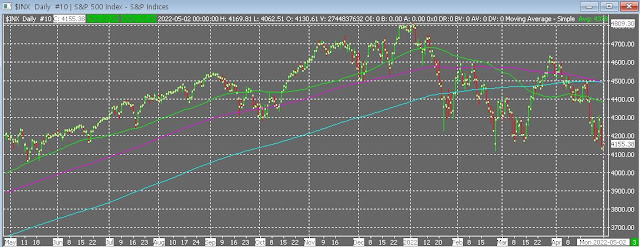

2022 is turning out to be like 2000. The second half of 2000 that is. Here are the charts for 2000 and the past 12 months.

|

| SPX daily (2000) |

|

| SPX daily (May 2021 to May 2022) |

The worm has turned. The bears are back. They've been getting destroyed year after year since 2008. Only brief glimmers of success taken back with a vengeance with each V bottom ripping the heart out of the shorts and annoying those holding mostly cash. Its a different story now.

This game is about making adjustments. Like a 7 game series in the playoffs. After seeing what happens in game 1, you have to determine if you just had bad luck or if you actually had a bad strategy and the circumstances have changed. There is a fine line between sticking with your strategy that has been working over the years but recently hasn't, and changing your strategy on the belief that the market regime has changed. If it hasn't, you pay the price by missing out on a big move, or even worse, being faked out and being on the wrong side of one.

The evidence is mounting that the market regime has changed. Here are pieces of evidence:

1. Huge rally off the March 2020 bottom taking the SPX from 2192 to 4818 in less than 24 months.

2. Highest ever price to book, price to revenue ratio for the S&P 500 in 2021.

3. Massive equity inflows and retail participation in speculative garbage/meme stocks from November 2020 until January 2022, most since 2000. Lots of weak hands and public is highly exposed to stocks.

4. High inflation worrying politicians which leads to a hawkish Fed pivot. Results in a weak bond market, 10 year yields up to 3.00%, and Fed funds rate still at 25-50 bps, and Powell seems hell bent on getting Fed funds at least up to 1.75-2.00% before he slows down.

5. Lots of bearish sentiment in the sentiment surveys, but survey on equity allocation still very high (equity fund inflows have only recently turned into outflows). Fully invested bears?

6. Nasdaq tech stock underperformance, financials very weak even with rates projected to go much higher.

7. SPX is no longer giving bulls much time to sell the highs, rallies are sold quickly and the bottoms are messy, lots of U bottoms that lead to only brief rallies vs. V bottoms that lead to relentless rallies from 2009 to 2021.

There are probably more things out there like specific fundamentals for big cap tech which showing slowing earnings momentum despite big time overvaluation, bearish leading indicators, etc.

Yesterday, I could finally see some fear in the market as we broke the 4100 support level and made new lows for the year. Its not a great way to make a bottom, but a lot of pre-FOMC hedging / risk reduction happened over the past several days and it looks similar to the pre March FOMC setup that resulted in a big rally from 4140 to 4620 in 3 weeks. Not expecting anything close to that since we're beyond the point of recognition and its the sellers, not the buyers who are more eager these days. And seasonally, not a good time for investors from May to October.

Very few investors are used to these type of markets, it hasn't happened in over 13 years. The natural instinct of many fund managers is to wait for a big rally to sell, because they ALWAYS happen, right? I tend to agree, but I don't think we'll be getting anything that lasts more than a month from these levels, so I would not be surprised if we go up to 4400-4500 area and then go right back down to 4100. Its a seller's market. Something that investors are not used to. Investors talk bearish, but are they still fully invested? It seems retail investors are, while hedge funds have rightfully turned cautious this year, and for once in a blue moon, are actually outperforming the SPX.

Still low equity exposure, with most of it in energy. Staying away from taking significant SPX positions, unless its on a short setup. Going long SPX is treacherous in this market and to be avoided except for catching brief rallies after big dips.

No comments:

Post a Comment