Exhibit A: MSTR/Bitcoin. This is at the heart of the speculative bubble that is happening right now. When you see massive short squeezes and irrational price moves that defy the fundamentals, you are near the peak of the mania. After the crazy squeeze this month, the market capitalization of MSTR stock is now over 3 times the value of the Bitcoin on its balance sheet. MSTR's non-bitcoin related business is meaningless compared to its bitcoin holdings. This reminds me of the 3COM/Palm spinoff during the dotcom bubble, where Palm was valued way more than the Palm holdings of 3Com, considering that 3COM stock holders owned a huge chunk of Palm. It was one of those cloudy arbitrage situations where rampant speculation led to a supply/demand mismatch that overwhelmed the arbitrageurs' capital and willingness to hold the long 3COM, short Palm position. The same is happening with the arbitrageurs' willingness and capital to hold the long Bitcoin/short MSTR position. IBIT, the biggest Bitcoin ETF, is up 43% over the past 6 months, compared to 150% for MSTR. As recently as September, the returns were equal for IBIT vs MSTR.

Exhibit B: TSLA. TSLA is a $1.2 trillion company that is trading like a Trump meme stock. It is one thing to have a small cap trade like this. It is another thing to have a trillion dollar company gaining 65% in a month based on hopes that a Trump administration will slash all transportation regulations and allow TSLA to do whatever it wants with full self driving and autonomous vehicles. Never mind that TSLA full self driving is not ready for prime time and requires the driver to hold the steering wheel and be alert at all times. The dreams of Robotaxis roaming the roads has clouded any kind of judgment on the stock. Reality is not on anyone's mind. Its a speculative frenzy that is only taking a backseat to the Bitcoin mania.

Exhibit C: QUBT/IONQ. Quantum computing is suddenly a big thing among speculators. It had its 15 minutes of fame back in 2021 along with various other themes, but this one is running super hot recently. Never mind that these 2 companies, in particular QUBT, are basically just prototype companies that are more interested in pumping up the stock and selling shares to the public than actually running a profitable long term business.

Its a speculative frenzy out there. The current environment rhymes with 2000 and 2021, but 2024 is more focused on certain themes and less broad based. Just like 2000 and 2021, investors are heavily loaded up with equities with few worries about the economy or the stock market. Valuations now are historically in the 99th percentile, just like 2000 and 2021. From a seasonal perspective, the end of year in a big up year like 2024 is usually strong. You rarely get big pullbacks during the holiday season after such huge gains, with long term investors incentivized to delay stock sales into 2025 to push out capital gains taxes to 2026. Seasonally, this is a bullish time of year, although most of the bullishness happens around the last 10 days of November and the last 10 days of the year.

The ISEE options data shows heavy call buying for much of 2024, higher than 2021 when complacency and speculation was very high. Call options speculation is overwhelming any kind of demand for put protection, causing the put/call ratios to plummet.

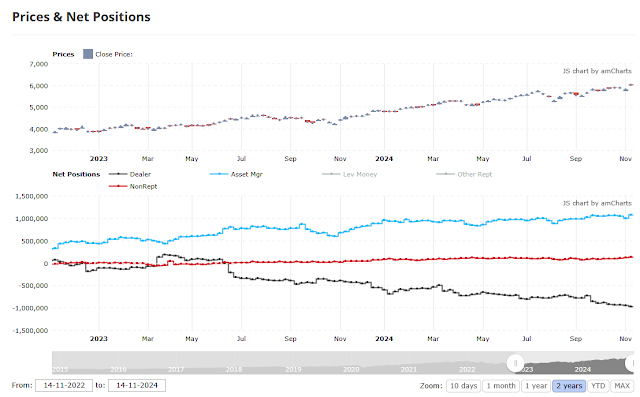

The COT data as of Tuesday, November 19, when SPX closed at 5917, shows non-dealers buying the dip, reinforcing their complacent positioning. Usually asset managers are reducing net longs into selloffs, but not this time. Its almost as if everyone knows that all dips are to be bought, not sold. Only suckers sell on dips. SPX asset manager net longs is at the highest levels since early 2020, and around the highest levels of the past 10 years. Other times when we've reached this level of asset manager net longs and dealer net shorts, was in early 2018, early 2020, and now. We had a huge selloff after the blowoff top in January 2018, where SPX dropped 11% from the highs. We all know what happened after the top in early 2020, and now we're in a similar point with regards to positioning. Seeing similar extremes in net longs among asset managers in Russell 2000 futures, reinforcing the overall bullish positioning out there.

|

| SPX COT Positions |

| |||||

| Russell 2000 COT Positions |

The ratio of leveraged long vs leveraged short ETF assets is now at a 3 year high, last time being above 12 in December of 2021. That just happened to be the top of the market right before the start of the 2022 bear market.

Still holding a small long position that I didn't exit gracefully after the post election moves up and down. I will be selling the remaining long today and watch and wait to look for a short entry. Despite the positive seasonal influence on the market, I see an opportunity to put on shorts to play for a pullback in the coming weeks. The way the market just dropped on just a hint of less Fed easing from Powell and some overblown nuclear war fears after Russia's threats show that long positioning is quite saturated. With VIX back around 15, the positive influence of reduced vol on equities will be limited. Upside should be capped around SPX 6025 and downside on a pullback could take it to SPX 5800. Based on last week's price action, you are not getting the same reflexive buying pressure on dips like you did earlier in the year. Its a sign that positioning is stretched and there are not many buyers waiting to get in.

Getting a gap up based on optimism that Trump's Treasury pick, Scott Bessent, will be positive for the stock and bond market. I disagree, considering how little power the Treasury has compared to what Powell can do for the next year and a half to spoil Trump's party. Trump, not Bessent will be making the final calls on tariffs and spending plans/tax cuts. Back in Trump's first term, Mnuchin was basically a Trump lackey, doing whatever he was told. That's why he lasted so long in the Adminstration, unlike others who actually had a backbone. Bessent either becomes Trump's lackey or he gets fired. That simple.

Powell will be incentivized to play for legacy and be hawkish on his way out, so don't expect any dovish gifts for the next several months unless the economy really craters. More and more, the non-consensus trade of a weaker US economy vs the past year is coming into view, as any focus on cutting government spending, raising tariffs, reducing immigration, and reducing the deficit will not be a positive for the US economy. Of course, in the heat of the moment, speculators only see dollar signs ahead, and have blinders on. This blind optimism phase doesn't last long, especially when everyone is already loaded up long.