Sector analysis is usually not very helpful in determining market direction, because the market often doesn't follow the economy. According to Ned Davis Research, since 1970, the best performing sectors in the 3 months leading up to a bull market top are health care, consumer discretionary, and consumer staples. The worst performing sectors in the 3 months ahead of a top are financials, utilities, and energy.

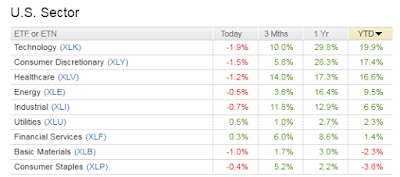

Here are the last 3 month and YTD performances for the biggest US sectors:

While the last 3 months are a mixed bag as far as signaling a bull market top, the YTD performance clearly shows that financials and utilities have underperformed the S&P 500, and health care and consumer discretionary have outperformed the S&P 500. What is especially notable is the weakness in the financials, because rising rates are supposed to be great for banks, increasing their net interest margin, but banks have been lagging all year, and have only started going up recently after the 10 year yield has rocketed higher for the past month. It is still barely up for the year, despite having massive stock buybacks and a 10 year yield that's gone up from 2.40% to 3.20%.

There are also the cluster of Hindenburg Omens that I mentioned last month which continues, as new lows continue to expand despite the market being close to all time highs. Add to that the pressure of higher yields and being in a blackout period for stock buybacks and you have a market that is vulnerable to a selloff. We are seeing that today and although I don't expect anything big on the downside, with decent support around the January highs and September lows of 2870, the probability of a quick plunge like you saw in February is getting higher. However, you still have positive end of year forces that will likely push stocks higher in November and December if we do get a pullback this month. We are nearing the end game for this 10 year bull market as a growing number of warning signs are flashing.

Thursday, October 4, 2018

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment