I can sense the bulls wanting to get more aggressively long, but only after they confirm that the financial world doesn't end after the CPI report comes out. A bit hyperbolic, but there seems to be a substantial amount of risk capital waiting for the CPI on Wednesday to be behind them before going to work. Also, to a lesser extent earnings reports later this month, especially tech.

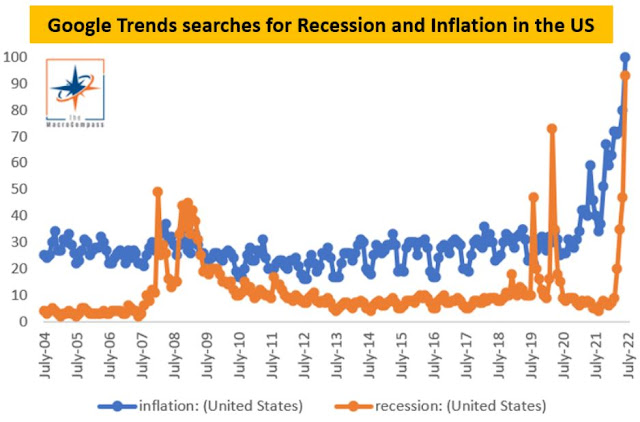

The buyers are still reluctant, as you can see in the price action, where the market can't stay at the local highs, and is constantly pulling back off highs and struggling to go north. The fundamentals are about as bad I've ever seen, relatively to the valuations. Even worse than the dotcom bubble bursting in 2001. When was the last time you saw a Fed this aggressively looking to hike rates as the leading indicators are falling off a cliff and the layperson is searching for the words inflation and recession in big numbers on Google?

With corporate bond yields much higher than they were over any period in the past 3 years, with a Fed determined to hike at least another 125 bps, maybe more (unlikely, IMO, but possible), you will end up with a Fed funds rate of at least 3.00% into an economy that is in recession, as the consumer is getting slammed by higher inflation and lower wealth due to stocks and bonds going down, as well as the possibility of layoffs looming around the corner. You can feel the tension, in those search numbers, as they hope that stocks will rally to help offset the higher cost of living. With a weakening economy, they will have a hard time getting wage increases to match inflation, if they can get wage increases at all in recessionary times.

Its bad out there. That can't be overstated enough. With nonfarm payrolls still firmly positive, you are getting a chance to jump on the recession trade train before the latecomers come on board and really get it moving. The 3 ways to play this recession trade is through 1) long bonds, 2) short stocks, or 3) short commodities.

Let's go through each one.

Long bonds. This can mainly be played going long US Treasuries, long Eurodollars/SOFR futures in 2023, or German Bunds. They will all work, but I prefer the US Treasuries trades, in the belly of the curve. The belly of the curve are traditionally the most sensitive to economic conditions and move the most aggressively when it senses a recession, regardless of whether the Fed has made a dovish pivot or not. For the Eurodollars/SOFR futures, in addition to economic conditions, you also have to take into account the Fed's reaction function to a weakening economy/inflation, which adds an extra variable. As for the German Bunds, its probably the safest trade of the 3, as Europe is in a terrible spot and the ECB probably can raise at most 2 times and barely get to zero, while Bund are yielding 1.30% right now. So very little room for Bund yields to go higher in this environment, but less upside than USTs as European yields are much lower.

Short stocks. A variety of ways to play this, but the most generic one is to short one of the major indices. Such as shorting Nasdaq 100, S&P 500, or Russell 2000. I don't see much meat on the bone in the European or Asian indices so US stocks look like much better shorts here. Also, US stocks have vastly more crowded positioning. They are the favorites both in the US and abroad. Just looking at the economic sensitivity and investor positioning, the Nasdaq 100 looks to be the most vulnerable, and it also has the most froth of the 3 indices. People forget that the mega cap tech stocks are just as sensitive to economic conditions as oil and gas stocks, if not more so. And even though the Nasdaq 100 has been a worse performer than SPX in 2022, it still looks like the mega cap tech names are still the most crowded trades among speculators and casual investors.

Short commodities. Don't think this is the best way to express a view on a big slowdown in the economy. First, commodities have already come way down off the highs this year, and that makes it less attractive. Second, the supply demand dynamics are much more favorable for a long term long position, not short position in most commodities, especially energy and agriculture. Third, the bigger commodity markets are in backwardation, so its negative carry to hold a short position, and it adds up quickly with the steep backwardation of the curve in energy.

Over the weekend, I was thinking that a short Nasdaq trade was the superior trade for expressing a view on a deep recession happening in the coming months, but there are compelling aspects to the long Treasuries trade (bonds have been going down for over 2 years), such as much more directly correlated to economic conditions, so a higher probability of the trade working if I am correct in my thesis, than a short Nasdaq trade. Perhaps a combination of the two will work best, and add some diversification. A Nasdaq short definitely has more potential profit, although I would say slightly lower probability of success than a long Treasuries trade.

We are getting some pre-CPI jitters, just 48 hours away from the big number that sparked a huge selloff last month. The crowd is nervous, my gut tells me they will be buyers of both stocks and bonds after the release, regardless of the number. The stock rally probably doesn't last for more than a week, but the bond rally should have legs and go well into the autumn period.

5 comments:

Rally still coming post cpi or is not going to happen? Looks dicey here now.

Looking more and more like 3900's was the top. Getting on for 1% down pre market already.

Bulls are running out of time to get a bounce. Bears are building up potential energy for another big down move after the consolidation. Really pathetic showing by the stock market bulls, I thought they could take it to SPX 3950-4000, and that's looking unlikely. In no man's land here, it feels a bit too gloomy for it to be a good short, and definitely treacherous to try to buy dips in this market.

Should take my loss now since it only seems to be getting worse but will see if PPI report gives us some sort of rally (or acceleration to the downside lol).

Optionalize it. Longer term views expressed in straight delta always get stopped out (or at least mine do).

TY calls, QQQ puts. Well, if you can manage to lift a TYZ offer (the weeklies are sparse, last I remember). True, vol is expensive, but at least you can see the trade through.

Post a Comment