves intraday are normal, scaring off safe haven buyers. What, did they expect only $70 up moves and no $70 down moves forever?

4) Swiss gives the FU to safe haven seeking speculators and decide to peg their currency to the euro with unlimited Swiss franc selling / euro buying.

5) Fed takes a break from QEing for more than a couple of months. Bazooka Ben takes a break from bombing dollar longs to get cute and do Operation Twist, which will acheive basically nothing but squeeze 30 Year Treasury shorts.

6) Everyone believes that Obama is telling the truth when he says the $447 B jobs act will be balanced with equal amounts of spending cuts. Or, what's another $447 B in the budget deficit among friends, do people really care if it is $1.7 T instead of $1.2 T? They are dumb enough to buy 10 Year Treasuries at 2% anyway, feed them more hay.

There you have it, we have finally achieved enough conditions necessary to get a temporary speculative bid in the dollar. For those expecting a long lasting dollar rally, I suggest you join Robert Prechter in the deflationistas camp, those who think a 10 year bull run in oil prices is temporary, believe in the CPI numbers and the tooth fairy, and think S&P will go to 400.

Thursday, September 8, 2011

Crackpot Market

93 points down in less than 3 trading days. 66 points up in 36 hours. Something is really unstable here. This is a mini fall of 2008 trading. There has been nothing really substantial coming out of the EU to stop their crisis. They probably need a TARP or a bond buying spree like the Fed did in 2009. But all we've gotten are little band aids while the crisis gains momentum. It is a bigger problem than in May 2010 but we are much higher on S&P. But Europe is much lower than May 2010. So are the crowd favorites, Brazil and China. Something is not adding up. QE2 did a lot to distort dollar based assets higher, and it has just left us with bloated commodity prices. Oil at $116 even during a financial crisis! (WTI is irrelevant now, the global oil price is Brent). Killing the consumer with high oil prices via QE2 and bailing them out with payroll tax cuts and jobless benefits forever.

I don't see a sustained rally until Europe comes up with their version of Ben and Hank's bazookas. And that probably doesn't happen until markets really panic. Before then, you will see all sharp rallies get faded and eventually we will test 1100 and break it. This zone around 1200 is a place to sell.

I don't see a sustained rally until Europe comes up with their version of Ben and Hank's bazookas. And that probably doesn't happen until markets really panic. Before then, you will see all sharp rallies get faded and eventually we will test 1100 and break it. This zone around 1200 is a place to sell.

Wednesday, September 7, 2011

Tax Cut Addiction