So what are the main drivers of profit margins? Its mainly 3 things: pricing power, labor costs, and interest rates/taxes, in that order. Obviously if you don't have pricing power, that really kills your profit margins as you can't collect as much for the same product. In the U.S. in particular, the lack of antitrust enforcement has allowed a huge amount of concentration in various industries. This has allowed for corporate profit margins to keep rising even as economic growth keeps shrinking. Corporate welfare is the default stance for politicians as the corporations play a huge part in financing the campaigns of politicians on both sides. Corporate lobbyists have huge influence and are the reason corporate tax rates are the lowest in the past 50 years. They also ensure that corporate tax loopholes remain open and unchanged. Corporate profits as a percent of GDP is at the highest levels in the past 75 years.

Pricing power is one facet of profit margins that is the most bulletproof, as the politicians are bought and paid for by corporate America, so its unlikely that antitrust legislation will gain any traction unless there is a revolution from the masses. The average person is uninformed about the tax code, or the laws that are not being enforced by the government to prevent monopolies and collusion. So the cause of their lower living standards and higher costs for goods and services is shrouded in a veil that few are sophisticated enough to dig into. Its just easier to blame the other party for inflation and a lower standard of living.

Next comes labor costs. Labor is the biggest expense for most corporations, so it has a notable effect on corporate profits. Corporations want to pay the least they can get away with while still retaining workers. The lack of competition is a key factor in keeping wages down, as there just aren't many different places to find similar work for a lot of workers. Also outsourcing to cheaper labor countries like China keep wages lower as corporations are very willing to go overseas to keep labor costs down. But the balance of power which has been heavily skewed towards corporations is slowly shifting. The lack of labor force growth in the G7 and China is giving workers a bit more bargaining power as labor supply is unable to keep up with labor demand.

Quiet quitting and work from home wouldn't even be a thing unless workers had confidence in getting another job if they got fired. The aging population ensures that the labor force will continue to shrink even if the population remains stable, as more people drop out of the labor force due to retirement.

This shrinking labor pool hurts corporate profit margins in 2 ways: companies have to pay more for the same job, and they are getting less productive workers because they are working from home/quiet quitting/less qualified.

The last factor is interest rates/taxes. Corporations as a whole are net borrowers. So higher interest rates on corporate bonds hurts the bottom line. If we are to assume that the structural energy shortage and profligate fiscal policy due to populism are secular trends, then you are likely to have higher interest rates in the future than you did from 2008 to 2021. That increases interest expense, which hurts profit margins. And corporate tax rates are at 21%, the lowest in 50 years. Its very unlikely they will be cut further. Its much more likely that they are increased in the future as the budget deficits keep getting bigger. That would reduce profit margins for almost all corporations.

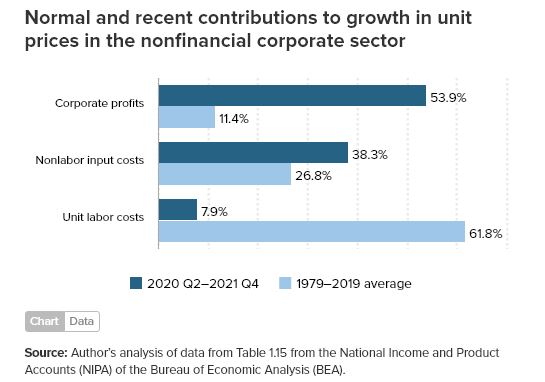

Inflation has mostly come from an increase in corporate profits rather than an increase in labor and nonlabor input costs, as most assume. This shows you how much pricing power corporations have in the U.S.

So pricing power likely remains a constant, labor costs are likely rising, and interest rates/taxes are likely rising compared to the past several years. These are things that long term stock investors need to take into account when trying to estimate the forward returns on equities over the next 10 years. It just makes me more of a bear on stocks from a fundamental perspective, which are already unfavorable due to historically high valuations.

It looks like we are getting more bulls on board the year end rally bus. It feels like its getting a little bit crowded. I am still not short yet, but its getting quite tempting to put on a starter position. The post holiday doldrums could hit this complacent market next week. I have noticed that the Nasdaq has been lagging badly for the past 2 weeks. It appears that the money flows are now going out of tech and into anything else but tech. I expect that trend to continue for the next 12 months. Its the dotcom bust all over again.

2 comments:

Was hoping for high 4000's to put on a small short but wondering now if the boat has sailed.

Small long at s&p 3985.

Post a Comment