They are not making it easy for bulls in this market. You have to fight and claw your way for small gains, big gains remain elusive, and rallies have not lasted for long.

What I have seen so far this week isn't all that encouraging for longs. You had a clean breakdown below the much touted SPX 4200 level, yet you didn't see a big jump in the put/call ratio, and in fact, you have seen quite a bit of call volume this week. The ISEE index measuring the options bought to open ratio of calls to puts shows the complacency.

Its concerning to see this while big tech earnings lead to intense selling of tech stocks. The COT futures positioning data comes out later today, so that should reveal how much positioning has changed since the selloff started last week. Bulls need to see asset managers significantly reducing longs to have more confidence in buying the SPX. So far, you haven't see enough fear and panic to get a tradable bottom.

The complacency extends over to the bond market, where investors seem to feel more sanguine and bullish than they are on stocks. It boggles the mind to see the option traders come in day after day to buy up TLT calls, as if its a generational buying opportunity in long bonds. And they keep getting creamed, with hardly any signs of life from the weakest major market in the world. Not only are they hoovering up "cheap" TLT calls, they are piling in to TLT itself, with huge flows in the past 2 days, with back to back $1+ billion inflows (Oct. 25 and 26). Also from what I hear from most of the financial experts, they are bearish on the economy and most seem to be calling for a recession in 2024. The weak price action in bonds along with the overall bearish view on the economy from the pundits tells me a lot of bond investors are offside here and feeling a lot of pain. I don't expect that pain to go away until you see a flush out capitulation with 10 years breaking above 5%, and getting much closer to the Fed funds rate of 5.33%.

The bond market continues to cry for help, and its only been answered by limited ammo call punters and knife catchers in TLT who are quickly losing their fingers. Politicians in Washington DC have totally ignored the message that the bond vigilantes are sending. That message is simple: cut your reckless spending and raise taxes. Instead, you see Biden ask for another $100B to spend on wars, touting it as a good for the economy and providing more jobs! And the Republicans are more concerned about being anti-woke and keeping immigrants out of America than they are about the huge budget deficit from Bidenomics and ballooning national debt. And most of the voting public can't put two and two together, and think the plunging bond market is because of Fed rate hikes, not the reckless spending in Washington DC.

The cavalry is not coming to save the bond market. Powell isn't coming to the rescue until you see blood in the labor market. And if he does, that's going to help the short end much more than the long end, as I don't think he's going to do QE when the Fed funds rate is so high. Bottom line, if you are going to make long term bets on the bond market, being leveraged long in the short to intermediate part of the curve will be much more profitable than being long in the long end of the curve when the economy slows. The steepening will continue for a while.

And I don't see the economy slowing fast enough to rescue the TLT buyers. There are way too many doom and gloomers hoping to profit off of TLT calls expecting a credit event like 2008. The excesses just aren't there in the private sector. Only from an unwind of a private sector credit boom can you get a credit event. The balance sheets of most households is rock solid, as the US government and the Fed re-liquified everyone with massive debt fueled spending mostly financed by QE over the past few years.

The only way you get a recession is if corporations decide to get much leaner, reduce debt by not reissuing at higher rates, and cut labor as a result. The next recession will have to come from CEOs and small business owners who choose not to issue bonds/take out loans at high rates, and instead choose to match the lower capital with less labor. You are not going to get a recession from a financial crisis, there is just way too much liquidity out there, with the Fed's balance sheet still bloated and with the US government pumping out multitrillion dollar deficits during expansions. And you definitely will not get the US government to cut spending or raise taxes, so they won't be the cause of any future demand weakness. All in all, its just a terrible fundamental situation for long term Treasuries.

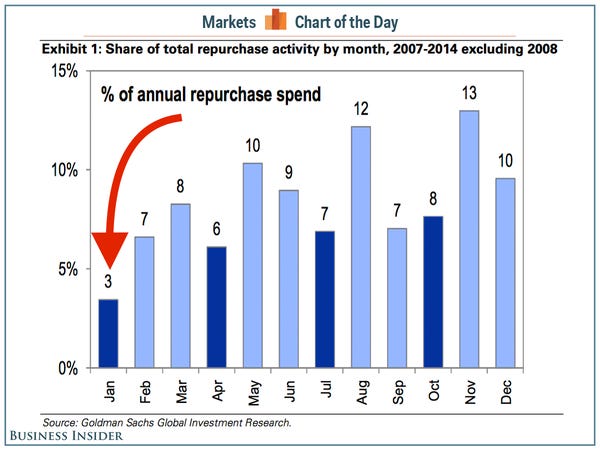

While I don't like the price action in stocks recently, and the complacency in the options market lately, I still think we are close to an intermediate term bottom due to oversold conditions and a seasonally favorable time with lots of stock buybacks coming in the next 2 months.

Expect the weakness to continue into Monday/Tuesday of next week, where I will be looking to buy the dip.

4 comments:

what are you thinking @marketowl? long/short/no man's land?

Looking to add longs, missed the long entry on Monday and waiting to add. A bit surprised to see such a rally ahead of the FOMC meeting, but probably sets up a selloff on Thursday. Still negative on bonds, and I think we'll breakout above 5% in Nov. in 10 yr.

thanks a lot

By the way, my worries about the bond market is keeping me more cautious on stocks than I would be otherwise. It could get ugly over the next 2 months for bonds and that could definitely spill over into the stock market.

Post a Comment