Markets change. This isn't your 1999-2000 late cycle market, or your 2006-2007 late cycle market. Markets of the past put a lot of weight on the business cycle, as recessions would lead to stock indices falling into bear markets. So investors were focused on getting ahead of the business cycle, by selling before the recession, near the peak, and buying during the recession, near the bottom. That's the old game. The old pattern. Front running the business cycle. Selling stocks when its late cycle and after the Fed has finished its hiking campaign, ahead of the recession.

The new game has moved 2 steps ahead. It's not so much about getting out of stocks ahead of the recession. Its about getting out of stocks just ahead of a big increase in bond yields, even as the economy is hot. Bond yields have now become more important to the stock market than economic growth. That is what the 2022 bear market was all about. Investors assumed that much higher rates would then lead to a recession, ignoring lag effects and fiscal policy. With no recession in 2023 and SPX going much higher despite higher rates, most forecasters were wrong. They don't want to be fooled again, so they've given up on their hard landing call, and have tilted towards a soft landing view.

Higher rates have done little to hurt the US economy, so many assume that it will do little to hurt the economy going forward. Thus, their consensus view of higher for longer and a soft landing in 2024. But the fiscal support that was there in spades in 2022 and most of 2023, will be fading in 2024. Most of the fiscal largesse is going to cash rich buyers of Treasury debt, who have a much higher propensity to save than consume. There will still be a big deficit, but less stimulative than previous years. All of this while banks are issuing fewer new loans, slowly choking out growth in future years.

Investors don't have patience to wait anymore. What is happening now is assumed to be a good guess for what will happen in 6 months. After having egg on their face for calling for a recession due to higher rates and monetary tightening, they are now jumping on the lower inflation numbers and calling for a gentle path lower in rates. Once again, jumping the gun, thinking that lower rates will immediately mean a mild slowdown, with little pain. With the Fed taking their foot off the break gently, they assume that the economy will have a feathery, soft landing that will keep corporate profits growing and job losses at a minimum.

In this new game, its all about bond yields. Investors now try to stay long throughout the easing cycle, even if its during a weak economy, and get out during the start of the rate hiking cycle, just before bond yields surge higher. Modern day markets are infatuated with liquidity and monetary policy. Its more important than the business cycle, and the ups and downs of corporate earnings tied to that cycle. The market would rather have a weak economy with monetary policy getting easier than a strong economy with monetary policy getting tighter. The simplest way to measure monetary policy is through the change in bond yields.

The game has changed because of what happened after 2008. From March 2009 to January 2022, over a span of just over 12 years, SPX went from 666 to 4818. That is a 623% return, not including dividends, over 12 years, with ZIRP almost through the whole time period. Investors have been shown one of the biggest divergences between the real economy, where growth has been low, and the stock market indexes, where growth has been high. That has never happened before.

Its human nature to always fight the last war. Recency bias. The bias among investors is that low rates and QE lead to high stock market returns. But what market historians forget is that valuations were very low in March 2009, and super high in January 2022. It was not just ZIRP and QE that created huge returns. It was the much lower valuations after the GFC that was the potential energy unleashed by recklessly loose monetary policy. So while investors still have the same playbook, with expectations of great returns when the Fed eases (e.g.: 2019, March 2020 to Dec. 2021), the potential energy is no longer there. Valuations are very rich. Household allocations to equities are historically high, and only surpassed by the bubble period in 2021. In fact, this time, instead of a coiled spring, its a stretched out spring with no potential energy.

That being said, its not like 2000-2002 or 2007-2008. This time around, fiscal policy is much looser. Big budget deficits are mostly going towards enriching the top 10%, who are big financial asset owners. When you have so much interest income, subsidies, and pork thrown at the rich and lobbying corporations, they won't feel any pressure to hold a fire sale or issue more equity to re-liquify. Even in a recession. With such profligate fiscal policy aimed at shooting more dollars at the wealthy, I don't see how you get a 40-50% drop in the stock market. Anything is possible, but the US is clearly on an inflationary path, and that's incongruent with extended deflationary stock price movements. We could still get another bear market, but I think it will be like the 2022 bear market, a 20-25% drop without a surge higher in volatility.

With the current high valuations, returns will be muted, and organic growth and productivity are very low. All future growth will come from the money printer coming straight from the US Treasury, if the Federal Reserve doesn't play ball. If the Fed also joins the party, then the dollar will be wrecked. T-bill fueled deficit spending is essentially fiscal QE, because T-bills are essentially treated like cash. Most of future real growth will come from under-reported inflation via CPI hedonic/substitution manipulation lower of the inflation rate.

In this cycle, there will be two local maximums. One at maximum economic growth, which was in late 2021. The other local maximum is when the hopes of a soft landing reach their highest, right before the Fed begins its easing cycle. That's likely to come sometime in the spring of 2024. The timing will be the hard part, as the Fed will wait till the last minute to reveal that they are on the cusp of cutting rates. That's going to be the last gasp higher for this bloated stock market, and will likely mark the beginning of another roller coaster ride lower.

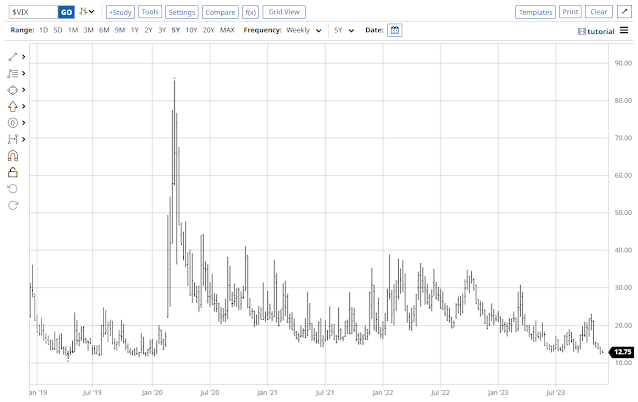

Volatility has made a round trip from 12.50 to over 80 and back down to 12.50 over the last 4 years. Low volatility environments encourage overreach by investors looking to sell options premium, more leverage use, and slow grinds higher. Its not a conducive environment for buying puts, even though they are cheap. This is the kind of market that's best to just avoid if you are a trader. Don't see much to do here. Perhaps a small short in bonds and crude oil as potential short term plays. There is nothing juicy out there. Laying low in the weeds, like a sniper. Long periods of boredom which could be interrupted by short periods of sudden action.

No comments:

Post a Comment