The stock market is irrational. Its based on numbers, but its not math or science. There are no set rules. There is no iron law in finance. Its an art that people try to make into a science. This isn't physics or math. The closest thing that comes to mind is fashion. There is no real logic when it comes to fashion. Its based on feel, personal taste, emotion, societal trends, etc. The thing about fashion is that it really doesn't matter how you feel about your clothes, its how others feel about your clothes. That's the stock market. It doesn't matter what you feel. It matters what others are feeling.

Having a quantitative mindset, it was bewildering to see how investors would get more excited about the stock market the higher it went. The rationalization, the excuses, the reasons for the moves. They are arbitrary but are quickly clamored onto like indisputable facts by the crowd. There is no wisdom of crowds in the stock market. That's BS. Its the madness of crowds. Its herd behavior coming from our primal instincts, that evolved over tens of thousands of years when survival was always the priority. That way of thinking, the emotions and actions that all evolved when there was no stock market, when there was no crowd gambling on a huge scale.

Trying to put logic or numbers into this game is like trying to put a square peg into a round hole. Its an art, and it will always be art, even when AI or machines take over. There is no science here. The stock market is just a huge, glorified casino. In fact, its less quantitative than a casino, where the odds are set. In the market, the odds are unknown. Its this mystery that keeps the hope alive, that provide fertile grounds for snake oil salesmen and subscription sellers. The day that I start a substack to try to sell subscriptions is the day that I admit that I no longer can beat this game, and can only make money selling dreams rather than living the dream.

Its an illogical game, but there are patterns to it. Arbitrage has been sucked out of the market and there is very little alpha in that space. The main edge in markets is finding patterns and playing them over and over again. Those patterns are derived from human psychology and they repeat. Some patterns are long term, some are very short term. But they repeat. Successful speculation is about finding the patterns and anticipating the next move to come in the pattern. There are seasonal patterns, patterns around events, etc. Some patterns are higher probability than others. And the probabilities change and are unknowable, but intuitively, you can sense what patterns are reliable and which ones are less so. But to do so, you have to stop thinking about what's going on in your head. But what's going on in the head of those moving the market.

First order thinking is what you are thinking about the situation. Second order thinking is what you are thinking about what others are thinking about the situation. First order thinking doesn't help you much in this game. Its second order thinking which is the foundation for market analysis. No one cares about what I think. No one cares about what you think. I'm not the one who's going to drive the next move. I want to know what the big money is thinking and what's their next move.

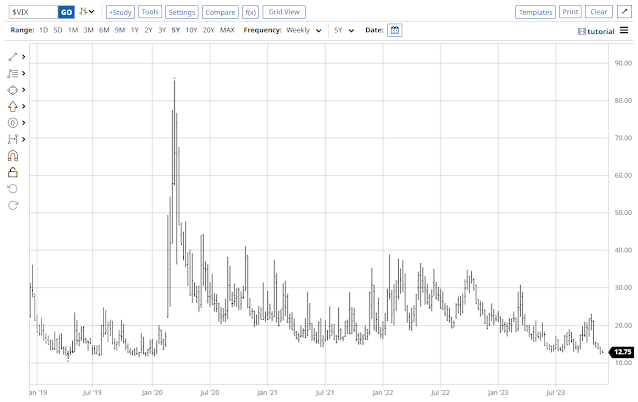

The current bull run in stocks is puzzling from my view of how markets should be valued, but it really doesn't matter what I think. If others are in a risk seeking mode, and past patterns of risk seeking behavior play out, we are not done with this uptrend. That doesn't make me want to play this uptrend at the current time, even though the probability is high that the market will be higher 2 months from now. Its the risk/reward thats not attractive here. There is more downside risk in the short term than upside risk, even though its more likely to go up than down.

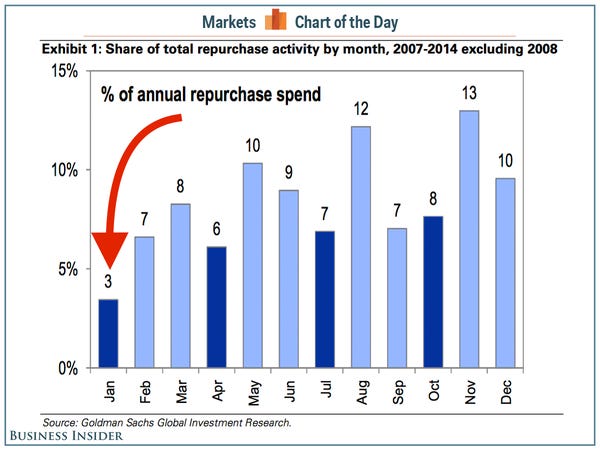

These big bull runs, which we are currently on, tend to last 4 to 5 months before facing its first real test/correction. Since this rally started at the end of October, that means a rally that likely lasts until late February to late March. This also jives with the psychological importance of the Fed and the first rate cut, which looks like will happen at the March FOMC meeting. Its a classic buy the rumor, sell the fact setup happening over several months. This will be the framework with how I trade the market for the 1st quarter of 2024. Its too early to think about shorting for longer than a couple of days, so I'd rather not play that game.

No imminent trades at the moment, but I will be buying dips in SPX and Treasuries in January, as I expect the uptrend to continue into March.