"I skate to where the puck is going, not where it has been." - Wayne Gretzky

Its been a bad time to be short. The afterglow from the big cut from the Fed lasted longer than expected. Last week was some of the slowest, grinding, bleed higher markets that you will see. The Chinese stimulus added to the feel good environment and you had a gap up all 5 days last week, a couple of them quite sizeable. Nothing saps the soul of the bears more than feeling good after a regular trading hours selloff, only to see it all taken back effortlessly on light volume overnight. While those gap ups tended to fade once the US market opened, you still ended up with an overall up week. While the international markets are still focused on the positives of a Fed rate cut and the weaker dollar, the US market is less enthused. Surprisingly, the Fed rate cuts have actually helped emerging markets and Europe more than the US.

While most of the talk on finance TV is still about the repercussions of a super dovish Fed and a China pumping up stimulus, you can sense that the US market is starting to hesitate at this high level. It seems the US stock market is moving on from the post event euphoria of the Fed going full dove and slowly focusing on the US election, which is still a 50-50 situation according to betting markets. The market generally views a Trump victory as a positive for stocks, and a Harris victory as a negative for stock. There should be some downside vol in the coming weeks as the focus shifts from monetary policy to potential fiscal policy over the next 4 years.

The market is in agreement that both candidates will keep deficits high and the fiscal pump going, but Harris is viewed as one who will let the Trump tax cuts expire, at least for the rich and for corporations, which will be viewed as an equity negative. She's even trying to increase the capital gains tax, but its doubtful that would pass a divided Congress, which is more likely than not if she wins. The uncertainty of higher taxes looms over this market, which priced for near perfection at these valuations. If Harris does somehow win the election, which I view as less than 10% chance, but still a chance, a reflexive selloff in the SPX is very likely. Since I view a Harris victory as very unlikely, I will not be going into the election with a short position.

But what I think is irrelevant. The majority believe in the betting markets and think this election is a crapshoot. And with heavy long positioning in SPX, I can picture a de-risking scenario in October to hedge against a potential Harris victory. That's what's going to be the market's main concern over the next few weeks.

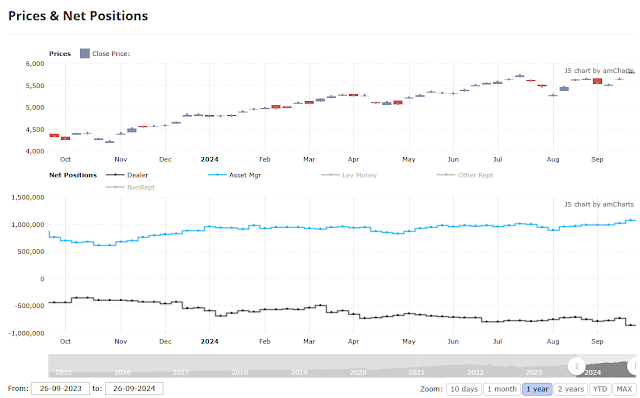

The COT data for SPX futures as of September 24 showed a big jump in net long positioning among asset managers. You saw nearly a similar increase in net short positioning among dealers. Asset managers now have the biggest net long position in SPX futures YTD.

|

| SPX Futures Net Positions for Asset Mgrs and Dealers |

In the past, when there was actually some caution and fear in the market, many asset managers used SPX futures to hedge their long exposure. Now, with very few asset managers short the SPX futures, its completely changed. SPX futures are now used as a quick way to add long US stock exposure, to add beta, and turbocharge returns without having to go to the trouble of stock picking, which most asset managers are bad at anyway. This is more of a long term sell signal than a short term one. But it tells you the environment that we're in, which is one of heavy long positioning, and very few shorts. That is an environment that has led to sharp moves lower, such as Q3 of 2015, Q4 of 2018, Q1 of 2020, and Q1 of 2022.

The OCC options data at the ISEE index last week showed a renewed interest in call buying, as we're back to low fear market. Low volatility, new all time highs, and good news leads to more short term risk taking. I won't put too much weight on this data, as its to be expected in this kind of environment. But it does show how much traders are leaning to one side of the trade.

The original plan last week was to trim my short position. I canceled that plan because it looks like its too late to cover the short and microtrade, and I want to play for the pullback in October. Do NOT want to miss any potential downside in October. We've reached a level of complacency and one sided trading action which can go the other way quickly during this time of year. October is not necessarily a bearish month. But it tends to be bearish if you had a strong summer/September.

Add to the the past seasonal tendencies with election uncertainty and there is a high probability trade to short the SPX over the coming weeks.

The bond market also seems to be changing its focus from the Fed to the election. You have seen persistent, calm selling in Treasuries since the FOMC announcement. I don't think most bond investors want to be loading up on bonds ahead of a potential Trump victory. After what happened to bonds after 2016 and 2020 elections, I expect further weakness in Treasuries in October, even if stocks go down.

Staying short. Its too late to cover. I expect chop this week, and then a move lower starting sometime next week, lasting 2-3 weeks till mid to late October. The market should move lower as the Fed goes into the rear view mirror and the election comes closer into view.

44 comments:

Any read into how the day ended? Wonder if this will have legs to move higher if job report is strong too making soft landing plus rate cuts the likely scenario? Needless to say, i am a little jittery given the proce action

No, it looks like typical end of month price action, which has been squeezy the past few months. I wouldn’t read much into it. Not expecting any big moves until next week. A strong job report will just make yields go higher, which I think is better than a weak report actually for shorts.

I think we moon if strike averted

Because of avoiding a strike? Moon? :-/

Well maybe a waning crescent moon

Its not the news that matters, its the reaction to the news. There has been geopolitical headlines for weeks now, and its only affecting the market now AFTER we have reached long saturation. The longs are loaded up with longs, and as a result, will have a quick trigger finger on the sell button.

Hunt for Red October

I did not trim tet will wait a few more days minimum

You are very correct.

are we getting to a big fall day?

Yes, but I'm not expecting a big down day right away, you probably need to get past NFP and wait for the chicken little longs to jump in once they feel safer.

Does that not mean another move higher before it goes down? So more pain for the shorts before it goes down? And if it goes up another couple of points, down five will not mean as much.

No, it doesnt mean that we go up a lot. We can just sit around these levels and then make a big move lower later.

ok thanks, will hold on. if we dont get the big move next week also, would you rethink the shorts? thanks

Sold DIA puts at 6.60 from around 7

I have to see what's happening. Based on what I've seen so far this week with the put/call ratios and return of call speculation in individual names, I'll probably just stay short. It could be like the July swoon where the market delayed the down move only to go down big and fast. I could see that happening this month.

Sold IWM puts 8.73 from 7. Long SMMT 18 11/15 calls 3.05

Trimming half of the short here. Don't want to be short too much ahead of NFP tomorrow. And there is a possible relief rally if geopolitical worries subside. Want to maintain some shorts though because I expect a much bigger move lower later this month, and don't want to miss that move.

This market is having a hard time going down. That 50 bp cut put some kind of floor to this shit.

Agree, its hanging tough considering the "scary" headlines. I still believe you will have a 5-6% pullback this month, but it could be pushed back towards the 2nd half of the month. Likely some chop for the next few days and another stronger selling wave that comes that should take SPX down towards 5500 or lower.

We are where we started the day after the rate cut. Back to 9/18 level

I mean 9/19

Strong job report and market rallying. If past is any guide we get past 5800 before we see 5600

Let the bulls roam and get greedy today. I will be looking to add shorts early next week. Overall, higher bond yields are not a positive considering the economy which is not as strong as it was earlier this year.

Is there a level that entices u to short more today or u plan to wait until early next week anyway?

As fake as Kamalas accent

If it gets to 5790, I will put on some shorts. Otherwise, wait till Monday to feed the ducks. Agree, the NFP was manufactured by the BLS for the Harris campaign. Those that believe these numbers, I have a bridge to sell you.

BLS follows a process so while they can affect numbers generally, dont think they can do anything with one month’s number. May be the economy is not as weak as we beleive it to be

Man I can't believe I didn't sell any of the SMMT because of stupid boss team message me at 7 in the morning. Fuck!

Dawg, you need to go full time trading.

The chop before the drop continues

Nah when I have to rely on trading as my full time job is when I fail. I can't emotionally detach myself from the emotional and stressful aspects of the job if it's full time like sort of you can.

Shorting xhb. Price to perfection and doomed to fail if rates go up or if people lose jobs one of those two things is bound to happen

Now that I am long I feel that the spx will go to 5850 before it can go back down. Market wants a blowoff top it looks like. One big up day drawing in the last round of bulls. I say this could happen within a week even less.

I feel good now that I am out of my shorts. I feel I can get short at better prices though. The big move is still down.

here is my prediction, we go down next week to 566, 564 on spy till 10/14, sideways till 10/18 , they new high by 10/25 could go above 582-584

XHB is not bad for a short. If I had to pick a sector to short, it would be XLU. Way overbought, overloved, and too dependent on AI hype and lower rates.

Doubt you see a blowoff top. Too close to the election and already sensing weakness in bonds due to election fears (not mentioned yet, but its a big factor). Bond weakness foreshadows equity weakness. Think we might have 1-2 more days of rallies at most. And then we start going down, slowly and then suddenly.

Alex, I think you are a bit too optimistic about the 2nd half of October. Ahead of the election, you are unlikely to see any big rallies until perhaps a week ahead of time when everyone is already hedged up and reduced long exposure. Not even close to that yet.

Looking at COT as of 10/01, asset managers barely sold down their very high net long positions, and dealers added even more short to their high net short positions. Overall, looks like we'll have to go down much more before you get a bottom. Will be looking to aggressively add shorts early next week.

Like xhb short , how about xly consumer discretionary should not do well in this high inflation slowing economy

No opinion on XLY. Overall, I would be bearish high beta and less bearish low beta. Global economy is weaker than investors think and will remain that way even with rate cuts.

Is there a time

To short cvna? Very hard to time but crazy profits to be made eventually

I would wait till Jan 2025 to short CVNA. Lots of capital gains will be delayed by longs due to huge profits this year.

Thx

Post a Comment