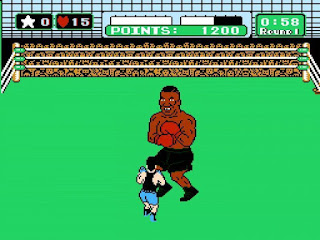

"Everyone has a plan until they get punched in the face" (or bit in the ear.) - Munchin' Mike Tyson

The moves in recent weeks are uncommon in a bull market. In strong uptrending environments, it is not common to see such an extended pullback. Its been over a month since the market was at all time highs, and for most of that time, in a downtrending channel. They are common in bearish environments, but not bullish ones.

So does it mean the uptrend has now turned into a downtrend? Its possible, but considering the fairly small SPX drawdown from all time highs, and its relative strength vs. other global equity indices, I am leaning to a bull market until proven otherwise for longer.

Its been a tough environment for mean reversion traders, and those that follow historical patterns. Looking on the bright side, if the market always followed historical patterns and statistics, then all the patterns would change as systems traders front run trades and that itself would change the patterns, making them harder to time.

The unpredictability and luck factor are what keeps everyone on their toes, it keeps any one group of traders or investors from totally taking over the whole market. But I'm sure that will change with the advance of technology and AI. The days of discretionary trading big macro moves becoming so tough that its not worth it are not too far ahead in the future. Already, FX is almost untradeable. I could definitely picture a day when equity index futures and Treasuries follow suit, and become just as untradeable.

Everyone can trade well when things go as one predicts, while making money. Most of the alpha is generated in dealing with the drawdowns and when the market makes unexpected moves. Knowing when to hang tight and when to reduce risk is what separates the winners from the losers. Its the toughest part of trading, making the right decisions when losing money.

This market is not scaring them out, but wearing them out. Its jab after jab after jab. Not many knockout punches, but stiff jabs over and over again. Yesterday was another one. It feels like endless chop and the market can't sustain a rally. It feels heavy, and its slowly turning overconfident bulls into reluctant bulls and even into reluctant bears.

I remain long, but don't have any plans to add any more. The SPX has worn me out. The probabilities still favor the long side, but they are going down with each passing day of more chop between 4300 and 4400. The wall of worry is quite high: inflation, supply chain worries, China, central bank tightening, bond yields, etc. It appears that fund managers are taking down risk ahead of this earnings season and the upcoming Fed taper. Hedge fund equity long exposure is still above average levels, but its come down over the past 2 weeks. The put/call ratios have remained near the upper end of the 2021 range. Slowly, the positioning is coming down to levels where we can sustain an extended rally phase again, perhaps for the next 2 months.

With October almost halfway done, the seasonally weak period is almost over and the buybacks can't come back fast enough for the bulls. Its just grin and bear it time for the longs here, waiting for the storm to pass. Looking at charts doesn't help anymore. Reading the news is repetitive and talking about the same things over and over again. Its just discipline, risk management, and following the game plan now.

1 comment:

No Plan is Perfect Plan in this madness Market.

Post a Comment