Now you will have those who say that it wasn't political, that Powell was worried about the labor market. But he could easily do a 25 bps cut, a 50 bps cut after the election, and get to the same place. And he even hinted not to expect another 50 bps cut at the next meeting. So why 50 bps before the election and then a 25 bps cut after? Its smells like the Fed trying to tilt the election in one side's favor.

And I really could care less if Trump or Harris wins. Of course, if I had a position going into the election, I would want one side to win because it would help my position, but from a political point of view, I can't stand either side.

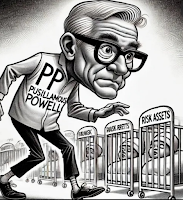

Powell is the most power hungry and political Fed chairman since Arthur Burns. He's well known for talking to Senators on both sides, kissing ass, trying to gather support for his reappointment. He did that in 2021 and 2022 before his reappointment. His delayed reappointment in 2021 being pushed out to 2022 was the main reason he didn't raise rates even though inflation was raging higher during that time. He didn't even hint at rate hikes. He waited till after he was basically a lock to get reconfirmed by the Senate before he did his first rate cut in spring of 2022, and was way behind what STIRs market was pricing for rate hikes. That cemented my previous belief that this guy is first and foremost a politician.

Anyway, knowing how political Powell is, will help navigate and predict which way he will lean for the next 2 years before his next re-nomination by the next President in fall of 2026. So basically, he will do whatever the stock market wants him to do, because that's what will make him the most popular. Only if inflation is raging higher (has to be very high, at least 6-7% CPI) and a major concern for the President, he will lean on the hawkish side. In all other cases, he will lean on the dovish side, because it helps him politically. This makes it very likely that you will get a weaker dollar over the next 2 years, a steeper yield curve, and financial repression.

For the bears out there, including me, you have to recognize that you will be fighting the Fed in the next bear market, and you need to embrace it. Shorts were fighting Greenspan all the way from the start of 2001 to the middle of 2003. And that was still a great time to be a short seller. The most important things for being short, in order, are: 1. earnings growth rate 2. investor positioning and psychology 3. valuations. Then would come fiscal policy and monetary policy in that order. Only in exceptional circumstances like Covid, government policy becomes the most important thing. But those are rare circumstances, and usually happen only in "crisis" situations, when the equity markets are already down a lot.

Over the next few months, especially if the stock market is going higher, you will hear talk about "don't fight the Fed", Fed put, Fed is supporting the market, etc. That is what builds optimism during an economic slowdown. The bulls are down to what they believe is their most reliable bullet. But it's their last bullet. The Fed. But monetary policy is not what it used to be. In an era of fiscal dominance, the huge national debt serves to provide a tremendous amount of interest income when rates are higher. So rate cuts would actually reduce that Treasury interest income. In addition, since a majority of mortgages are already paying very low interest rates, mortgage re-financings will have a much weaker effect than previous rate cutting cycles. Lastly, corporate borrowing will likely be done at higher rates than 5 and 10 years ago, so debt rollovers will not be stimulative, even as rates go down.

Last week's 50 bps cut has re-ignited the soft landing view as markets reacted with bonds selling off and equities rallying. Don't have a strong macro view, but I would lean towards economic weakness over economic strength over the next 12 months. However, I do think that there will be a post election bump higher in economic activity and optimism with the election out of the way and with Trump likely to be the winner. But even a Trump victory won't make much difference as this economic weakness appears to be a lagged effect from a lack of money supply growth and bank lending over the past 2 years. That should continue well into 2025 and probably ensures the Fed panicking with more big rate cuts sometime next year.

Investor positioning is low on cash, very low on short positions, and high on long positions. Here is the cash allocation according to BofA. This is much lower than one would expect when cash is yielding over 5%. You had lower cash levels in the mid 2000s (housing bubble) and early 2010s (cash yields were 0%). Other than that, the current cash levels are the lowest in the past 25 years. Even during the height of the dotcom bubble, the cash levels didn't get below 5%. This is just further evidence that there is a lot of downside fuel once the stock uptrend turns into a downtrend.

Back to the market. SPX futures COT data last week as of September 17 showed asset managers increased to their longest net long positioning since February 2020. Back in early 2020, SPX futures open interest was averaging around 3,000,000 contracts. For the past few weeks, SPX futures open interest is only averaging around 2,200,000 contracts. On a net % of OI basis, the net long positioning is much greater now than back in Feb. 2020. After the rally post FOMC, I expect the asset manager net longs to be even higher currently.

The weekly OCC options data over the weekend was a bit of a disappointment. I was expecting much more call buying and much fewer puts opened relative to calls opened, but that didn't happen. Last week saw quite a bit of put buying, which appears to be those that are looking to hedge over the next several weeks and into the election. When investors are well hedged, downside is more limited. So it makes it less likely that you will see a big selloff in September and October. It appears that the most downside one can expect over the next 6 weeks is SPX 5400. Base case now is probably a pullback down towards 5450-5500 sometime in October, and then a strong rally from late October into the end of the year.

Still have a heavy SPX short position, looking for seasonal weakness as well as bit of the Fed euphoria to cool off this week, post opex. But given the put buying last week, I don't expect any big selloffs quite yet. We'll need to rebuild some more complacency if we are to get a big selloff. It could happen over the next 2 weeks if the economic data comes in stronger than expected, especially if there is a benign nonfarm payrolls report. Current plan is to cover half later this week, and hold the rest of the short looking for a bigger move lower in October.

25 comments:

this gives me a feeling of slow grind higher and I dont like it. low vol upwards movement

Not great price action for shorts. Give it a few more days, but downside looks limited from here.

In Oct 2020 we went from 3550 on 10/12 to 3233 by 10/30. 9% drop from the high

In Oct 2016 we went from 2164 on 10/3 to 2100 by 11/1. 3% drop

In Oct 2012 we went from 1457 on 10/1 to 1403 by 10/26 3.7% drop

The problem is it might be at 5800-5900 by 10/1 so exiting shorts will be in trouble. Need a miracle move for a gracious exit

I see both upside and downside to be limited. Volatility is dying here.

Volatiity dries up before a big move. The next move should be up somehow.

MBZ distribution center for Socal is in Long Beach. Offloading tankers from Germany. The DC used to be the old Boeing plant. It's a huge warehouse can probably fit thousands of cars. I looked inside yesterday. Completely packed inside the warehouse. Yesterday was the first time I saw them park the cars that came in from the tankers outside the warehouse because its full in there. Huge inventory buildup.

5800 is about 1.5% from here. There should be a pullback before the election like the last 3 elections. This one should be no different. 5% from 5800 is 5510.

3% pullback in 2012 and 2016 the index was much lower back then. Less than half of current levels. 2020 was an anomaly. I say 5% pullback incoming in October.

If we gap up tomorrow it'll be another 2% day on Q's to 294 ish , then sideways on Thursday and finish the week on the highest on Friday, Monday start with a continuation and then the October pull back starts

Lack of participation by IWM seems to be the only hope for shorts like me

Any updated thoughts @marketowl. Last 2 shorting attempts have been tough wondering if should bail

Still full short position. Seeing much more call speculation this week, low put/call ratios, more complacency, CNBC Fast Money is very bullish. All topping signals. Staying short. May cover half if we get a pullback this week or next week, but want to remain short half for a bigger move lower, perhaps down to 5450.

I am sincerely hoping we are wrong. The decline did not happen as expected. But now when we are not expecting one, may be there will be a monster down move

It's over for the bulls. I grew up as a middle class kid. From day one I will bring down stock prices.

Although short term spending bill will likely pass there doesn't seem to be much talk about the storm and port strikes all basically playing out into eom. idk but the port strike could become important.

market seems overly complacent.

Hmm another big up day today it seems

Still trim this week or at this point just hold on to the shorts potentially even add?

Maybe trim a little, but not half. I would be trimming with the goal of adding again within a week or two. I still think odds are high that we get a 5% pullback in October, but from what level, that remains to be determined.

10 year yield breaking out above 3.80%. VIX up on the day. Put/call ratios very low so far. Some positives for the bears so far today.

Nikkei futures -5%, Asia multi strat book blow up Monday on the long Japan short China trade? All

very calm still elsewhere, minor tremors before the big one? Maybe they need to see Monday print. Golden the week might just be.

Asset managers added huge into SPX futures as of Tuesday, 9/24. Net long increased by 49K contracts. It is going to be a volatile October. Not covering anything, ready for some turbulence.

Any take on usdollar. It's in a decendending triangle about to bread down does not look like we have another leg up , with us productivity slowing down vs oversear inflation and interest rates us dollar seem to be in more pressure which is good for stocks especially ones who make money overseas like nvda etc , isn't the dollar need to rise a bit in October for market to have some form of correction

I expect dollar weakness with stock market weakness in 2025. In the short term, FX is hard to predict. Long term, its valuations vs historical avg and interest rate differentials. Since I expect continued rate cuts from a dovish Fed, I expect dollar weakness. And stocks can go down with a weaker dollar, just as it did in July/August. In fact, you had a lot of dollar weakness from the 2nd half of 2007 to the first half of 2008 and stocks got crushed during that time.

Economy is weak now. All the stores and restaurants are half as busy as they used to be. No more job solicitations from recruiters. How exactly are we supposed to go to 6000 by end of the year.

Stock market only cares about how rich are doing. Its a rich man’s market. The poor dont matter. The middle class dont matter. Its only about upper class now. And they are flush with cash and loving this economy. Plus they are getting rate cuts and mo money. Thats all they want.

Post a Comment