Speculation in bitcoin and AI is flaming hot. But tariff headlines are making a comeback, and starting to act as a fire extinguisher. Investors still view these tariffs as TACO material, which is encouraging for those looking to put on short positions. You want to see complacency out there as the news flow gets worse. But the outperformance of the high beta sectors and speculative names reveal some subtle clues for the short and long term.

At the start of the month, my initial thesis was that we could see a meaningful, long term top in July, based on the slowing economy, huge amounts of equity fund inflows, and retail investor overconfidence. There were signs that bitcoin was starting to lag vs. SPX. To confirm a long term top, you want to see Nasdaq underperform vs. SPX, and the SPX underperform vs. Russell 2000. That has not happened. Bitcoin has surged higher and is again a leader in this market. You are seeing strength in AI names, and big cap tech continues to trade strong vs. the overall market.

This is not what a final top feels like. You are not seeing a big chase for the Russell 2000, which you often see late in a rally. In the past, the Russell 2000 used to be a leading indicator for the SPX. Now its a leading indicator in the contrarian sense, where Russell 2000 outperforms right before a big downside reversal.

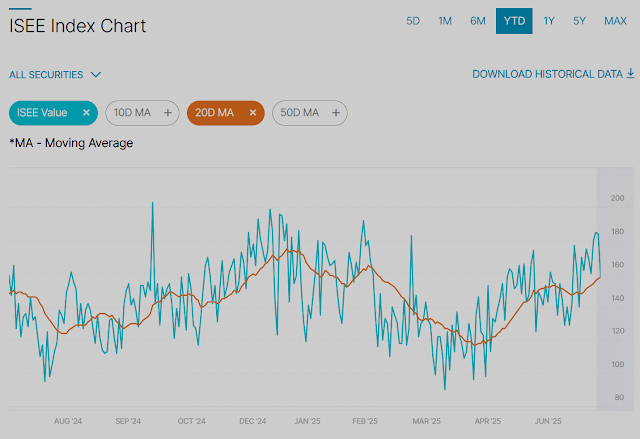

However, it feels like the beginning of the topping phase. The highest beta, most speculative stocks in the market are outperforming the market, and have even gone up when the SPX has gone down. AI bubble is getting bigger. Bitcoin is on fire. You are seeing a very active pump and dump market, which can happen around local tops, but usually not around final tops. These are signs of a rally in the late stages, with long positioning getting saturated. When retail investors are this active and confident, bad things happen in the long term.

If we are to make a comparison, this feels more like December 2024 than February 2025. Remember, the speculators were much more active and bullish in December 2024, enjoying the Trump victory afterglow, than in February 2024, when the SPX made marginal new all time highs with AI names and bitcoin lagging.

Big picture, there is limited upside and lots of potential downside. Equity allocations among BofA private clients is now the highest since early 2022.

3 comments:

Here come the bulls.

Its getting close to shorting time. A small breakout above SPX 6300 would be a good entry point. Today or tomorrow.

Started a short SPX position. Will continue to add this week.

Post a Comment