They are impervious to weakness. They believe. In SPX We Trust. Like those Reddit meme investors. They have diamond hands. They don’t get shaken out easily, and are willing to ride it out, come hell or high water.

Last week, we hit the short term pain threshold for some index put options sellers and VIX call sellers, as well as some asset managers. But overall, you didn't get a true purge that you need for a V bottom. Which makes it likely that we'll repeat what happened in February to April of 2018 where you bottomed off the initial volatility spike higher and rallied hard, but then sold off a few weeks later to retest the lows. You probably don't get as much of a rally this time, as Feb. 2018 had a bigger selloff and was during a more seasonally favorable period of the calendar.

Compared to 2018, the price action is much more subdued this time, and you had less capitulation. You didn't even get a retest of the panic like Feb. 2018 after a few days because the dip buyers and vol sellers were so active. Which is unusual because the economic conditions are worse now than in early 2018. In early 2018, the economy was actually strengthening globally, with commodities prices rising along with bond yields. Now, global growth is clearly slowing as shown by the weakness in commodities and the recent strength in bonds.

The VIX closed at 23.39 on Friday, Aug. 2, and the SPX closed at 5346. After last week's panic, VIX closed at 20.37 on Friday, Aug. 2, while the SPX closed 5344. So you had the SPX lower on the week, with volatile intraday moves, yet the VIX sold off 3 points. That is the power of active vol sellers in this market. They suppress the IV of options, reducing the delta hedging and gamma forces in the market, supporting the indices. As of Tuesday August 6, leveraged funds (in blue) added to their VIX short positions, basically doubling down on their bets shorting volatility. Dealers (in red) remain very long volatility, as they take the other side of the leveraged funds positioning.

On the other hand, you finally got capitulation in the yen carry trade. The huge net short position held in JPY by trend followers and carry traders has been purged over the past couple weeks. You are unlikely to see much yen strength from here in the short term, which is a positive for risk assets.

For the SPX, you saw asset managers significantly reduce their net long positions from July 30 to August 6, as they usually do during big selloffs. But asset managers are not completely dumb. They have a tendency to reduce their net positioning from max long as the SPX enters the final stage of a bull market. Examples include early 2015, early 2018, mid 2021, and now mid 2024.

|

| SPX COT Asset Manager Net Positions |

Asset manager net positioning is a reflection of Wall Street sentiment. Bullish sentiment on the market usually tops out before the SPX does. So the best time to make bets for a big sustained down move is after the bullish sentiment has been decreasing for a few months while the SPX grinds higher. For example, the bullish sentiment peaked in January 2018, but the SPX made a higher high in October 2018, right before a big sustained drop lower. Same thing happened in November 2014, where bullish sentiment peaked in late November, but the SPX made a higher high in the spring/summer of 2015 before a waterfall decline in August 2015. It also happened in 2021, where bullish sentiment peaked in the summer, and the SPX grinded higher all year before the bear market started in January 2022.

It appears now that we've reached peak euphoria for this bull market in July, with the mix of the AI bubble, Trump election hopes, sudden embrace of small caps as the Russell 2000 squeezed higher, and with bonds rallying on Fed rate cut hopes. I don't think we'll be able to top that level of bullishness for this cycle. I expect bullish sentiment to slowly drop over the next few months, while at the same time, complacency remain as the SPX stays in an uptrend. Then like a lion escaping its cage, you can expect a sudden start to a raging bear market. Best guess is that bear market starts in the first quarter of 2025.

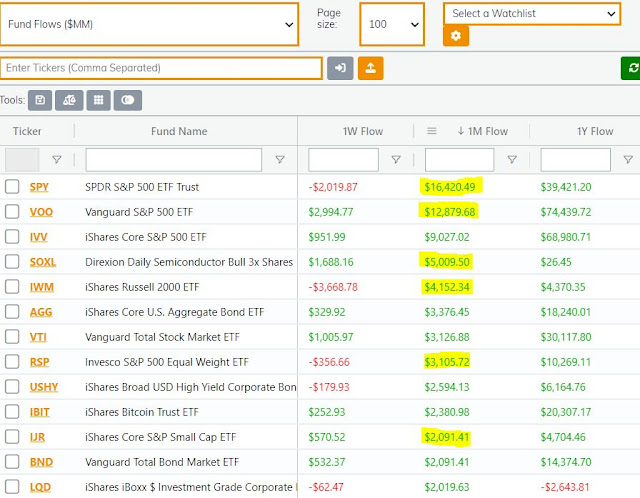

The ETF flows over the past month are more evidence that investors got really excited about the stock market. Comparing 1M to 1Y flows, you see how much has suddenly flooded into equity ETFs. You also had big inflows into short VIX ETFs. Net inflows for SVIX for the year have all happened in the past week. You don't see that when investors are scared. And there was very little selling by equity index ETF investors during this selloff. This is a short term bullish sign, as it shows that US stock investors are acting like meme stock investors, having diamond hands. But its a long term bearish sign as investors remain heavily long equities and stay complacent despite the volatility.

OCC opening put/call transactions showed some more put buying than the previous week, but still below the levels that you saw in mid April. You only got a partial capitulation, and many are still hanging on to their positions, or even adding to them, which means you still have plenty of underwater longs in this market. It makes the next few weeks harder to trade as you didn’t get a full capitulation which can be the springboard for a strong rally. Now its more likely to be a choppy bounce that will lack the buying power that you saw after past bottoms. But you have gone down quite a bit over the past 3 weeks, so its not a great spot to put on shorts either.

I would be careful trying to short a rally too early before its matured because the SPX can grind higher from here for several days. At the same time, you can have sudden sharp 1-2 day selloffs that shake out the late coming, weaker hands. Timing a good short will be harder than timing a good long during this relief rally phase. Its a different strategy now than the one used from mid July to August 5. For the next couple weeks, you have to be quicker to exit shorts in profit and be more willing to buy dips.

Bottom line, its a mixed picture. You had capitulation in the yen among CTAs and carry traders, and among some asset managers, but not in equity ETF buyers or vol traders. For the rest of August, it should grind higher, with brief, but sharp dips that will likely be bought up quickly. Beyond that, looking out into September and October, expect another wave lower back towards SPX 5200, or a slight undercut of last week's lows, in the seasonally weakest time of year, ahead of the election in November.

40 comments:

Getting to 5400 today but i want to wait and see some more time

I am slowly starting to short here close to 5400. We may have one more up day from this level but I like the short term risk/reward. Price target on the short is 5300.

Too much implied vol so have to wait for a better entry point. Hoping for a push higher into the close to get in

I see short term upside possible up to 5450. Implied vol dropped a lot today, they are pre-selling the vol ahead of CPI, like they usually do. CPI will end up being a sell the news event.

do you think CPI will be much low and imply recession risk today?

No prediction for CPI. I just expect a sell on the news after rallying strongly into the number. Plus getting close to strong resistance around 5450.

Will add to shorts this morning. Looking for this rally to top out soon.

I added some shorts late afternoon. Price action not looking weak by any means but worth a shot. Will reassess tomorrow. Would love tour continued thoughts @marketowl

Added shorts in xom spy qqq and net

May add nvda shorts tomorrow desite likey great results coming. Will exit soon

I also added to shorts at the close. Probably won't get a big pullback, but I think SPX 5380-5400 is possible by early next week if things play out as expected. If it stays above 5450 for the next few trading days, that's a bad sign for shorts.

That is not a good risk reward. Might bail out today.

Wrong on the short, but not covering yet. Looking for a graceful exit within the next few days on a dip. Will be out of the short by Monday at the latest.

This looks like it wants to past 5650 may be end the year at 6000

I wouldn't overreact here. Opex gamma influences are in play here. Considering that monthly opex is one day away, and with the huge moves we've had over the past week, I think you will get some of that up move taken back in the next 3 trading days. After that, I want to be back on the sidelines waiting for a better spot to trade.

noted. the price action is not crazy strong today. qqq unable to break 470 which is a big plus. nvda not able to break out either. will be more patient, thank you

Liquidity is completely depleted. I'm all in today with table money at 5 quad.

5555

what do you mean soong? u are short or long all in?

Half position QQQ 450 12/20 puts @ 11.90 and Long LYFT @ 9.21

Just an average 100 point up day.

Tough day for shorts. In hindsight shorted too early. Today should have been the first day to start shorting. If today did not happen, was ok to sit neutral

@marketowl been thinking more deeply about equities and increasingly coming to the view that US equities might be the new risk free asset after al. would love your thoughts.

1929-33 - system reset with nominal values down. in 1970, reset happened by real value going down

may be shorting nominal values does not work at all this time. here are the various things that may happen

1. continued inflation with data managed to show inflation is contained

2. regime changes as happening everywhere

3. gold spikes 500-2000%

4. AI productivity miracle - least likely imo

so there is a scenario where the stock market never comes down nominally in fact just keeps going up even when real value is down. so buy equities with both hands and buy gold calls as a hedge, may be physical if option for some.

what am I missing? looks like we are crossing 6k within a few months and never really going to have even a 10% correction. pls advise

i meant 1970s not 1970 - 1973-1983 to be precise

You are talking about the Argentina scenario. That is a Mad Max scenario where the dollar will weaken tremendously and yes, gold and stocks would skyrocket. So would food, energy, goods, services prices. That would be a disaster for any politician in office. Of course, politicians would blame anybody but themselves for the inflation, and while the masses are dumb, they eventually figure out the real reason for high inflation. That would be money printing by the government.

Before you get to that Argentina scenario, you would get a revolt in the bond market, which would crush the stock market, at least until the Fed starts doing QE. And then you get the dollar getting crushed. Only after that will you get the stock market exploding higher. So instead of going long stocks, you would actually want to short bonds because bonds would go down first under your scenario, and then you would buy stocks after the bond induced correction.

So shorting bonds would be the superior trade to going long stocks.

hmm food for thought for me...thank you for your views

Are we not high enough now to just wait for more weakness in sept/oct or you think its still better to get out for now? What s&p price for graceful exit?

I am short, so I am betting that we go down over the next few days to give us that graceful exit. Not sure what SPX goes down to, I will let the market decide. But the plan is to cover shorts either Monday or Tuesday. After I get out of shorts next week, I will likely wait on the sidelines to see how the market develops.

Long ASTS 34 8/16 puts 1.30

sold ASTS 34 8/16 puts @ 3.39

3x in 4 min that is a nice trade. Wow lol

Long MLCO 9/20 5 call @ .59

Long MLCO @ 5.29 for investment account

@marketowl i am getting nervous about holding shorts on to next week. I dont understand the move and when I don't, it usually continues - feel like I am overlooking or ignoring something

sold LYFT 11.50 long ASTS 30 puts 9/6 4.50

I would give to till early next week to get out of shorts. Given how much the monthly opex has influenced the price action, I would give it till early next week to get out of shorts once those opex forces are gone. But agree that I wouldn't hold shorts beyond next Tuesday.

What signs to look for tomorrow am? Wondering if this just grinds higher without a graceful exit option?

You have to see selling in the first two hours after the open. If not, you probably don’t get much of a pullback for the next two days. Plan is to exit on Tuesday with or without a pullback.

You would hold into Tuesday no

Matter what?

Pretty much holding into Tue. no matter what.

May I know why you choose tuesday?

Post a Comment