It didn't take much of a dip for the worry to rise. All I can do is shake my head, at how easily equity investors start worrying about a pullback. I don't even need to mention what they say on CNBC Fast Money, as they recently brought that permabull Tony Dwyer, notorious for being bullish all the time except when the markets are in a raging uptrend. He's been looking for a pullback since March, 400 SPX points ago.

Let's take a look at the CBOE equity put/call ratio:

Right back towards the high end of the range this year, when the market made V bottoms in late January, late March, mid May, and mid June.

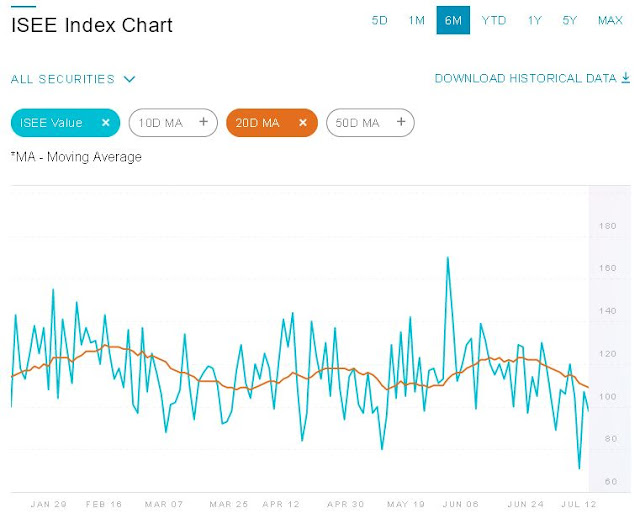

Bearish activity in options is confirmed by the ISEE call/put index.

Powell came out on Wednesday as his usual over the top dovish manner, using different language this time to try to brainwash investors into thinking inflation is transitory. If you could get inside his head, I'm sure he's on automatic QE pilot until reappointment, but he'd never tell anybody that.

He'd never say the Fed is political, but his future is in the hands of Bazooka Joe Biden, who has basically become the puppet for the grand American MMT experiment. Of course Powell will do everything to please his boss, and that's to be as dovish as all get out, regardless of the data or the markets. Once he gets reappointed, don't be surprised if he suddenly changes his tune and sounds much less dovish.

This is a grinder's market, you're not getting any easy setups right now. The best trade is probably just being long the SPX, but its run up so far this year, its not easy to put on the trade, especially if you want to put on size.

Treasury market is also tough, another strong market that refuses to stay down. I'd also be a buyer of dips there.

The best opportunities come when investors are getting shaken out, stopped out, but these days, the uptrend is so strong, the dips so shallow and fleeting, that's just not happening. Tough.

No comments:

Post a Comment