"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” - Sir John Templeton

2022 was pessimism. 2023 was skepticism. 2024 is optimism, now bordering on euphoria. You are seeing euphoria in the parabolic price action in high beta Trump trade risk assets like bitcoin and TSLA. Investors got euphoric on NVDA this past May/June and are still very bullish on the name. The ingredients are there are for a durable, long lasting top. Since the election, investors got high on the Trump win but are now experiencing a hangover.

The post election move from Nov. 6 to Nov. 11 has been completely taken down, just as quickly as it was taken up. It catches my attention when all the bullish talk on Twitter, CNBC, and Bloomberg doesn't match the price action. Investors can't seem to imagine a world where the Trump led US economy disappoints. You are seeing that with bond yields grinding higher and higher. It appears the supply/demand fundamentals are just too poor in US Treasuries to get a sustained rally even with Fed rate cuts. A fundamentally weak bond market due to excessive deficit spending and inflation that is sticky above 2%. That bond market weakness eventually catches with the stock market.

From past experience trading tops in SPX, they are a process. Greed is a less intense emotion than fear, but greed lasts longer. Bull markets usually don't end with a defined blowoff top, but end with a choppy consolidation that can last for a few months. During the topping process, optimism slowly fades even while prices stay high. That sets up the trap door when the crowd slowly head to the exits which eventually suddenly turns into a stampede leading to a waterfall decline.

This post election price action has revealed the boundaries for the upside and downside for the next few months. The upside should be capped around 6050-6150, with the downside capped around 5700-5800. Range traders will be able to play both sides for the next few months, selling the upper part of the range, and buying the lower part of the range. For this strategy, I prefer the short side, just because of the topping process and trap door risk with the very large net long positioning. At least for the next 3 months, the probability of a waterfall decline (+10% down move in a short period) are low enough that you could probably play the long side as well with decent risk/reward.

It has been hell for countertrend traders in 2024. These one way bull trends with high net equity exposure among fund managers and retail investors set up the conditions for a bear market. We saw this happen in late 2021, where high equity exposures led to a very weak market over the next 12 months. The catalyst for the selloff in 2022 was the Fed rapidly raising rates to slow down inflation, causing a bond market panic which led to a bear market in stocks. The downside catalyst this time seems less clear. If I had to guess, it would be that US growth disappoints, and earnings fail to meet expectations. With these kind of high net equity positioning, it doesn't take much to catalyze a big drop.

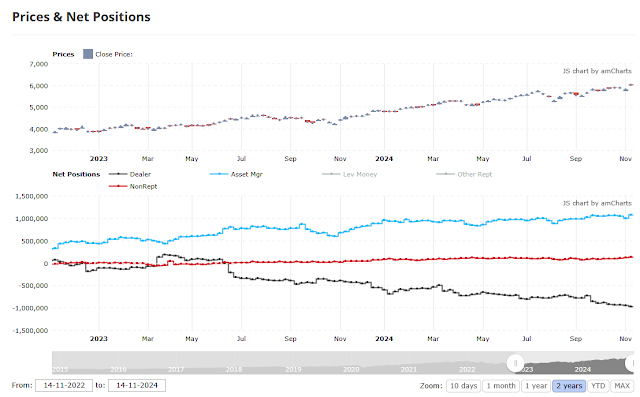

The COT data for SPX futures as of Tuesday, Nov. 12 shows asset managers hitting new 52 week highs in net long positioning, joined by the small speculators who are also the most net long over the past year. On the other side of the coin, dealers are now massively short, biggest net short in the past 10 years. This is about as bearish of a long term setup that you will see.

|

| SPX COT |

Russell 2000 futures also show extended net long positioning among asset managers, adding another bearish piece to the puzzle.

|

| Russell 2000 COT |

The bond market remains weak amidst potential inflation concerns from a Trump economy. A less dovish Powell on Thursday stating that rates could be normalized slowly added to the weakness. Its not a great environment for either stocks or bonds here. In the short term, I would rather be long stocks, but in the long term, I would rather be long bonds.

The trend is still up in the SPX, but the price action is not as bullish as you would expect considering the widespread optimism on Wall St. WSJ articles like this are another warning sign:

"U.S. equity exchange-traded and mutual funds drew nearly $56 billion in the week ended Wednesday, the second-largest weekly haul in records going back to 2008, according to EPFR data. Such funds have drawn inflows for seven consecutive months, the longest streak since 2021,"

Those kind of heavy ETF inflows after a huge move higher are tell tale signs of late bull market FOMO among investors. Valuation expansion has been the main driver of this bull market, as earnings can't keep up with the pace of increase in SPX prices. This is 1999-2000 type FOMO. Now you just need to see volatile, choppy price action to confirm that a top is being made.

Missed the exit on the partial long SPX position that I have. I'll hold for bit longer before selling. Will be looking to put on a short on the next bounce, if it takes SPX above 6000. I see limited upside above 6000 this year, so good risk/reward to put on shorts at those levels.

2 comments:

Well said, there is lot of optimism around trump regime wiping out us debt , stoping Ukraine war , wondering how long this optimism will last

The optimism will probably last till the end of the year. There is more hype than substance with a lot of the views out there on a 2nd term of Trump. Putin wants to continue the war, and he could care less what Trump thinks.

Post a Comment