Everyone is talking about a soft landing. It is the zeitgeist of the moment. The current environment reminds me of those wingsuit jumpers who dive off cliffs and high places, gliding down like a flying squirrel. It looks way more fun than your ordinary sky diver who just drops straight down towards the ground. I actually don’t have a strong argument against a soft landing. The ingredients for a soft landing are present:

1. Large budget deficits (6-7% of GDP) in a low unemployment environment.

2. Energy and commodity prices which are stable to lower.

3. Fed policy pivoting to preemptive rate cuts in a non-recessionary economy.

4. Inventories de-stocked to normal levels.

5. Strong balance sheet for the top 50% as home prices remain high, and most have low rate mortgages from 2020-2021 refis.

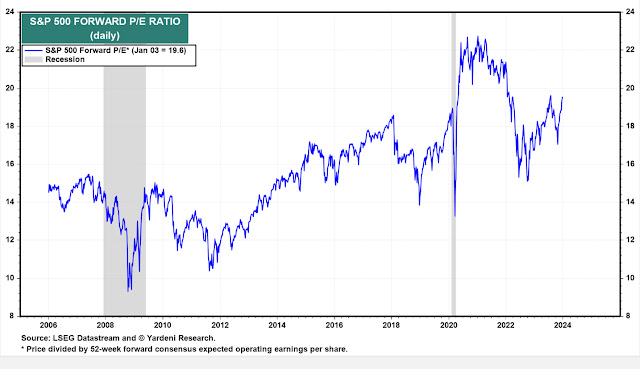

With everyone focused on the short term, macro is always at the forefront. Thus, this soft landing thesis is talked about quite often. Based on my read of sellside research reports and listening to CNBC and Bloomberg, the consensus for 2024 is a soft landing, with a lean towards weak growth. This is not the kind of backdrop that usually forms bubbles, but here we are. The SPX forward P/E ratio is the highest outside of the 2021 everything bubble period over the past 20 years. This is with Fed funds rate at 5.33%, with a 10 year yield close to 4%.The stock market is not the economy. But you would think it is based on what you hear on CNBC. Its the backdrop for almost every conversation about the market. In October 1987, when the Dow crashed 19% in one day, the US was not in a recession. GDP growth was strong. In February 2018, when the VIX went from 14 to 50 in 3 days, the US was not in a recession. GDP growth was strong. Stocks can go down hard and the VIX can spike without a weakening economy. The common trigger for these sharp drops in stocks is a big run up higher into all time highs and rich valuations. The current setup is not quite there yet, as the SPX has not hit an all time high, and the run up is not as steep as 1987 or 2018. But if the SPX keeps rallying for the next few months, the setup will be ripe for a sharp drop and a vol explosion. It won’t be as dramatic as 1987 or 2018, because the rise is unlikely to be so steep. But it will cause some damage. More than March 2023. More than October 2023.

2024, being an election year, will have a lot of political headlines which will be a convenient rationalization for any selloffs. Don’t buy into any of it. The winner of the election, whoever it is, will not be able to cut spending. They will not be able to raise taxes. That’s all that matters for the market. The stock market loves the government overspending while cutting/not raising taxes. Rising budget deficits are a boon for stocks. No matter how much the permabears spin it as a negative. There will be no fiscal austerity, even if the bond vigilantes have a fit. Congress and the White House didn’t even blink an eye when the 30 year yield went from 4% to 5% last fall. Nothing will stop the deluge of Treasury issuance. Nothing.

Sure, the market hates uncertainty, and there is a subset of chicken little investors who think Trump will hurt the market. But after what they’ve seen of Trump and Biden the past 8 years, the election will be viewed a positive catalyst in their eyes, not a negative. This Goldilocks theme based on a soft landing, Powell dovish pivot, and the near certainty of more government cowbell with either Trump or Biden winning in November, what is there to fear? Mainly one thing: the return of inflation and the ghost of Arthur Burns. An economic slowdown is not the real fear. It can be dealt with by bazooka stimmies from the Fed and US government. The real fear is inflation picking up again during the Fed cutting cycle. Commodities are underpriced compared to the growth of the money supply over the past 4 years. It won’t take much for inflation to surge back up on the back of higher food and energy prices and a weaker dollar.

In a low inflation environment, like what you had from 2000-2020, bonds are the best hedge for equity downside. In a high inflation environment, like what you have since 2021, commodities are the best hedge for equity downside. As the economy gets more financialized, like the US, stocks and bonds become more positively correlated, so bonds become a poor hedge for stocks. This will lead to more volatile markets than in the past, because of that lack of hedge from the fixed income side. But the current market is pricing volatility as if it was a similar environment to the 2010s, when you had bonds act as a positive carry risk off hedge, when that's no longer the case. 2022 was a wake up call. Inflation is a bigger long term problem than a potential recession from higher rates.

We are getting a nasty little pullback off the end of year rally, as the post FOMC day gains have all been erased. I started a long in SPX slightly above 4700, thinking that the bulls would defend that zone, but it fell easily. This is just a short term trade, and it still has merit, because I don't see a sustained selloff in bonds at the moment. But I won't hold this for more than a week or two at the most. Once again, stocks have a hard time rallying when yields are going higher. Ten year yields are back above 4%. Nothing has changed. The bond market is in control here.

After this pullback in bonds from the year end rally, I am neutral to positive for the next few weeks due to the impending rate cut cycle, seasonal weakness in most commodity markets, and the skepticism that I see among Wall St forecasters who still think too many rate cuts are priced into the SOFR curve. It is this wall of worry about higher for longer that the stock and bond market will likely be climbing for the next couple of months. This makes me more constructive on stocks as well, since the stock and bond markets are connected at the hip these days.

We have nonfarm payrolls and apparently the higher than expected ADP number and lower than expected jobless claims numbers have both bond and stock investors nervous. These economic data releases are overblown in their importance, so I wouldn't jump to any conclusions based on this jobs number. Powell seems hellbent on going for a soft landing so he'll ignore strong data and cling to anything supporting rate cuts, like lower CPI, lower job openings, etc. Its all about politics now for the Fed, even though most people will think that's just a conspiracy theory.

The Fed will find almost any excuse to cut rates this year. Those clinging to the higher for longer thesis are playing last year's playbook. This year will be the year of Powell the "Caveman Lawyer". Eventually the SPX will form a long lasting top, once you get the majority of investors to completely buy into the coming fast and furious rate cut cycle. It probably will take a few more hints from Powell and company for the message to be understood, loud and clear: they are coming with preemptive rate cuts to prop up Biden and stop Trump. I could care less who wins in 2024. But the Fed is definitely going to be rooting for Biden and helping him out as much as possible. Powell and Yellen are on the same team now.

2 comments:

Are you expecting more downside here since you are said you are only playing the upside for a week or so?

I am expecting another dip after this week. But I have to see how the market rallies this week to get an idea of how much we dip again. A strong rally off last week’s dip means the next djp will be more shallow If we dont have much more upside from here, hen we could go under Friday’s lows by late January.

Post a Comment