The global stock markets have been amazingly resilient in the face of the fastest tightening cycle in recent history. The stock market is fighting the Fed, and holding up well. So is the credit market. The Fed keeps raising, yet credit spreads are much tighter than they were last fall.

The easiest explanation for the high asset prices is the massive amounts of fiscal and monetary policy in 2020 and 2021. It is the gift that keeps on giving. It also explains the resilience of the global economy in the midst of a huge increase in interest rates all across the curve. Everyone talks about the excess savings as a reason for the strength of the consumer. But don't forget about the super low rates from early 2020 to early 2022. They have made a lasting impact. Households were able to buy or refi into very low rate mortgages. Corporations were able to issue tons of debt at low rates. Most corporations and households are holding low interest loans/bonds that will slowly roll over into much higher interest rate loans/bonds. It is a gradual process. Wall St. doesn't have any patience, so when they don't see an immediate recession, they jump to conclusions like soft landing/no landing.

Here is the Federal Reserve balance sheet:

Despite all the QT fear peddling from the permabears, the Fed's balance sheet is still sky high. Their QT program is painfully inadequate. They have only reduced the balance sheet by $600B in the past 10 months, after adding $4800B from February 2020 to April 2022. That is $4.2 trillion extra Treasuries and MBS that are on the Fed balance sheet and not in private hands, $4.2 trillion of ammo for private investors to buy financial assets with. That is the elephant in the room the Fed doesn't talk about. It is what is keeping a bid under stocks. It is why the yield curve is so inverted. There is just too much damn liquidity out there. That is why it will take time to erode that bid for stocks as the economy gradually weakens.

So if there is so much liquidity out there, why am I negative on the economy? Its because of secular stagnation (demographics, lack of productivity, etc). Without big time fiscal stimulus and very low interest rates, many businesses aren't viable in a zero population growth world. In 2023 and 2024, you will see many businesses go out of business. The last time you had 5% Fed funds rates was in 2007, and the global economy couldn't handle it. There wasn't enough organic growth to sustain that level of rates. People talk about the bursting of the housing bubble and the ensuing financial crisis in 2008 as the causes, but they don't talk much about the slowing organic growth of the developed world since the early 2000s, aging demographics, and slowing population growth rates. That trend has only gathered momentum in the past 5 years, masked by big budget deficits and massive fiscal and monetary stimulus. If the US government ran a balanced budget now, like it did in 2000, the US would be in the depths of a deep, deep recession. The only growth you are seeing in the US is from government pork and entitlement spending. If they just stay at current levels for the next few years, you will have zero growth.

The inflationistas out there, which have grown in number quite a bit over the past year, are forgetting that the main cause of the huge rise in 2022 inflation was the 2020 and 2021 Covid bazooka stimulus that was the largest stimulus EVER in US history. That was a one time bonanza for the financial markets and the economy, and it resulted in an inflationary surge with a 12 to 24 month lag. The main cause of the inflation, a 40% rocket higher in M2 money supply from mid 2020 to end of 2021, is gone. The M2 money supply is going in reverse, almost unheard of in US financial market history. The monetary contraction starting from late 2021 and still ongoing will be the reason that inflation cools down in 2023 and 2024.

All things being equal, inflation going lower in a high inflation environment is bullish for the financial markets, but this time, the cooling inflation will be accompanied by a big drop in economic growth with high interest rates. Unlike the higher for longer crowd out there, I don't think the economy will hold up for long under this current high rate regime. Do you really think the stock market will be happy with Powell sitting there, keeping short term interest rates above 5% for several months, while the economy deteriorates, like nothing is happening?

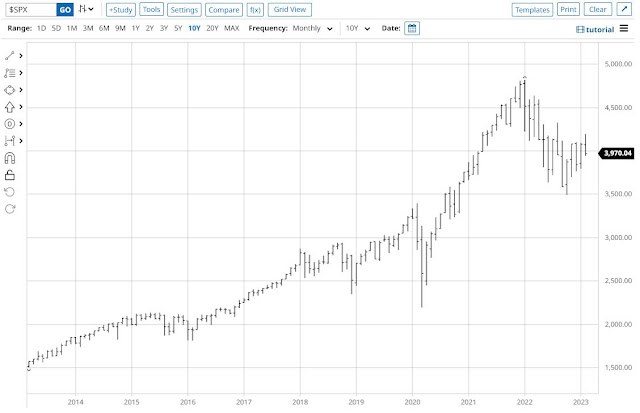

If the Fed truly commits to its higher for longer rate regime, then they will have to do it in the face of a falling stock market, disinflation, rising credit spreads, and increasing unemployment. Powell is not dogmatic. He's from the Church of What's Happening Now. He's not going to ignore incoming weak economic data just so that he can fulfill his forward guidance promise of higher for longer. Just like he didn't fulfill his promise of rates at zero till 2024 in his forward guidance in 2021. There is a high probability that the data will cause Powell to pivot later this year. By that point, the stock market will probably be much lower than current levels, and it will have to be, in order to get Powell's attention. If the stock market just meanders around 4000, give or take 200 SPX points, he's probably going to stay with high rates.

Corporations will be sharply cutting back on investment, as the hurdle for productive use of debt in a 5% risk free rate world is much, much higher than it was when it was hugging zero. If you can't make money borrowing money at 7,8,9%, why would you borrow at those rates? If corporations cut back on debt issuance, that just means less investment, less stock buybacks, and less economic activity. Businesses can't keep raising prices in perpetuity when the money supply isn't increasing. The customers just won't have the money to buy the goods and services. There has to be more money in circulation to keep inflation going.

While I respect the price action in the bond market, as the sovereign bond market is trading extremely weak, I don't expect that to be a long term trend. Short term, you have worries about econ. data continuing to come in hot, as the lag effect of higher rates has yet to really work its way through the economy. The chart looks horrible for bonds. It is also a seasonally weak period for bonds, as they tend to sell off in March and April.

Maintaining my equity shorts and just watching the SPX/NDX for now. The stock selloff likely continues if the bond market stays weak. CTAs, after getting long in January and February, started dumping SPX last week, so they are probably either flat or slightly short now. Volatility is still relatively low so vol control funds are not selling here. Don't have a lot of conviction on the indices, so just watching and waiting for a better spot.