For a big chunk of the Russell 2000, higher yields are a big drag on earnings, as they are less profitable or unprofitable, with weak cash flows, making them more reliant on debt. The S&P 600 (small caps) has a net debt to EBITDA ratio that's 3 times that of the S&P 500 (large caps).

There is no free lunch in running the economy hot with big budget deficits. Higher inflation leads to higher yields which increases the cost of debt capital. It also leads to higher wages which increases labor costs. When interest expenses and labor costs go up, that squeezes profit margins, forcing nonprofitable or barely profitable companies to borrow more. Increasing leverage makes the bottom of the capital stack, equity, riskier, which is reflected in lower stock prices and valuations.

We've reached a point where the benefits of higher revenues coming from a stronger economy are less than the costs of higher interest and labor expenses. Its why the stock and bond market correlations have gotten so positive. This is a symptom of higher inflation coming from fiscal dominance, as expansive fiscal policy initially helps the stock market (2020, 2021), but this leads to tighter monetary policy which ends up hurting the stock market (2022). When the lagged effect of tighter monetary policy slows down the economy and reduces inflation, the stock market front runs the loosening of monetary policy by going up, even as earnings growth is weak. This is where we are in the cycle, as stocks front run the rate cut cycle, expecting a soft landing. But the variable this time are the large budget deficits and the need to keep issuing $2T+ of Treasury debt each year to keep the game going. The Fed either lets long end rates stay high to keep the economy from overheating and inflation in check, or they go back to QE and low rates to keep the economy from going into recession, risking a resurgence of inflation.

We are in an interesting spot where the lagged effect of higher rates is hitting small caps and small businesses, while the rich keep getting richer as the SPX goes higher and they collect 5% on their excess cash, most of it coming from the government's huge interest expense. Its a torturous trickle down effect where the rich with excess cash get paid higher interest from the government and corporations at the expense of small businesses having to pay more interest on their borrowings. Since the rich are so flush with cash, as stocks keep making new all time highs, and collect lots of interest, that money finds its way into the stock market. Its a virtuous cycle fed by the government running big deficits.

So what breaks this virtuous cycle? A couple of scenarios would do it.

1. Enough small businesses and small cap companies start cutting back on labor to protect their profit margins, leading to higher unemployment, and less revenues and thus lower earnings. More corporations have to start feeling the pain from higher interest and labor costs for this to happen.

2. Inflation makes a comeback, rebounding to higher levels, keeping the Fed from making big rate cuts. This is what most people seem to fear more than a surge in job losses. Although my view is that job losses are much more likely than another inflation surge in 2024.

With the SPX making a big breakout towards new all time highs, investors don't have much concern about either of the above scenarios. A soft landing is the base case for most. While there is quite a bit of skepticism about the rally and it going up too far too fast, its based mainly on the belief that the Fed will not cut rates as much as the market expects. I've written in the past few blog posts about this consensus belief, which I believe will be wrong as the economic data comes in weaker in the coming months. Since investors are skeptical about the magnitude of the Fed cuts coming, that's a positive catalyst that still remains to fuel this market higher. You should only consider putting on a longer term short position in US stocks after the consensus starts to buy into the Fed cutting rates more aggressively this year. There is still that wall of worry out there about rates staying higher for longer.

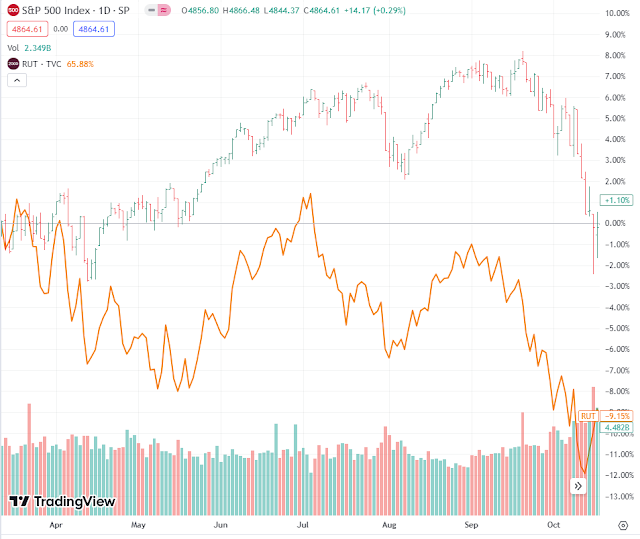

We've seen the Russell 2000 lag the SPX badly since the start of the year. Here's a look at a couple of other times where the Russell 2000 lagged the SPX so much during a strong uptrend. They both eventually resulted in a sharp correction of 10% within a few months.

|

| September-October 2014 correction |

|

| January-February 2018 correction |

Timing these tops is hard, as it takes months of this SPX-RUT divergence to eventually lead to the SPX breaking down. Things like the Hindenburg Omen which flash warnings of a split market of lots of new 52 week highs and new 52 week lows as the SPX makes new highs have started to fire up. A couple of them on the Nasdaq composite over the past week. Along with the high valuations and general complacency out there (low put/call ratios, high CTA equity exposure), a deep correction is waiting in the wings. The key will be not to get short too early, as momentum in these type of up markets last longer than most people expect.

SPX is gapping up again, this time to another all time high, as SPX is around 4885 as I write. Given how effortlessly its gone up since breaking 4800 on Friday, it looks like a break of 5000 is going to happen within the next 30 days. This bubble reminds me a bit of 2000, when the Nasdaq broke out above 5000, as there was a frenzy for tech stocks. I distinctly remember semiconductor stocks flying higher in February of 2000, a month before the bubble top. Right now, semiconductors are the hottest sector in the market. History doesn't repeat, but it does rhyme.

5 comments:

is 5000 a done deal? seems the market already feeling very stretched and better to short now?

5000 is almost a done deal. I'd give it an 80% chance of happening within 2 months. There are initial warning signs with small caps underperformance, but I'm being careful shorting this market. This market is extremely strong considering how weak bonds have been so far this year.

hmm i dont care if it breaches 5000 or not but dont want it to take 2 months to get there, get there or not but move faster because the medium term path is lower. turning more than mildly bearish on some tech and homebuilders - not sure what will trigger a collapse but the risks are just piling up on top of a heap

Taking a look at latest COT data for SPX futures, not ideal for bears. Dealers reduced shorts, asset managers added shorts, and leveraged funds massively added to shorts. Bears want to see asset managers add to longs and dealers add to shorts. Saw neither on a strong rally, which is unusual, and usually bullish.

Cool noted and thanks for ur feedback. May be earnings will be weak. My gut tells me it is about time for a breather followed by a fall

Post a Comment