Pumping Powell pulled off an AAPL special: under promise, over deliver. This time, he raised expectations for rate hikes so high, that even just promising to do 50 bps at a time in the next 2 meetings was received as dovish. In reality, he's sticking to his original plan back when he was talking hawkish in early April. Its just the Eurodollars/Fed funds rate market that drank the Jim Bullard kool-aid and started pricing in a chance of a 75 bps move, when it wasn't going to happen.

The market is acting according to script, scaring out investors and getting them nervous ahead of a big FOMC meeting, and then breathing a sigh of relief when Powell didn't talk more hawkish than he did a few weeks ago, resulting in a face ripper. Big picture, the situation hasn't changed. Fed is still on automatic pilot for the next couple of meetings, for rate hikes, so you can book 50 bps hike in June and probably 50 bps in July. If the market starts to fall apart going into the July meeting, Powell could just do 25 bps in July to try to foment another short squeeze and rescue the market.

In either case, the Fed funds rate will get up to 175-200 bps by end of July. That would probably be enough for Powell to slow down and only do 25 bps hikes if the stock market is not weak. That's way different than what the Eurodollars market is pricing in, which is penciling in 50 bps in June, 50 bps in July, 40 bps in Sept, 28 bps in Nov, and 23 bps in Dec. That's a total of 191 bps of additional rate hikes in 2022. That's not going to happen. The market will break so hard if the Fed tried to follow the market pricing that Powell will pivot before he could pull it off, guaranteed.

People don't learn from history. How soon do we forget about Mr. Transitory. Powell has no backbone, and he loves to find excuses to be dovish, or less hawkish. How soon we forget about the dovish pivot in January 2019, after the S&P 500 went down 20%, and he kept the dovish pivot even as SPX was ripping to new all time highs in 2019.

This time, It took 8% CPI to get him to finally stop QE and start talking about 25 bp hikes. Only market pricing in 50 bps hikes for several meetings did he finally get the message and the balls to at least try to catch up to the Eurodollars market. The Fed has never been a leader in starting the hawkish wave. It waits for the market to price in rate hikes and then follows suit, usually being way too late.

I know people love to rip on Jim Bullard, especially because his hawkish tone has sparked some selloffs in the past few months, but he's been right more than Powell. Powell is a politician wearing a central banker costume. He does what the politicians and the financial markets want him to do, in that order. He could care less about price stability. He's looking for positional stability, as in staying as Fed chairman for as long as possible. Once again, he will be praised for pumping the markets higher at the FOMC meeting. If it was the opposite reaction, he would have been loudly jeered and criticized. That's the nature of the central bank game. It incentivizes the Fed chairman to be dovish. Don't forget that.

2022 reminds me of 2000, but worse. Inflation is much higher and the budget deficits required to keep this pig afloat is now the highest that its ever been. Once you start handing out money to solve short term economic problems, it becomes an addiction. The Rona stimulus checks were enormously popular. If you do a search on youtube, you'll see so many videos regarding stimulus checks and when they will arrive, whether there will be more, etc. Also, with an aging demographic, Social Security and Medicare spending will keep going much higher, and those are golden gooses that politicians can't touch. All that money that the elderly receive either through Social Security or through healthcare subsidies from Medicare are inflationary. Money for doing nothing. Money for being old and retired.

Even in an inflationary environment, the government knows only one way to solve the problem, either hand out money or reduce taxes. Already student debt is being forgiven, $10,000, and that's just the beginning. Gas taxes will probably be eliminated or drastically reduced if oil prices keep going higher, which is very likely given the supply/demand situation. The Republican party has basically become the Trump party, so like Trump, they will try to pump up the economy with short term band aid solutions like tax cuts and more stimmy. Since Republicans are much more aggressive about tax cuts than Democrats, yet only slightly less aggressive on government spending, they would likely cause bigger budget deficits than big spending Democrats, and thus more stimulative for the economy. Of course, since Republicans are much more politicially savvy than Democrats, they won't provide any of that stimmy under a Democrat president, and instead wait for Trump to retake the throne in 2024 to pour on the stimulus and tax cuts.

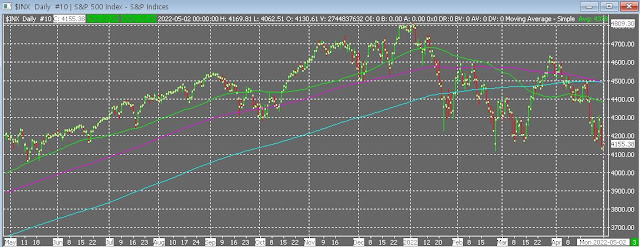

Don't lose sight of the big picture. The SPX and in particular, the NDX

has topped out. The price action is terrible. I know a lot of people

talk about the bearish AAII and II sentiment surveys, but those are only

good contrarian signals in a bull market. In a bear market, not so much. Sure lots of people talk a bearish game, but are they still heavily invested in stocks? Yes.

I am sure most will agree that 2020 and 2021 was a giant speculative bubble (tons of SPAC IPOs, rampant speculation in meme stocks, ridiculous moves in tech stocks, bitcoin, etc.). So in a post bubble environment that we've entered, the closest analog is Nasdaq 2000, especially considering how much retail investors got excited about stocks. Nikkei in the late 1980s, 1990, Shanghai in the mid 2000s, 2007, are also good analogs of a bubble market.

TINA has been engrained in the brains of millennials throughout the last 13 years. Almost like tech stock speculation was engrained in the brains of baby boomers in the late 90s to 2000. The usual aftermath of these speculative boom periods is an extended bear market. Here are a few examples:

|

Nikkei 1990

|

|

| Shanghai Composite 2007, Nasdaq 2000 |

|

|

Nasdaq 2021-2022

|

Past bubbles tell you that the first year of the post bubble downtrend is the steepest and most painful. Right now, we are closing in on almost 6 months after the Nasdaq peak in November 2021. So if past is prologue, you have at least another 6 months of a steep downtrend where countertrend rallies will be brief and be great shorting opportunities. The Nasdaq will be the place to put on short bets, as its much weaker than SPX this year, and has much more froth and the worst overvaluations.