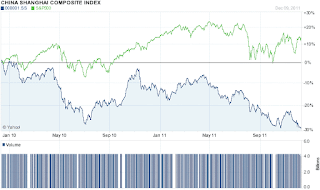

The Shanghai Composite hit a new 52 week low today. It is the weakest market in the world. For those of you who still believe in the China story, the facts are telling the opposite. The real estate market is set up for a crash. Overcapacity, overconstruction, and high inflation. Sounds like Japan in 1990. The comparison between the S&P 500 and the Shanghai Composite over the past 2 years tells the tale. Real estate developers missing payments, real estate buyers protesting their stupidity of buying at the top, etc. Everyone's favorite investment is crashing.

Market looks like it can't bust 1265, and most shorts already covered because of fears of getting squeezed by the EU summit and a monster gap up. We will dip again, still expecting us to test that 1210 zone.

Monday, December 12, 2011

Subscribe to:

Post Comments (Atom)

4 comments:

That is because PBOC was raising rates past 2 years while the fed was leveraging our futures for 2 years of s&p returns. agree that China will have hard landing if it hasn't already. This is the wildcard that few are speaking of. If China has issues you can forget about any world recovery next year and then Europe will definitely default in unison

PBOC was not raising rates. Raising reserve requirment ratios is not raising rates. Their short term rates are TOO LOW considering their high inflation. That is why you have lemmings go into to real estate over there because they can't keep up with inflation with the puny short term rates that the PBOC is offering to savers.

China had short term rates that were too low, which subsided real estate developers, taking away from savers.

Actually China raised rates 5 times over 9 months last year on top of reserve bank ratio requirements to try to curb inflation.

I think so but if the intent was to cool the housing then they surely succeeded....I believe they headed for recession will not be good for the world economy next year especially japan and Korea. Globally in general not looking so good

Post a Comment