"I skate to where the puck is going, not where it has been." - Wayne Gretzky

Its been a bad time to be short. The afterglow from the big cut from the Fed lasted longer than expected. Last week was some of the slowest, grinding, bleed higher markets that you will see. The Chinese stimulus added to the feel good environment and you had a gap up all 5 days last week, a couple of them quite sizeable. Nothing saps the soul of the bears more than feeling good after a regular trading hours selloff, only to see it all taken back effortlessly on light volume overnight. While those gap ups tended to fade once the US market opened, you still ended up with an overall up week. While the international markets are still focused on the positives of a Fed rate cut and the weaker dollar, the US market is less enthused. Surprisingly, the Fed rate cuts have actually helped emerging markets and Europe more than the US.

While most of the talk on finance TV is still about the repercussions of a super dovish Fed and a China pumping up stimulus, you can sense that the US market is starting to hesitate at this high level. It seems the US stock market is moving on from the post event euphoria of the Fed going full dove and slowly focusing on the US election, which is still a 50-50 situation according to betting markets. The market generally views a Trump victory as a positive for stocks, and a Harris victory as a negative for stock. There should be some downside vol in the coming weeks as the focus shifts from monetary policy to potential fiscal policy over the next 4 years.

The market is in agreement that both candidates will keep deficits high and the fiscal pump going, but Harris is viewed as one who will let the Trump tax cuts expire, at least for the rich and for corporations, which will be viewed as an equity negative. She's even trying to increase the capital gains tax, but its doubtful that would pass a divided Congress, which is more likely than not if she wins. The uncertainty of higher taxes looms over this market, which priced for near perfection at these valuations. If Harris does somehow win the election, which I view as less than 10% chance, but still a chance, a reflexive selloff in the SPX is very likely. Since I view a Harris victory as very unlikely, I will not be going into the election with a short position.

But what I think is irrelevant. The majority believe in the betting markets and think this election is a crapshoot. And with heavy long positioning in SPX, I can picture a de-risking scenario in October to hedge against a potential Harris victory. That's what's going to be the market's main concern over the next few weeks.

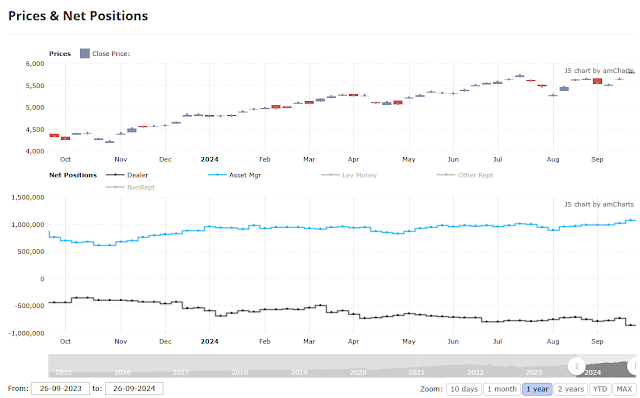

The COT data for SPX futures as of September 24 showed a big jump in net long positioning among asset managers. You saw nearly a similar increase in net short positioning among dealers. Asset managers now have the biggest net long position in SPX futures YTD.

|

| SPX Futures Net Positions for Asset Mgrs and Dealers |

In the past, when there was actually some caution and fear in the market, many asset managers used SPX futures to hedge their long exposure. Now, with very few asset managers short the SPX futures, its completely changed. SPX futures are now used as a quick way to add long US stock exposure, to add beta, and turbocharge returns without having to go to the trouble of stock picking, which most asset managers are bad at anyway. This is more of a long term sell signal than a short term one. But it tells you the environment that we're in, which is one of heavy long positioning, and very few shorts. That is an environment that has led to sharp moves lower, such as Q3 of 2015, Q4 of 2018, Q1 of 2020, and Q1 of 2022.

The OCC options data at the ISEE index last week showed a renewed interest in call buying, as we're back to low fear market. Low volatility, new all time highs, and good news leads to more short term risk taking. I won't put too much weight on this data, as its to be expected in this kind of environment. But it does show how much traders are leaning to one side of the trade.

The original plan last week was to trim my short position. I canceled that plan because it looks like its too late to cover the short and microtrade, and I want to play for the pullback in October. Do NOT want to miss any potential downside in October. We've reached a level of complacency and one sided trading action which can go the other way quickly during this time of year. October is not necessarily a bearish month. But it tends to be bearish if you had a strong summer/September.

Add to the the past seasonal tendencies with election uncertainty and there is a high probability trade to short the SPX over the coming weeks.

The bond market also seems to be changing its focus from the Fed to the election. You have seen persistent, calm selling in Treasuries since the FOMC announcement. I don't think most bond investors want to be loading up on bonds ahead of a potential Trump victory. After what happened to bonds after 2016 and 2020 elections, I expect further weakness in Treasuries in October, even if stocks go down.

Staying short. Its too late to cover. I expect chop this week, and then a move lower starting sometime next week, lasting 2-3 weeks till mid to late October. The market should move lower as the Fed goes into the rear view mirror and the election comes closer into view.